Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A 11 Overvie X Final Pr X Chapte X Chapte X Chapter X Cengag X chapter X G Credit L x TT Home X

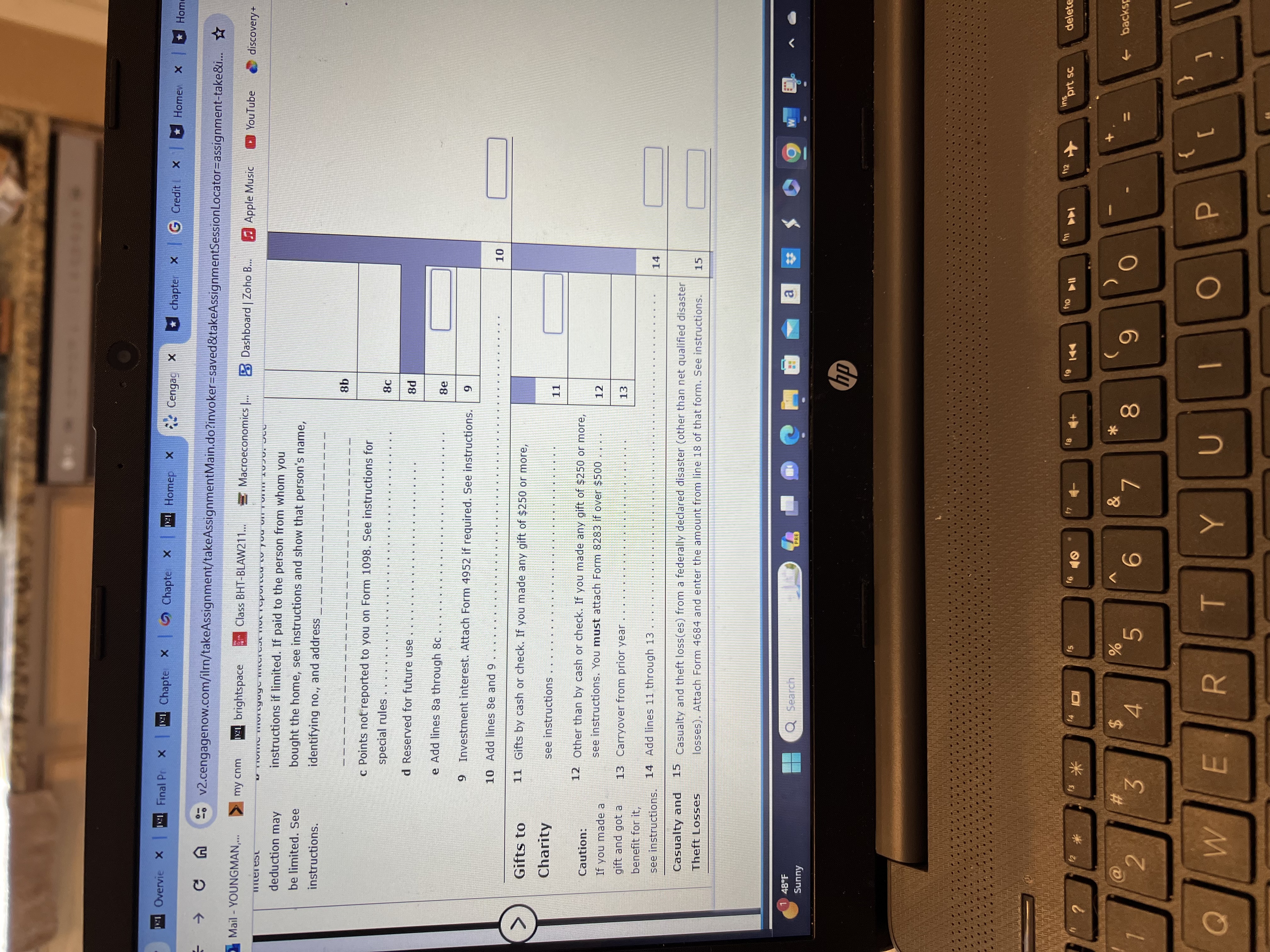

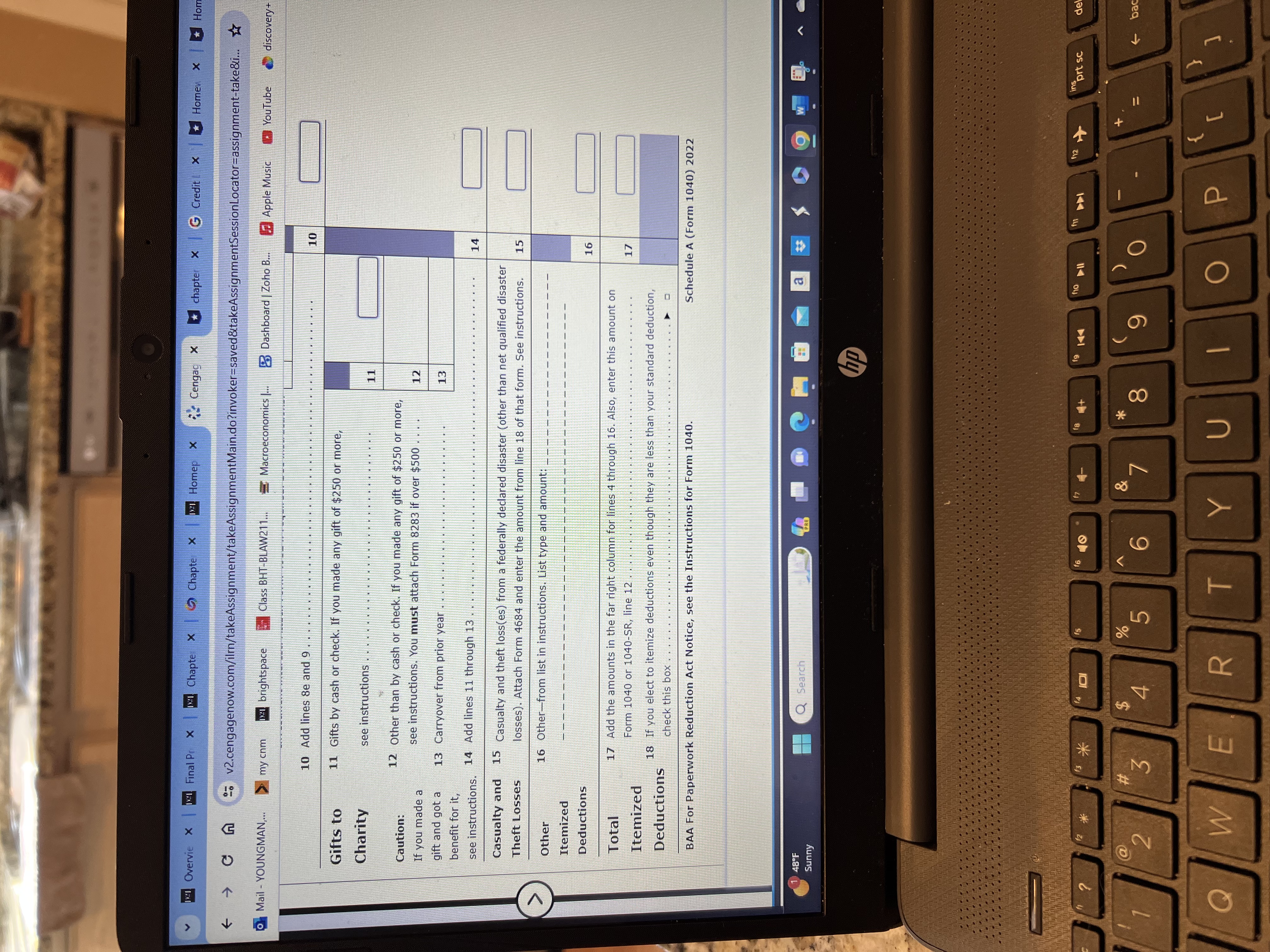

A 11 Overvie X Final Pr X Chapte X Chapte X Chapter X Cengag X chapter X G Credit L x TT Home X v2.cengagenow.com/ilmn/takeAssignment/takeAssignmentMain.do?invoker=saved&takeAssignmentSession Locator-assignment-take&i... CA Mail-YOUNGMAN,... Chapter 6 Tax Return my cnm 2 brightspace Class BHT-BLAW211... Print Item Ho Macroeconomics |... BDashboard | Zoho B... Apple Music YouTube discovery Instructions Form 1040 Schedule 1 Schedule A Schedule B Schedule D Form 8949 Schedule E Schedule 8812 Instructions Note: This problem is for the 2022 tax year. Roberta Santos, age 41, is single and lives at 120 Sanborne Avenue, Springfield, IL 62701. Her Social Security number is 123-45-6780. Roberta has been divorced from her former husband, Wayne, for two years. She has a son, Jason, who is 16, and a daughter, June, who is 18. Jason's Social Security number is 111-11-1112, and June's is 123-45-6788. Roberta has never owned or used a digital asset. She does not want to contribute $3 to the Presidential Election Campaign Fund. Roberta, an advertising executive, earned a salary from ABC Advertising of $136,000 in 2022. Her employer withheld $16,000 in Federal income tax and $4,400 in state income tax. Roberta has legal custody of Jason and June. The divorce decree provides that Roberta is to receive the dependency deductions for the children. Jason lives with his father during summer vacation. Wayne indicates that his expenses for Jason are $5,500. Roberta can document that she spent $8,500 for Jason's support during 2022. In prior years, Roberta gave a signed Form 8332 to Wayne regarding Jason. For 2022, she has decided not to do so. Roberta provides all of June's support. Roberta's mother died on January 7, 2022. Roberta inherited assets worth $625,000 from her mother. As the sole beneficiary of her mother's life insurance policy, Roberta received insurance proceeds of $300,000. Her mother's cost basis for the life insurance policy was $120,000. Roberta's favorite aunt gave her $15,000 for her birthday in October. On November 8, 2022, Roberta sells for $22,000 Amber stock that she had purchased for $24,000 from her first cousin, Walt, on December 5, 2017. Walt's cost basis for the stock was $26,000. On December 1, 2022, Roberta sold Falcon stock for $13,500. She had acquired the stock on July 2, 2018, for $8,000. An examination of Roberta's records reveals that she received the following: 1 48F Sunny @ 2 Q Search PRE ? hp a W ** 3 $ 4 f6 15 % 5 10 6 & 7 f8 fg * 8 9 ins f10 f11 112 prt sc O C C 121 Overvie X Final Pr X 21 Chapte X Chapte X Chapte X Cengag X chapter x G Credit! x Homew CA Mail-YOUNGMAN,... esc v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=saved&takeAssignmentSession Locator-assignment-tal my cnm 121 brightspace Class BHT-BLAW211... Macroeconomics ... BDashboard | Zoho B... Apple Music YouTube stock on July 2, 2018, for $8,000. An examination of Roberta's records reveals that she received the following: Interest income of $2,500 from First Savings Bank. Groceries valued at $750 from Kroger Groceries for being the 100,000th customer. Qualified dividend income of $1,800 from Amber. Interest income of $3,750 on City of Springfield school bonds. Alimony of $16,000 from Wayne; divorce finalized in May 2020. Distribution of $4,800 from ST Partnership (Employer Identification Number: 46-4567893). Her distributive share of the partnership passive taxable income was $5,300. She had no prior passive activity losses. Assume that the qualified business income deduction applies and the W-2 wage limitation does not. From her checkbook records, she determines that she made the following payments during 2022: Charitable contributions of $4,500 to First Presbyterian Church and $1,500 to the American Red Cross (proper receipts obtained). Payment of $5,000 to ECM Hospital for the medical expenses of a friend from work. Mortgage interest on her residence of $7,800 to Peoples Bank. Property taxes of $3,200 on her residence and $1,100 (ad valorem) on her car. $800 for landscaping expenses for residence. Estimated Federal income taxes of $2,800 and estimated state income taxes of $1,000. Medical expenses of $5,000 for her and $800 for Jason. In December, her medical insurance policy reimbursed $1,500 of her medical expenses. She had full-year health care coverage. A $1,000 ticket for parking in a handicapped space. Attorney's fees of $500 associated with unsuccessfully contesting the parking ticket. Contribution of $250 to the campaign of a candidate for governor. Because she did not maintain records of the sales tax she paid, she calculates the amount from the sales tax table to be $1,808. Required: Calculate Roberta's net tax payable or refund due for 2022. 1 48F Sunny ? 2 Q Search PRE ? hp f4 f5 40 * # 3 4 % 5 6 & 7 f8 * 80 fg a W 144 f10 9 O E f11 +241 A 11 Overvie X Final Pr X Chapte X Chapte X Homep X *Cengag X chapter XG Credit X Home CA v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=saved&takeAssignmentSessionLocator-assignment-ta Mail -YOUNGMAN,... my cnm 121 brightspace Class BHT-BLAW211... Macroeconomics ... Dashboard | Zoho B... Apple Music YouTube SCHEDULE A (Form 