Answered step by step

Verified Expert Solution

Question

1 Approved Answer

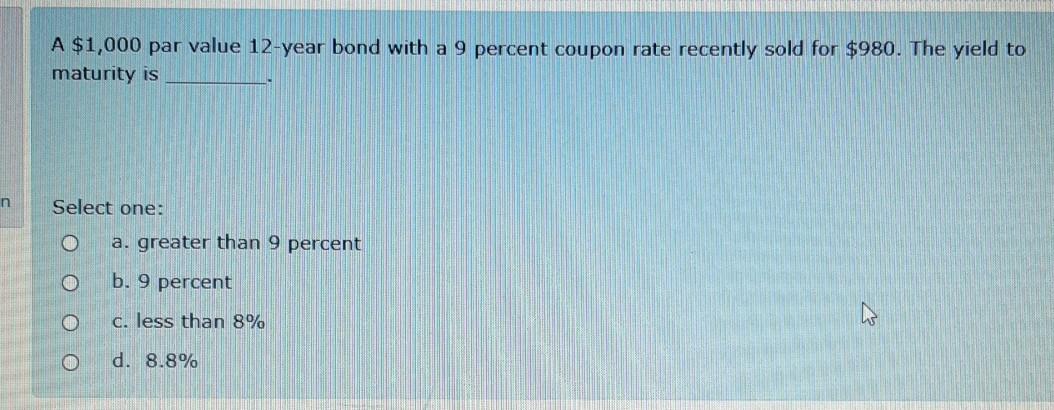

A $1,000 par value 12-year bond with a 9 percent coupon rate recently sold for $980. The yield to maturity is n Select one: a.

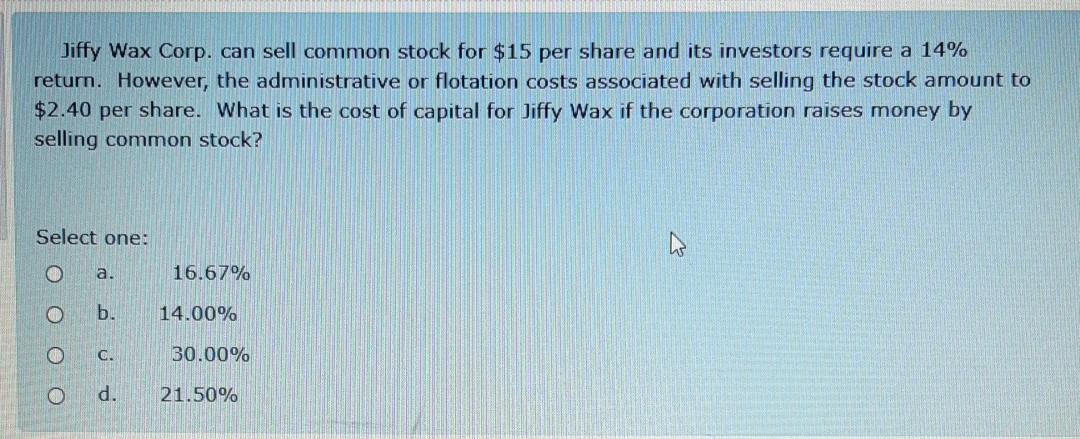

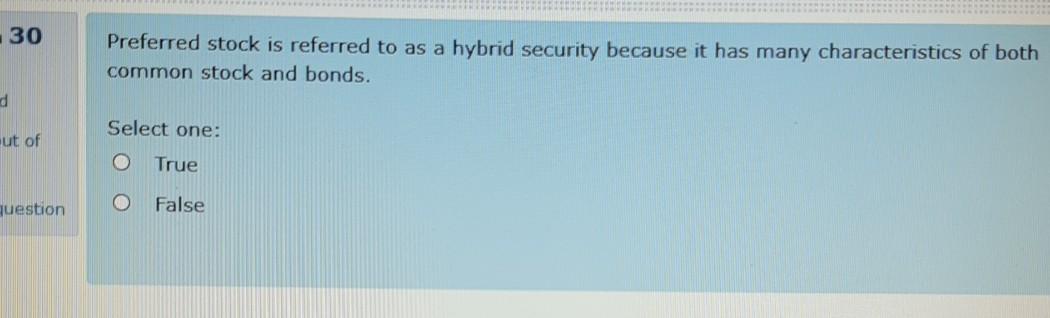

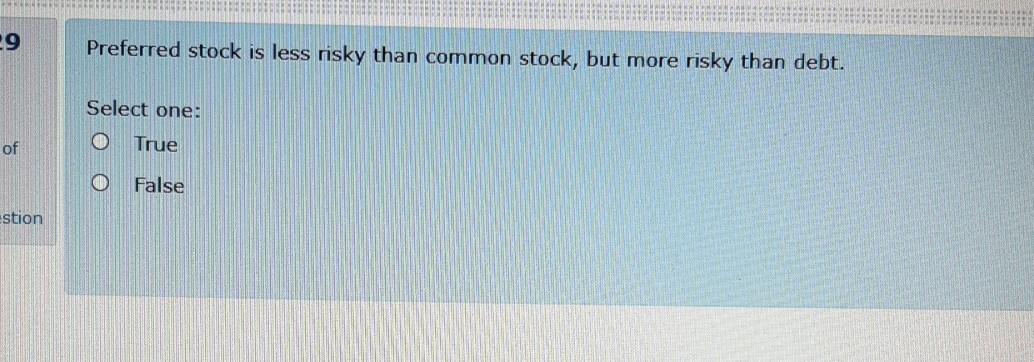

A $1,000 par value 12-year bond with a 9 percent coupon rate recently sold for $980. The yield to maturity is n Select one: a. greater than 9 percent b. 9 percent c. less than 8% d. 8.8% Jiffy Wax Corp. can sell common stock for $15 per share and its investors require a 14% return. However, the administrative or flotation costs associated with selling the stock amount to $2.40 per share. What is the cost of capital for Jiffy Wax if the corporation raises money by selling common stock? Select one: a. 16.67% b. 14.00% C. 30.00% O d. 21.50% 30 Preferred stock is referred to as a hybrid security because it has many characteristics of both common stock and bonds. d Select one: ut of True question False 29 Preferred stock is less risky than common stock, but more risky than debt. Select one: True of False estion If a bond's rating declines, then so does its price, everything else equal. Select one: True IN False 27 As market rates of interest rise, investors move their funds into bonds, thus increasing their price and lowering their yield Select one: tof True estion False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started