Answered step by step

Verified Expert Solution

Question

1 Approved Answer

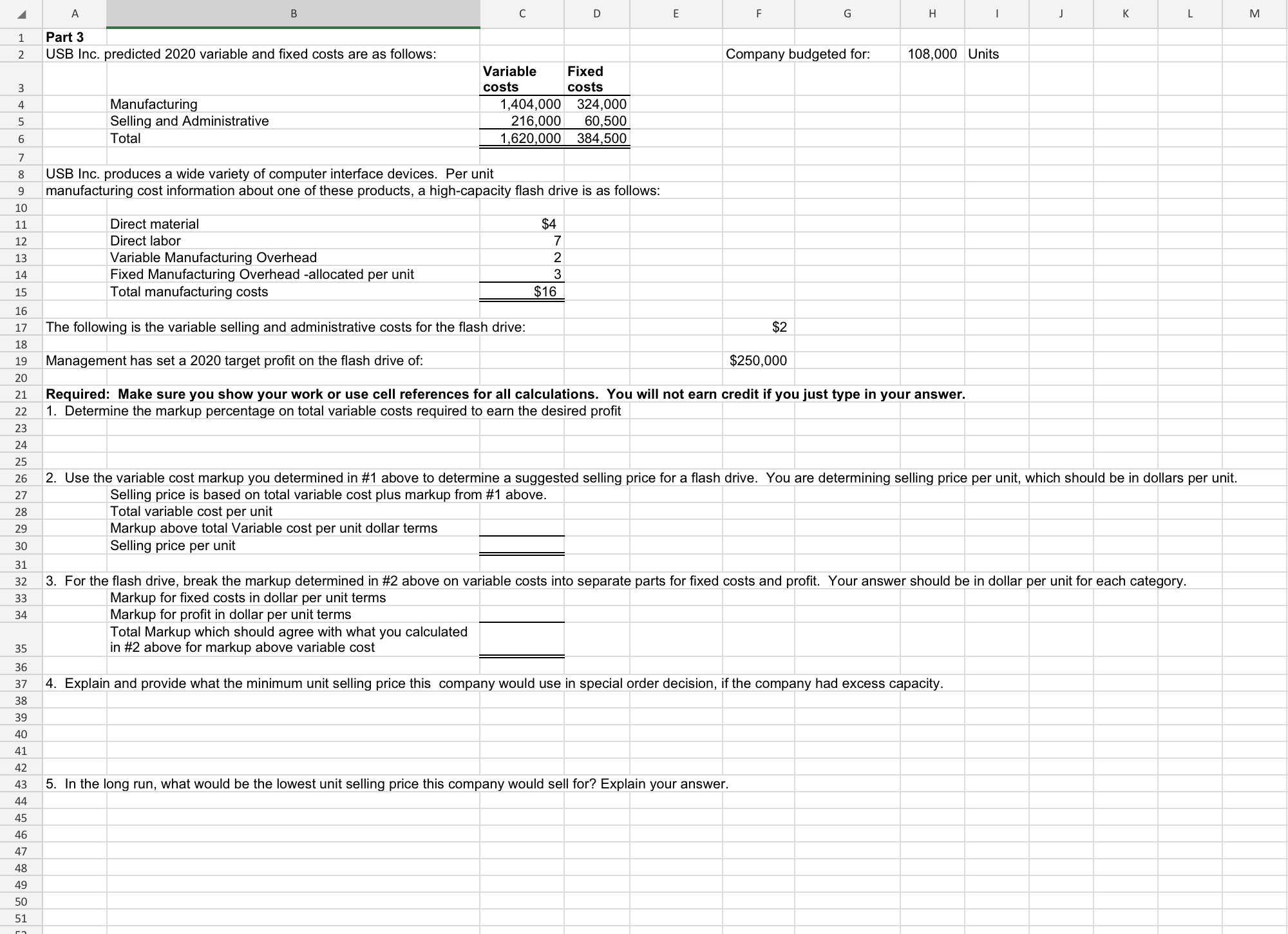

A 1 Part 3 2 B USB Inc. predicted 2020 variable and fixed costs are as follows: C D E F G H |

A 1 Part 3 2 B USB Inc. predicted 2020 variable and fixed costs are as follows: C D E F G H | J K L M Company budgeted for: 108,000 Units 3 4 5 6 7 8 9 10 11 12 24 25 26 27 28 29 30 RECENT 1222222222222233 34 Manufacturing Selling and Administrative Total Variable costs Fixed costs 1,404,000 324,000 216,000 60,500 1,620,000 384,500 13 14 USB Inc. produces a wide variety of computer interface devices. Per unit manufacturing cost information about one of these products, a high-capacity flash drive is as follows: Direct material Direct labor Variable Manufacturing Overhead Fixed Manufacturing Overhead -allocated per unit $4 7 2 3 15 Total manufacturing costs $16 16 17 The following is the variable selling and administrative costs for the flash drive: 18 19 Management has set a 2020 target profit on the flash drive of: $2 $250,000 20 Required: Make sure you show your work or use cell references for all calculations. You will not earn credit if you just type in your answer. 1. Determine the markup percentage on total variable costs required to earn the desired profit 35 36 37 2. Use the variable cost markup you determined in #1 above to determine a suggested selling price for a flash drive. You are determining selling price per unit, which should be in dollars per unit. Selling price is based on total variable cost plus markup from #1 above. Total variable cost per unit Markup above total Variable cost per unit dollar terms Selling price per unit 3. For the flash drive, break the markup determined in #2 above on variable costs into separate parts for fixed costs and profit. Your answer should be in dollar per unit for each category. Markup for fixed costs in dollar per unit terms Markup for profit in dollar per unit terms Total Markup which should agree with what you calculated in #2 above for markup above variable cost 4. Explain and provide what the minimum unit selling price this company would use in special order decision, if the company had excess capacity. 38 39 40 41 42 43 5. In the long run, what would be the lowest unit selling price this company would sell for? Explain your answer. 44 45 46 47 48 49 50 51

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started