1040) Department of the Treasury Internal Revenue Service Itemized Deductions Go to www.irs.gov/ScheduleA for instructions and the latest information. Attach to Form 1040 or 1040-SR. Caution: If you are claiming a net qualified disaster loss on Form 4684, see the instructions for line 16. Name(s) shown on Form 1040 or 1040-SR Roberta Santos OMB No. 1545-0074 2022 Attachment Sequence No. 07 Your social security number 123-45-6780 Caution: Do not include expenses reimbursed or paid by others. 1 Medical and dental expenses (see instructions) 1 Medical > and Dental Expenses 2 Enter amount from Form 1040 or 1040- SR, line 11. 2 3 Multiply line 2 by 7.5% (0.075) 3 13 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter -0- Taxes You Paid 5 State and local taxes. a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead of income taxes, check this box b State and local real estate taxes (see instructions) 1 48F Sunny Q Search PREI 5a 5b hp 0 4 a W 16 17 110 144 f12 3 Overvie X Final Pr X Chapte X Chapte x X Homep X Cengag X chapter X G Credit x Home X Hom CA v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=saved&takeAssignmentSession Locator-assignment-take&i... Mail -YOUNGMAN,... Paid my cnm 121 brightspace Class BHT-BLAW211... Macroeconomics |... BDashboard | Zoho B... Apple Music YouTube discovery+ a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead of income taxes, check this box b State and local real estate taxes (see instructions) c State and local personal property taxes d Add lines 5a through 5c 5a 5b 5c 5d e Enter the smaller of line 5d or $10,000 ($5,000 if married filing separately) 5e 6 Other taxes. List type and amount: Interest You Paid Caution: Your mortgage interest deduction may be limited. See 8 7 Add lines 5e and 6 L 39 Home mortgage interest and points. If you didn't use all of your home mortgage loan(s) to buy, build, or improve your home, see instructions and check this box a Home mortgage interest and points reported to you on Form 1098. See instructions if limited b Home mortgage interest not reported to you on Form 1098. See instructions if limited. If paid to the person from whom you bought the home, see instructions and show that person's name, 1 48F Sunny ? Q Search PRE 6 8a f4 * 10 # $ % & * 2 3 4 5 6 7 8 Q W E R T Y 10000 hp 9 7 a W f10 O M P CN f12 ins prt sc delete t backsp [ ] = Overvie X Final Pr X 121 Chapter X Chapte X Homep X Cengag X chapter x G Credit x Home X Home CA Mail -YOUNGMAN,... mterest deduction may be limited. See instructions. v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=saved&takeAssignmentSession Locator-assignment-take&i... my cnm 21 brightspace L Class BHT-BLAW211... Macroeconomics ... Dashboard | Zoho B... Apple Music YouTube discovery+ TIMING Mvityuge intervLTIVE Oported LV you VITVI C instructions if limited. