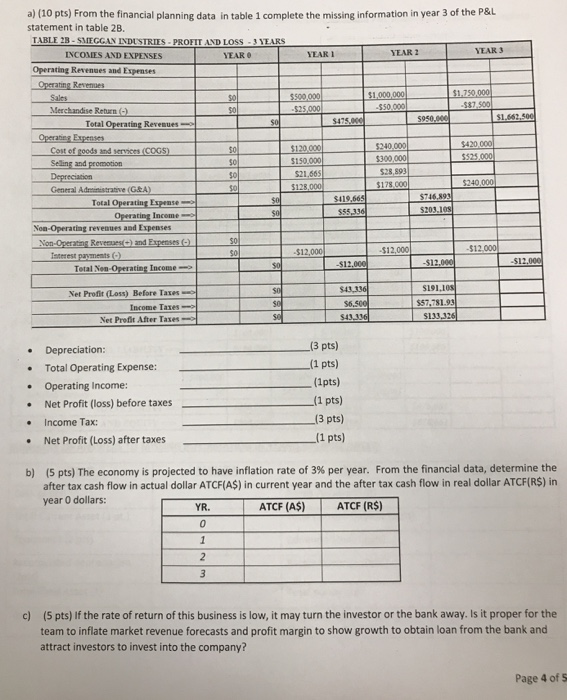

a) (10 pts) From the financial planning data in table 1 complete the missing information in year 3 of the P&L statement in table 28. TABLE 3-SI ECC LV INDUSTRIES-PROFIT AND LOSS 3 STARS YEAR YEAR 2 YEAR 3 INCOMES AND EXPENSES EAR I Operating Revenses and Expenses 5500 Merchandise Retarn 475 5950 Total Operating Revesues S150.000 521,665 300 $28,893 eling and promotion General Adstrative (G&A) otal Operating Expense Operating Income Noa-Operating revenues and Expenses $12 $12 512 $12 Total Non-Operating Inconme $191.108 $57.781.93 43,336 Net Profit (Loss) Before Taxes Income Taxes> Net Profit After Taxes Depreciation: Total Operating Expense: Operating Income: Net Profit (loss) before taxes Income Tax: (3 pts) (1 pts) (1pts) (1 pts) (3 pts) (1 pts .Net Profit (Loss) after taxes (5 pts) The economy is projected to have inflation rate of 3% per year. From the financial data, determine the after tax cash flow in actual dollar ATCF(AS) in current year and the after tax cash flow in real dollar ATCFIRS) in year 0 dollars: b) YR. ATCF (AS) ATCF (RS) 0 (5 pts) If the rate of return of this business is low, it may turn the investor or the bank away. Is it proper for the team to inflate market revenue forecasts and profit margin to show growth to obtain loan from the bank and attract investors to invest into the company? c) Page 4 of S a) (10 pts) From the financial planning data in table 1 complete the missing information in year 3 of the P&L statement in table 28. TABLE 3-SI ECC LV INDUSTRIES-PROFIT AND LOSS 3 STARS YEAR YEAR 2 YEAR 3 INCOMES AND EXPENSES EAR I Operating Revenses and Expenses 5500 Merchandise Retarn 475 5950 Total Operating Revesues S150.000 521,665 300 $28,893 eling and promotion General Adstrative (G&A) otal Operating Expense Operating Income Noa-Operating revenues and Expenses $12 $12 512 $12 Total Non-Operating Inconme $191.108 $57.781.93 43,336 Net Profit (Loss) Before Taxes Income Taxes> Net Profit After Taxes Depreciation: Total Operating Expense: Operating Income: Net Profit (loss) before taxes Income Tax: (3 pts) (1 pts) (1pts) (1 pts) (3 pts) (1 pts .Net Profit (Loss) after taxes (5 pts) The economy is projected to have inflation rate of 3% per year. From the financial data, determine the after tax cash flow in actual dollar ATCF(AS) in current year and the after tax cash flow in real dollar ATCFIRS) in year 0 dollars: b) YR. ATCF (AS) ATCF (RS) 0 (5 pts) If the rate of return of this business is low, it may turn the investor or the bank away. Is it proper for the team to inflate market revenue forecasts and profit margin to show growth to obtain loan from the bank and attract investors to invest into the company? c) Page 4 of S