Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A $1.505.52 $1,067.24 C $1.758.71 D. $1,519 58 E$902.71 14. The Steel Factory is considering a project that will produce annual cash flows of $43,800,

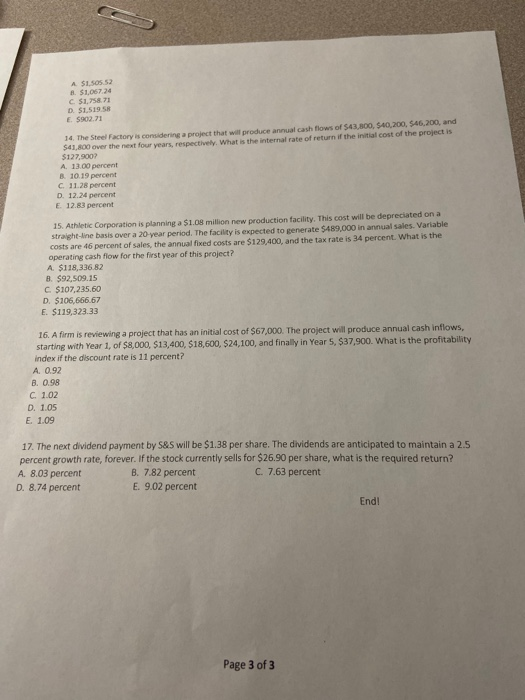

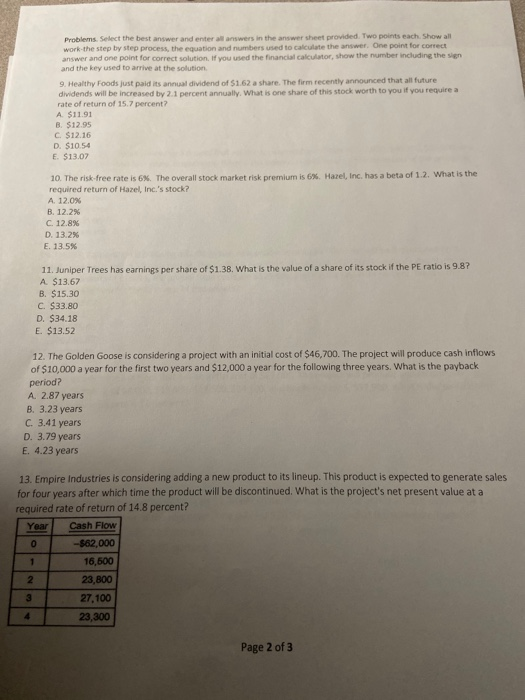

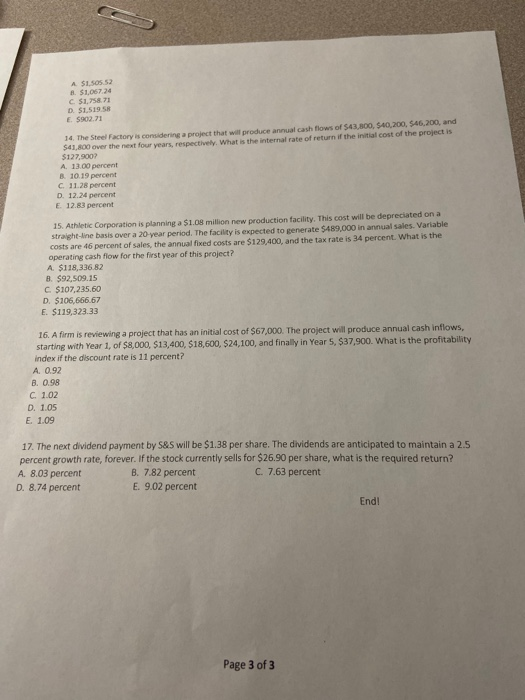

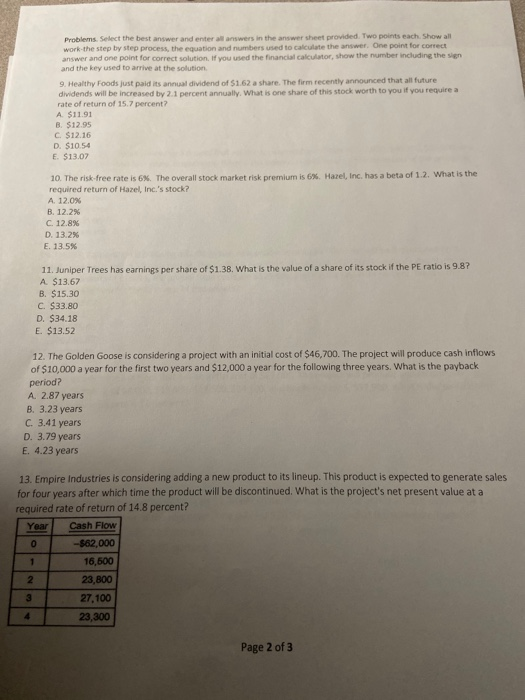

A $1.505.52 $1,067.24 C $1.758.71 D. $1,519 58 E$902.71 14. The Steel Factory is considering a project that will produce annual cash flows of $43,800, $40,200, $46,200, and $41,800 over the next four years, respectively, What is the internal rate of return if the initial cost of the project is $127,900 A. 13.00 percent B. 10.19 percent C. 11.28 percent D. 12.24 percent E 12.83 percent 15. Athletic Corporation is planning a $1.08 million new production facility. This cost will be depreciated on a straight-line basis over a 20-year period. The facility is expected to generate $489,000 in annual sales. Variable costs are 46 percent of sales, the annual fixed costs are $129,400, and the tax rate is 34 percent. What is the operating cash flow for the first year of this project? A. $118,336.82 B. $92,509.15 C $107,235.60 D. $106,666.67 E. $119,323.33 16. A firm is reviewing a project that has an initial cost of $67,000. The project will produce annual cash inflows, starting with Year 1, of $8,000, $13,400, $18,600, $24,100, and finally in Year 5, $37,900. What is the profitability index if the discount rate is 11 percent? A. 0.92 . 0.98 C. 1.02 D. 1.05 . 1.09 17. The next dividend payment by S&S will be $1.38 per share. The dividends are anticipated to maintain a 2.5 percent growth rate, forever. If the stock currently sells for $26.90 per share, what is the required return? A. 8.03 percent B. 7.82 percent E. 9.02 percent C. 7.63 percent D. 8.74 percent End! Page 3 of 3 Problems. Select the best answer and enter all answers in the answer sheet provided. Two points each Show all work-the step by step process, the equation and numbers used to calculate the answer, One point for correct answer and one point for correct solution, If you used the financial calculator, show the number including the sign and the key used to arrive at the solution 9. Healthy Foods just paid its annual dividend of $1.62 a share. The firm recently announced that all future dividends will be increased by 2.1 percent annually. What is one share of this stock worth to you if you require a rate of return of 15.7 percent? A $11.91 B. $12.95 C. $12.16 D. $10.54 E. $13.07 10. The risk-free rate is 6%. The overall stock market risk premium is 6 %. Hazel, Inc. has a beta of 1.2. What is the required return of Hazel, Inc.'s stock? A. 12.0 % B. 12.2 % C. 12.8 % D. 13.2 % E. 13.5 % 11. Juniper Trees has earnings per share of $1.38. What is the value of a share of its stock if the PE ratio is 9.8? A $13.67 B. $15.30 C. $33.80 D. $34.18 E. $13.52 12. The Golden Goose is considering a project with an initial cost of $46,700. The project will produce cash inflows of $10,000 a year for the first two years and $12,000 a year for the following three years. What is the payback period? A. 2.87 years B. 3.23 years C. 3.41 years D. 3.79 years E. 4.23 years 13. Empire Industries is considering adding a new product to its lineup. This product is expected to generate sales for four years after which time the product will be discontinued. What is the project's net present value at a required rate of return of 14.8 percent? Cash Flow Year -562,000 16,600 1 23,800 2 3 27,100 23,300 Page 2 of 3