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no., and address 8b c Points not reported to you on Form 1098. See instructions for special rules 8c d Reserved for future use 8d e Add lines 8a through 8c. 8e 9 Investment interest. Attach Form 4952 if required. See instructions. 10 Add lines 8e and 9 9 10 Gifts to 11 Gifts by cash or check. If you made any gift of $250 or more, Charity see instructions 11 Caution: 12 Other than by cash or check. If you made any gift of $250 or more, see instructions. You must attach Form 8283 if over $500 12 If you made a gift and got a 13 Carryover from prior year 13 benefit for it, see instructions. 14 Add lines 11 through 13 14 Casualty and Theft Losses 15 Casualty and theft loss(es) from a federally declared disaster (other than net qualified disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See instructions. 15 48F Sunny Search PRE ? hp "? f6 f4 15 * # $ SA do 40 & 2 3 4 5 6 1 @ Q W E R T Y 7 * 8 a W 14 f10 go 9 12 12 + www ins prt sc delete O P { [ ] backsp ? Overvie X Final PrX Chapte X Chapte X 12 Homep X Cengag X chapter X G Credit X Homew Hom v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=saved&takeAssignmentSession Locator-assignment-take&i... CA Mail -YOUNGMAN,... > my cnm 21 brightspace ETH Class BHT-BLAW211... Macroeconomics |... BDashboard | Zoho B... Apple Music YouTube discovery+ 10 Add lines 8e and 9 10 Gifts to Charity 11 Gifts by cash or check. If you made any gift of $250 or more, see instructions 11 Caution: If you made a 12 Other than by cash or check. If you made any gift of $250 or more, see instructions. You must attach Form 8283 if over $500 12 gift and got a 13 Carryover from prior year 13 benefit for it, see instructions. 14 Add lines 11 through 13 14 Casualty and 15 Theft Losses Other Casualty and theft loss(es) from a federally declared disaster (other than net qualified disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See instructions. 16 Other-from list in instructions. List type and amount: 15 Itemized Deductions 16 Total 17 Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on Form 1040 or 1040-SR, line 12, 17 Itemized Deductions 18 If you elect to itemize deductions even though they are less than your standard deduction, check this box 1 48F Sunny BAA For Paperwork Reduction Act Notice, see the Instructions for Form 1040. Q Search PRE 13 f4 JOI f5 f6 40 &7 * 12 # # 3 $ % 4 5 6 Q W E R T Y 8 hp 9 11 . Schedule A (Form 1040) 2022 ot f10 a 11 f12 112 ins prt sc del bac { O P [ ]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started