Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A 11 Overvie X Final Pr X Chapte X Chapte X Chapter X Cengag X chapter X G Credit L x TT Home X

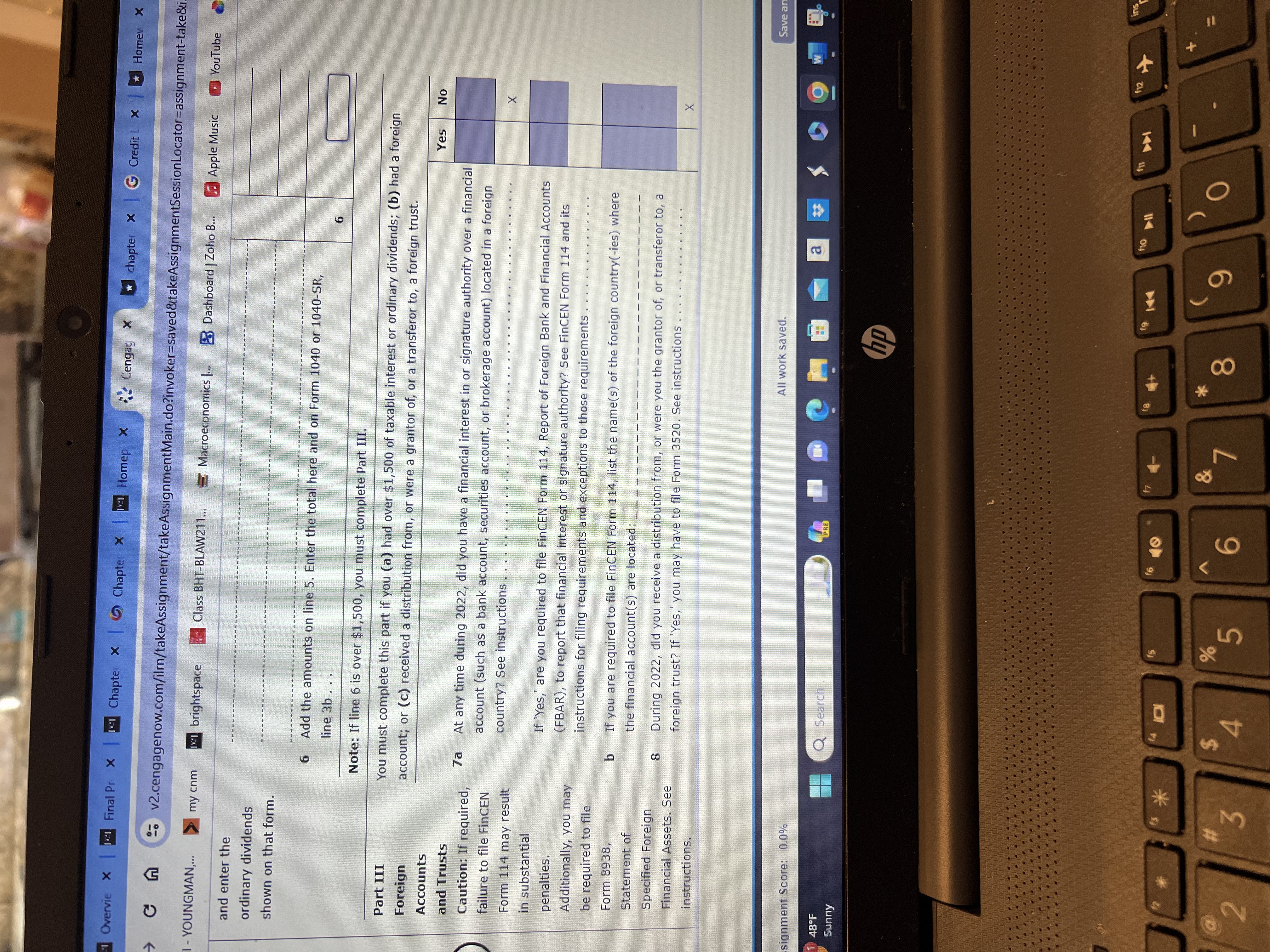

A 11 Overvie X Final Pr X Chapte X Chapte X Chapter X Cengag X chapter X G Credit L x TT Home X v2.cengagenow.com/ilmn/takeAssignment/takeAssignmentMain.do?invoker=saved&takeAssignmentSession Locator-assignment-take&i... CA Mail-YOUNGMAN,... Chapter 6 Tax Return my cnm 2 brightspace Class BHT-BLAW211... Print Item Ho Macroeconomics |... BDashboard | Zoho B... Apple Music YouTube discovery Instructions Form 1040 Schedule 1 Schedule A Schedule B Schedule D Form 8949 Schedule E Schedule 8812 Instructions Note: This problem is for the 2022 tax year. Roberta Santos, age 41, is single and lives at 120 Sanborne Avenue, Springfield, IL 62701. Her Social Security number is 123-45-6780. Roberta has been divorced from her former husband, Wayne, for two years. She has a son, Jason, who is 16, and a daughter, June, who is 18. Jason's Social Security number is 111-11-1112, and June's is 123-45-6788. Roberta has never owned or used a digital asset. She does not want to contribute $3 to the Presidential Election Campaign Fund. Roberta, an advertising executive, earned a salary from ABC Advertising of $136,000 in 2022. Her employer withheld $16,000 in Federal income tax and $4,400 in state income tax. Roberta has legal custody of Jason and June. The divorce decree provides that Roberta is to receive the dependency deductions for the children. Jason lives with his father during summer vacation. Wayne indicates that his expenses for Jason are $5,500. Roberta can document that she spent $8,500 for Jason's support during 2022. In prior years, Roberta gave a signed Form 8332 to Wayne regarding Jason. For 2022, she has decided not to do so. Roberta provides all of June's support. Roberta's mother died on January 7, 2022. Roberta inherited assets worth $625,000 from her mother. As the sole beneficiary of her mother's life insurance policy, Roberta received insurance proceeds of $300,000. Her mother's cost basis for the life insurance policy was $120,000. Roberta's favorite aunt gave her $15,000 for her birthday in October. On November 8, 2022, Roberta sells for $22,000 Amber stock that she had purchased for $24,000 from her first cousin, Walt, on December 5, 2017. Walt's cost basis for the stock was $26,000. On December 1, 2022, Roberta sold Falcon stock for $13,500. She had acquired the stock on July 2, 2018, for $8,000. An examination of Roberta's records reveals that she received the following: 1 48F Sunny @ 2 Q Search PRE ? hp a W ** 3 $ 4 f6 15 % 5 10 6 & 7 f8 fg * 8 9 ins f10 f11 112 prt sc O C C 121 Overvie X Final Pr X 21 Chapte X Chapte X Chapte X Cengag X chapter x G Credit! x Homew CA Mail-YOUNGMAN,... esc v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=saved&takeAssignmentSession Locator-assignment-tal my cnm 121 brightspace Class BHT-BLAW211... Macroeconomics ... BDashboard | Zoho B... Apple Music YouTube stock on July 2, 2018, for $8,000. An examination of Roberta's records reveals that she received