A $1.505.52 $1,067.24 C $1.758.71 D. $1,519 58 E$902.71 14. The Steel Factory is considering a project that will produce annual cash flows of $43,800, $40,200, $46,200, and $41,800 over the next four years, respectively, What is the internal rate of return if the initial cost of the project is $127,900 A. 13.00 percent B. 10.19 percent C. 11.28 percent D. 12.24 percent E 12.83 percent 15. Athletic Corporation is planning a $1.08 million new production facility. This cost will be depreciated on a straight-line basis over a 20-year period. The facility is expected to generate $489,000 in annual sales. Variable costs are 46 percent of sales, the annual fixed costs are $129,400, and the tax rate is 34 percent. What is the operating cash flow for the first year of this project? A. $118,336.82 B. $92,509.15 C $107,235.60 D. $106,666.67 E. $119,323.33 16. A firm is reviewing a project that has an initial cost of $67,000. The project will produce annual cash inflows, starting with Year 1, of $8,000, $13,400, $18,600, $24,100, and finally in Year 5, $37,900. What is the profitability index if the discount rate is 11 percent? A. 0.92 . 0.98 C. 1.02 D. 1.05 . 1.09 17. The next dividend payment by S&S will be $1.38 per share. The dividends are anticipated to maintain a 2.5 percent growth rate, forever. If the stock currently sells for $26.90 per share, what is the required return? A. 8.03 percent B. 7.82 percent E. 9.02 percent C. 7.63 percent D. 8.74 percent End! Page 3 of 3 Problems. Select the best answer and enter all answers in the answer sheet provided. Two points each Show all work-the step by step process, the equation and numbers used to calculate the answer, One point for correct answer and one point for correct solution, If you used the financial calculator, show the number including the sign and the key used to arrive at the solution 9. Healthy Foods just paid its annual dividend of $1.62 a share. The firm recently announced that all future dividends will be increased by 2.1 percent annually. What is one share of this stock worth to you if you require a rate of return of 15.7 percent? A $11.91 B. $12.95 C. $12.16 D. $10.54 E. $13.07 10. The risk-free rate is 6%. The overall stock market risk premium is 6 %. Hazel, Inc. has a beta of 1.2. What is the required return of Hazel, Inc.'s stock? A. 12.0 % B. 12.2 % C. 12.8 % D. 13.2 % E. 13.5 % 11. Juniper Trees has earnings per share of $1.38. What is the value of a share of its stock if the PE ratio is 9.8? A $13.67 B. $15.30 C. $33.80 D. $34.18 E. $13.52 12. The Golden Goose is considering a project with an initial cost of $46,700. The project will produce cash inflows of $10,000 a year for the first two years and $12,000 a year for the following three years. What is the payback period? A. 2.87 years B. 3.23 years C. 3.41 years D. 3.79 years E. 4.23 years 13. Empire Industries is considering adding a new product to its lineup. This product is expected to generate sales for four years after which time the product will be discontinued. What is the project's net present value at a required rate of return of 14.8 percent? Cash Flow Year -562,000 16,600 1 23,800 2 3 27,100 23,300 Page 2 of 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started