Question

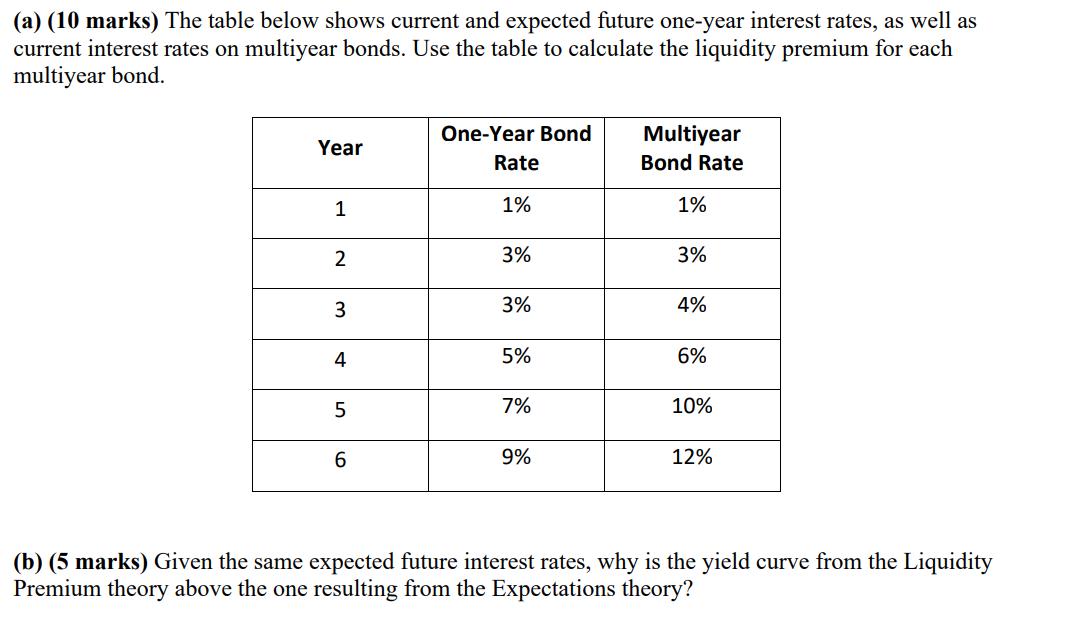

(a) (10 marks) The table below shows current and expected future one-year interest rates, as well as current interest rates on multiyear bonds. Use

(a) (10 marks) The table below shows current and expected future one-year interest rates, as well as current interest rates on multiyear bonds. Use the table to calculate the liquidity premium for each multiyear bond. One-Year Bond Multiyear Year Rate Bond Rate 1 1% 1% 2 3% 3% 3 3% 4% 4 5% 6% 5 7% 10% 6 9% 12% (b) (5 marks) Given the same expected future interest rates, why is the yield curve from the Liquidity Premium theory above the one resulting from the Expectations theory?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Economics For Investment Decision Makers

Authors: Sandeep Singh, Christopher D Piros, Jerald E Pinto

1st Edition

1118111966, 9781118111963

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App