the following: Interest income of $2,500 from First Savings Bank. Groceries valued at $750 from Kroger Groceries for being the 100,000th customer. Qualified dividend income of $1,800 from Amber. Interest income of $3,750 on City of Springfield school bonds. Alimony of $16,000 from Wayne; divorce finalized in May 2020. Distribution of $4,800 from ST Partnership (Employer Identification Number: 46-4567893). Her distributive share of the partnership passive taxable income was $5,300. She had no prior passive activity losses. Assume that the qualified business income deduction applies and the W-2 wage limitation does not. From her checkbook records, she determines that she made the following payments during 2022: Charitable contributions of $4,500 to First Presbyterian Church and $1,500 to the American Red Cross (proper receipts obtained). Payment of $5,000 to ECM Hospital for the medical expenses of a friend from work. Mortgage interest on her residence of $7,800 to Peoples Bank. Property taxes of $3,200 on her residence and $1,100 (ad valorem) on her car. $800 for landscaping expenses for residence. Estimated Federal income taxes of $2,800 and estimated state income taxes of $1,000. Medical expenses of $5,000 for her and $800 for Jason. In December, her medical insurance policy reimbursed $1,500 of her medical expenses. She had full-year health care coverage. A $1,000 ticket for parking in a handicapped space. Attorney's fees of $500 associated with unsuccessfully contesting the parking ticket. Contribution of $250 to the campaign of a candidate for governor. Because she did not maintain records of the sales tax she paid, she calculates the amount from the sales tax table to be $1,808. Required: Calculate Roberta's net tax payable or refund due for 2022. 1 48F Sunny ? 2 Q Search PRE ? hp f4 f5 40 * # 3 4 % 5 6 & 7 f8 * 80 fg a W 144 f10 9 O E f11 +241 P Overvie x Final Pr X Chapte X Chapte x Homep X *Cengag x chapter x G Credit x Homey X A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=saved&takeAssignmentSession Locator-assignment-take&i... Mail -YOUNGMAN,... my cnm brightspace Class BHT-BLAW211... Schedule B Complete Roberta's Schedule B for 2022. Macroeconomics... BDashboard | Zoho B... Apple Music YouTube disc SCHEDULE B (Form 1040) Department of the Treasury Internal Revenue Service Name(s) shown on return Roberta Santos Part I 1 Interest and Ordinary Dividends Go to www.irs.gov/ScheduleB for instructions and the latest information. Attach to Form 1040 or 1040-SR. Interest (See instructions and the instructions for Form 1040, line 2b.) Note: If you received a Form 1099-INT, Form List name of payer. If any interest is from a seller-financed mortgage and the buyer used the property as a personal residence, see the instructions and list this interest first. Also, show that buyer's social security number and address: City of Springfield Schools -First Savings Bank Amber Assignment Score: 0.0% 1 48F Sunny 12 * a 2 3 Q Search PRE $ 4 ale f6 5 A 6 ? All work saved. hp OMB No. 1545-0074 2022 Attachment Sequence No. 08 Your social security number 123-45-6780 1 Amount a W f9 144 11011 & 37 * 8 ( 9 144 Save and Exi f12 ins prt sc R Overvie X Final Pr X Chapte X Chapte x Homep X *Cengag x chapter x G Credit X Home X A ail -YOUNGMAN,... v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=saved&takeAssignmentSession Locator-assignment-take&i... my cnm brightspace Class BHT-BLAW211... Macroeconomics ... BDashboard | Zoho B... Apple Music YouTube TVI IC CO Note: If you received a Form 1099-INT, Form 1099-OID, or 1 substitute statement from a brokerage firm, list the firm's 2 Add the amounts on line 1 2 L name as the payer and enter the total 3 interest shown on that form. 19 Excludable interest on series EE and I U.S. savings bonds issued after 1989. Attach Form 8815 3 N 4 Subtract line 3 from line 2. Enter the result here and on Form 1040 or 1040-SR, line 2b 4 Note: If line 4 is over $1,500, you must complete Part III. Amount Part II 5 List name of payer: Ordinary Dividends (See instructions and the instructions for Form 1040, line 3b.) Signment Score: 0.0% 48F Sunny Q Search PRE f6 15 14 $ % A CO All work saved. hp f7 f8 fg 9 & 7 * 8 e 144 f10 90 11 f11 9 O 144 W f12 12 disco Save and E ins pr Overvie X Final Pr X Chapter X Chapte X Homep X Cengag X chapter x G Credit L x Home X CA v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=saved&takeAssignmentSession Locator-assignment-take&i. T-YOUNGMAN,... my cnm brightspace Class BHT-BLAW211... and enter the ordinary dividends shown on that form. Macroeconomics ... 8 Dashboard | Zoho B... Apple Music 6 N Add the amounts on line 5. Enter the total here and on Form 1040 or 1040-SR, line 3b 6 Note: If line 6 is over $1,500, you must complete Part III. Part III Foreign Accounts You must complete this part if you (a) had over $1,500 of taxable interest or ordinary dividends; (b) had a foreign account; or (c) received a distribution from, or were a grantor of, or a transferor to, a foreign trust. Yes No and Trusts Caution: If required, failure to file FinCEN 7a Form 114 may result in substantial penalties. Additionally, you may be required to file Form 8938, b Statement of Specified Foreign 8 Financial Assets. See instructions. signment Score: 0.0% 1 48F Sunny 12 2 # 3 * At any time during 2022, did you have a financial interest in or signature authority over a financial account (such as a bank account, securities account, or brokerage account) located in a foreign country? See instructions LE F E X If 'Yes,' are you required to file FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR), to report that financial interest or signature authority? See FinCEN Form 114 and its instructions for filing requirements and exceptions to those requirements. If you are required to file FinCEN Form 114, list the name(s) of the foreign country(-ies) where the financial account(s) are located: During 2022, did you receive a distribution from, or were you the grantor of, or transferor to, a foreign trust? If 'Yes,' you may have to file Form 3520. See instructions E Q Search PRE 15 14 $ 4 do X YouTube All work saved. a W hp f7 f8 14 f10 go 5 6 & 7 8 9 O f11 144 Save an 112 f12 ins + =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started