Question

(a) (2 marks) Find the missing total return for the Equity portfolio. (b) (5 marks) Calculate the performance of your entire portfolio and the benchmark

(a) (2 marks) Find the missing total return for the Equity portfolio.

(b) (5 marks) Calculate the performance of your entire portfolio and the benchmark portfolio. Did your portfolio underperform or overperform the benchmark portfolio?

(c) (8 marks) Evaluate the performance attributes of your entire portfolio relative to the benchmark portfolio. What does the analysis tell you about your skillset as a fund manager?

d) (6 marks) Evaluate the risk-adjusted performance of your entire portfolio relative to a benchmark portfolio and interpret your findings.

(e) (4 marks) What is benchmark error? And how could benchmark error influence your conclusion regarding fund performance in this question?

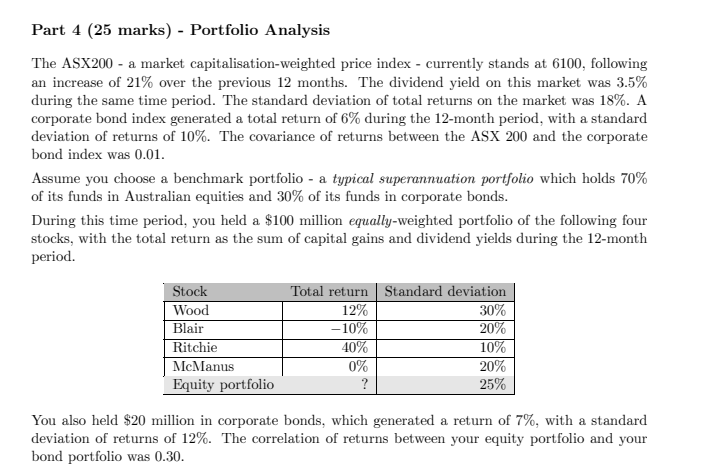

Part 4 (25 marks) - Portfolio Analysis The ASX200 - a market capitalisation-weighted price index - currently stands at 6100, following an increase of 21% over the previous 12 months. The dividend yield on this market was 3.5% during the same time period. The standard deviation of total returns on the market was 18%. A corporate bond index generated a total return of 6% during the 12-month period, with a standard deviation of returns of 10%. The covariance of returns between the ASX 200 and the corporate bond index was 0.01. Assume you choose a benchmark portfolio - a typical superannuation portfolio which holds 70% of its funds in Australian equities and 30% of its funds in corporate bonds. During this time period, you held a $100 million equally-weighted portfolio of the following four stocks, with the total return as the sum of capital gains and dividend yields during the 12-month period. Stock Wood Blair Ritchie McManus Equity portfolio Total return Standard deviation 12% 30% -10% 20% 40% 10% 0% 20% ? 25% You also held $20 million in corporate bonds, which generated a return of 7%, with a standard deviation of returns of 12%. The correlation of returns between your equity portfolio and your bond portfolio was 0.30. Part 4 (25 marks) - Portfolio Analysis The ASX200 - a market capitalisation-weighted price index - currently stands at 6100, following an increase of 21% over the previous 12 months. The dividend yield on this market was 3.5% during the same time period. The standard deviation of total returns on the market was 18%. A corporate bond index generated a total return of 6% during the 12-month period, with a standard deviation of returns of 10%. The covariance of returns between the ASX 200 and the corporate bond index was 0.01. Assume you choose a benchmark portfolio - a typical superannuation portfolio which holds 70% of its funds in Australian equities and 30% of its funds in corporate bonds. During this time period, you held a $100 million equally-weighted portfolio of the following four stocks, with the total return as the sum of capital gains and dividend yields during the 12-month period. Stock Wood Blair Ritchie McManus Equity portfolio Total return Standard deviation 12% 30% -10% 20% 40% 10% 0% 20% ? 25% You also held $20 million in corporate bonds, which generated a return of 7%, with a standard deviation of returns of 12%. The correlation of returns between your equity portfolio and your bond portfolio was 0.30Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started