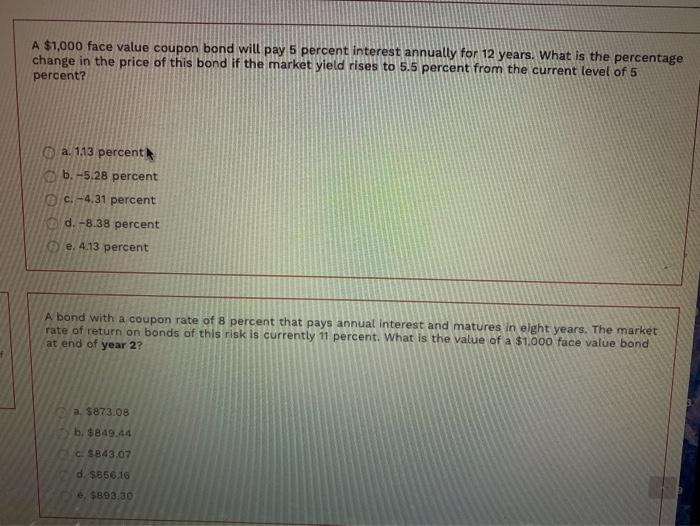

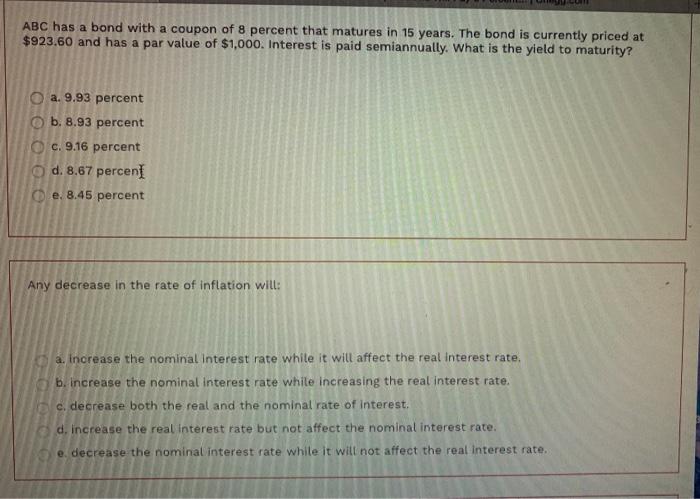

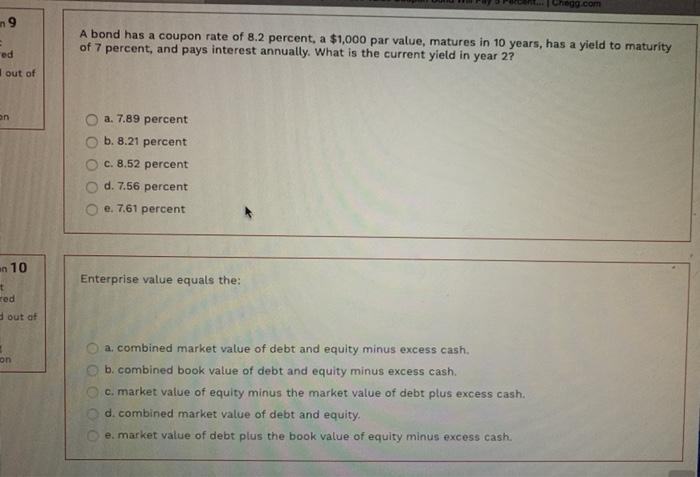

A $1,000 face value coupon bond will pay 5 percent interest annually for 12 years. What is the percentage change in the price of this bond if the market yield rises to 5.5 percent from the current level of 5 percent? a. 113 percent b.-5.28 percent c. +4.31 percent d.-8.38 percent e. 4.13 percent A bond with a coupon rate of 8 percent that pays annual interest and matures in eight years. The market rate of return on bonds of this risk is currently 11 percent. What is the value of a $1.000 face value bond at end of year 2? a $873.08 b, $849.44 CS843.07 d $856.16 e. $803:30 ABC has a bond with a coupon of 8 percent that matures in 15 years. The bond is currently priced at $923.60 and has a par value of $1,000. Interest is paid semiannually. What is the yield to maturity? O a. 9.93 percent b. 8.93 percent c. 9.16 percent d. 8.67 percent e. 8.45 percent Any decrease in the rate of inflation will: a. Increase the nominal Interest rate while it will affect the real interest rate, b. Increase the nominal interest rate while increasing the real interest rate. c. decrease both the real and the nominal rate of interest. d. Increase the real interest rate but not affect the nominal interest rate e decrease the nominal interest rate while it will not affect the real Interest rate. Chegg.com n9 A bond has a coupon rate of 8.2 percent, a $1,000 par value, matures in 10 years, has a yield to maturity of 7 percent, and pays interest annually. What is the current yield in year 2? od out of an a. 7.89 percent b. 8.21 percent c. 8.52 percent d. 7.56 percent e. 7.61 percent an 10 Enterprise value equals the: t Ted out of 3 on a combined market value of debt and equity minus excess cash. b. combined book value of debt and equity minus excess cash. c. market value of equity minus the market value of debt plus excess cash. d. combined market value of debt and equity. e. market value of debt plus the book value of equity minus excess cash