Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) [10 marks] Determine the incremental cash-flows from the purchase of the grocery packing robots. b) [10 marks] What is Acado's WACC? What is

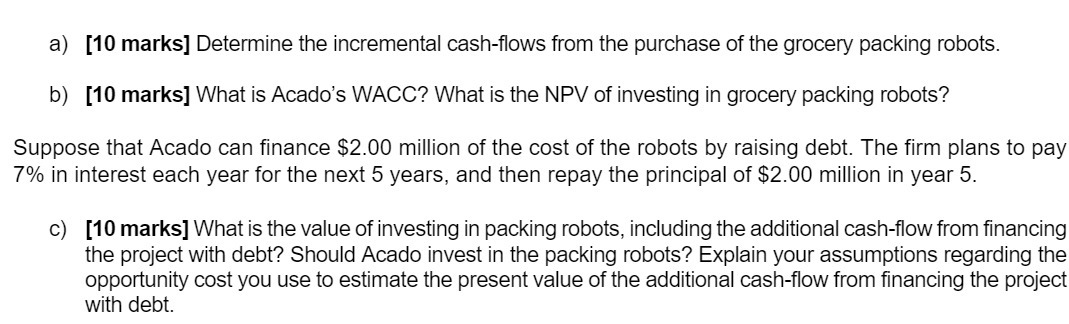

a) [10 marks] Determine the incremental cash-flows from the purchase of the grocery packing robots. b) [10 marks] What is Acado's WACC? What is the NPV of investing in grocery packing robots? Suppose that Acado can finance $2.00 million of the cost of the robots by raising debt. The firm plans to pay 7% in interest each year for the next 5 years, and then repay the principal of $2.00 million in year 5. c) [10 marks] What is the value of investing in packing robots, including the additional cash-flow from financing the project with debt? Should Acado invest in the packing robots? Explain your assumptions regarding the opportunity cost you use to estimate the present value of the additional cash-flow from financing the project with debt.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine the incremental cash flows from the purchase of the grocery packing robots we need to consider the additional cash inflows and outflows associated with the investment Here are the steps ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started