Question

A 15 yrs 7% coupon bond (sa), par value $1000 is selling at $1050. Let us suppose the investor needs to sell the bond after

A 15 yrs 7% coupon bond (sa), par value $1000 is selling at $1050. Let us suppose the investor needs to sell the bond after 10 yrs at YTM of 4%. Calculate the total return of your investment and the annual return.

A 30 yrs bond issued 15 years ago has the following parameters:

Cpn: 4.5% SA

Current Yield: 1.5%

Par Value: $1,000

Estimate Duration: ? yrs

Convexity: 169.65

You should provide 4 different prices

-Estimation of the price given the Duration (ΔP= -D * Δi) and convexity [1/2(convexity)*( Δi)^2]

-Table Bond Price

-PV formula in excel

-Long Formula (Annuity)

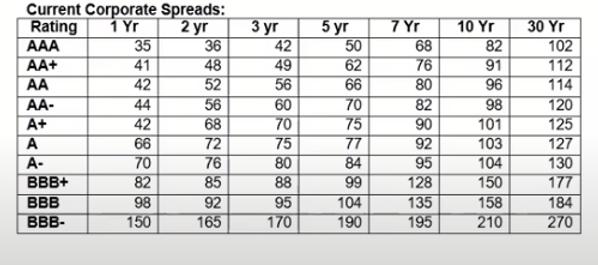

Assuming the face value of TOL's bond is $1,000, determine the current price of this bond. TOL's bond is a 25-year bond issue 23 years ago with a coupon of8% maturing in 2 years and as of today is rated BBB-. It was rated BBB+ 23 years ago at issuance.

Recent Treasury Yields:

3-months 2.20%

6-months 2.30%

1-year 2.35%

2-years 2.40%

5-years 2.5%

7-years 2.70%

10-years 2.80%

30-years 3.00%

Current Corporate Rating 1 AAA AA+ AA AA- A+ A - + - 35 41 42 44 42 66 70 82 98 150 Spreads: 2 yr 36 48 52 56 68 72 76 85 92 165 8 3 42 49 56 60 70 75 80 88 95 170 5 50 62 66 70 75 77 84 99 104 190 7 Yr 68 76 80 82 90 92 95 128 135 195 10 Yr 82 91 96 98 101 103 104 150 158 210 30 Yr 102 112 114 120 125 127 130 177 184 270

Step by Step Solution

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Lets tackle each of these bond questions one at a time First we have a 15year 7 coupon bond with a par value of 1000 that is selling at 1050 The investor needs to sell the bond after 10 years at a yie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started