Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a - 11.09, b - 10.33, can you solve c too? I don't have the textbook solution for c. Can you include the steps to

a - 11.09, b - 10.33, can you solve c too? I don't have the textbook solution for c. Can you include the steps to get to the answers? Thank you in advance.

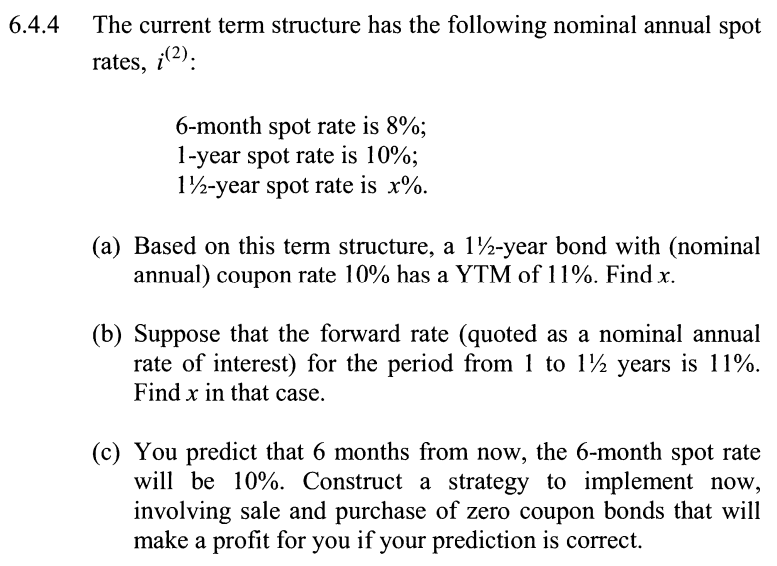

6.4.4 The current term structure has the following nominal annual spot rates, (2) 6-month spot rate is 8%; 1-year spot rate is 10%; 14-year spot rate is x%. (a) Based on this term structure, a 17-year bond with (nominal annual) coupon rate 10% has a YTM of 11%. Find x. (b) Suppose that the forward rate (quoted as a nominal annual rate of interest) for the period from 1 to 1/2 years is 11%. Find x in that case. (c) You predict that 6 months from now, the 6-month spot rate will be 10%. Construct a strategy to implement now, involving sale and purchase of zero coupon bonds that will make a profit for you if your prediction is correctStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started