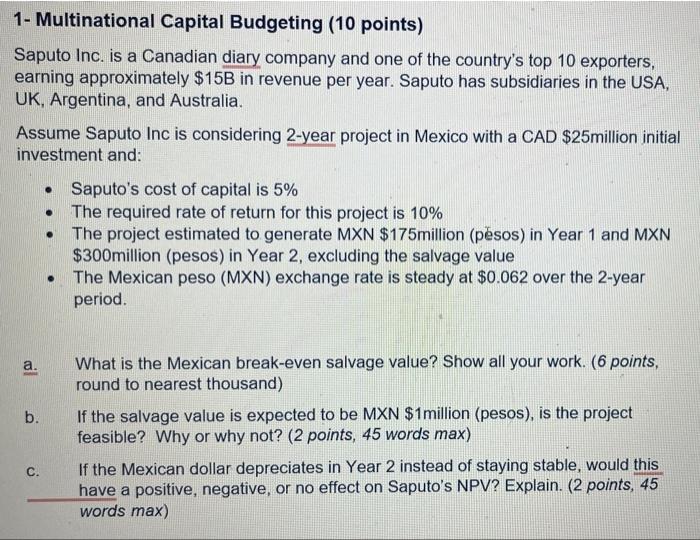

a 1- Multinational Capital Budgeting (10 points) Saputo Inc. is a Canadian diary company and one of the country's top 10 exporters, earning approximately $15B in revenue per year. Saputo has subsidiaries in the USA, UK, Argentina, and Australia. Assume Saputo Inc is considering 2-year project in Mexico with a CAD $25million initial investment and: . . Saputo's cost of capital is 5% The required rate of return for this project is 10% The project estimated to generate MXN $175million (psos) in Year 1 and MXN $300million (pesos) in Year 2, excluding the salvage value The Mexican Peso (MXN) exchange rate is steady at $0.062 over the 2-year period. . . a. b. What is the Mexican break-even salvage value? Show all your work. (6 points, round to nearest thousand) If the salvage value is expected to be MXN $1million (pesos), is the project feasible? Why or why not? (2 points, 45 words max) If the Mexican dollar depreciates in Year 2 instead of staying stable, would this have a positive, negative, or no effect on Saputo's NPV? Explain. (2 points, 45 words max) C. a 1- Multinational Capital Budgeting (10 points) Saputo Inc. is a Canadian diary company and one of the country's top 10 exporters, earning approximately $15B in revenue per year. Saputo has subsidiaries in the USA, UK, Argentina, and Australia. Assume Saputo Inc is considering 2-year project in Mexico with a CAD $25million initial investment and: . . Saputo's cost of capital is 5% The required rate of return for this project is 10% The project estimated to generate MXN $175million (psos) in Year 1 and MXN $300million (pesos) in Year 2, excluding the salvage value The Mexican Peso (MXN) exchange rate is steady at $0.062 over the 2-year period. . . a. b. What is the Mexican break-even salvage value? Show all your work. (6 points, round to nearest thousand) If the salvage value is expected to be MXN $1million (pesos), is the project feasible? Why or why not? (2 points, 45 words max) If the Mexican dollar depreciates in Year 2 instead of staying stable, would this have a positive, negative, or no effect on Saputo's NPV? Explain. (2 points, 45 words max) C