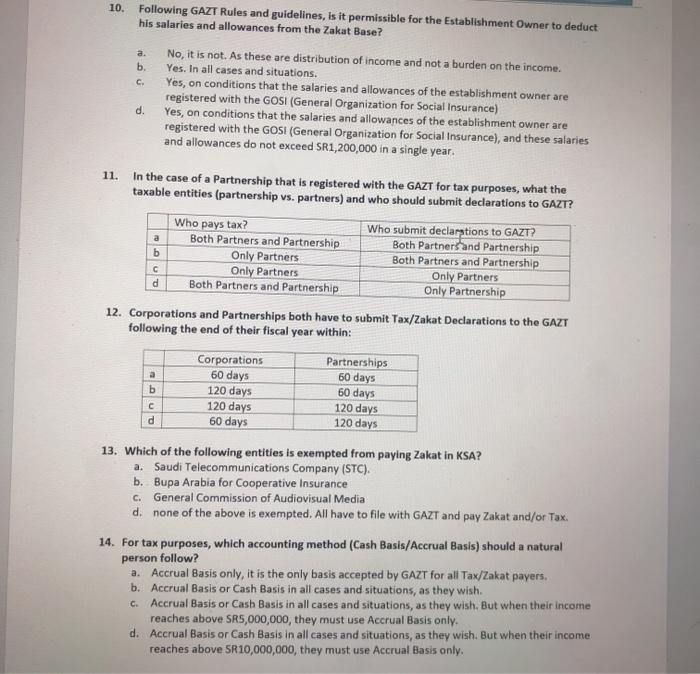

a. 10. Following GAZT Rules and guidelines, Is it permissible for the Establishment Owner to deduct his salaries and allowances from the Zakat Base? No, it is not. As these are distribution of income and not a burden on the income. b. Yes. In all cases and situations. Yes, on conditions that the salaries and allowances of the establishment owner are registered with the GOSI (General Organization for Social Insurance) Yes, on conditions that the salaries and allowances of the establishment owner are registered with the GOSI (General Organization for Social Insurance), and these salaries and allowances do not exceed SR1,200,000 in a single year. c. d. 11. a d In the case of a Partnership that is registered with the GAZT for tax purposes, what the taxable entities (partnership vs. partners) and who should submit declarations to GAZT? Who pays tax? Who submit declarations to GAZT? Both Partners and Partnership Both Partners and Partnership b Only Partners Both Partners and Partnership Only Partners Only Partners Both Partners and Partnership Only Partnership 12. Corporations and Partnerships both have to submit Tax/Zakat Declarations to the GAZT following the end of their fiscal year within: Corporations Partnerships 60 days 60 days b 120 days 60 days 120 days 120 days d 60 days 120 days a 13. Which of the following entities is exempted from paying Zakat in KSA? a. Saudi Telecommunications Company (STC). b. Bupa Arabia for Cooperative Insurance C. General Commission of Audiovisual Media d. none of the above is exempted. All have to file with GAZT and pay Zakat and/or Tax 14. For tax purposes, which accounting method (Cash Basis/Accrual Basis) should a natural person follow? a. Accrual Basis only, it is the only basis accepted by GAZT for all Tax/Zakat payers. b. Accrual Basis or Cash Basis in all cases and situations, as they wish. c. Accrual Basis or Cash Basis in all cases and situations, as they wish. But when their income reaches above SR5,000,000, they must use Accrual Basis only. d. Accrual Basis or Cash Basis in all cases and situations, as they wish. But when their income reaches above 5R10,000,000, they must use Accrual Basis only. a. 10. Following GAZT Rules and guidelines, Is it permissible for the Establishment Owner to deduct his salaries and allowances from the Zakat Base? No, it is not. As these are distribution of income and not a burden on the income. b. Yes. In all cases and situations. Yes, on conditions that the salaries and allowances of the establishment owner are registered with the GOSI (General Organization for Social Insurance) Yes, on conditions that the salaries and allowances of the establishment owner are registered with the GOSI (General Organization for Social Insurance), and these salaries and allowances do not exceed SR1,200,000 in a single year. c. d. 11. a d In the case of a Partnership that is registered with the GAZT for tax purposes, what the taxable entities (partnership vs. partners) and who should submit declarations to GAZT? Who pays tax? Who submit declarations to GAZT? Both Partners and Partnership Both Partners and Partnership b Only Partners Both Partners and Partnership Only Partners Only Partners Both Partners and Partnership Only Partnership 12. Corporations and Partnerships both have to submit Tax/Zakat Declarations to the GAZT following the end of their fiscal year within: Corporations Partnerships 60 days 60 days b 120 days 60 days 120 days 120 days d 60 days 120 days a 13. Which of the following entities is exempted from paying Zakat in KSA? a. Saudi Telecommunications Company (STC). b. Bupa Arabia for Cooperative Insurance C. General Commission of Audiovisual Media d. none of the above is exempted. All have to file with GAZT and pay Zakat and/or Tax 14. For tax purposes, which accounting method (Cash Basis/Accrual Basis) should a natural person follow? a. Accrual Basis only, it is the only basis accepted by GAZT for all Tax/Zakat payers. b. Accrual Basis or Cash Basis in all cases and situations, as they wish. c. Accrual Basis or Cash Basis in all cases and situations, as they wish. But when their income reaches above SR5,000,000, they must use Accrual Basis only. d. Accrual Basis or Cash Basis in all cases and situations, as they wish. But when their income reaches above 5R10,000,000, they must use Accrual Basis only