Question

A $2 million, five-year loan to a BBB-rated corporation in the computer parts industry. MC Bancorp charges a servicing fee of 75 basis points. The

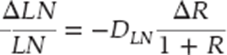

A $2 million, five-year loan to a BBB-rated corporation in the computer parts industry. MC Bancorp charges a servicing fee of 75 basis points. The duration on the loan is 4.5 years. The cost of funds for the bank (the RAROC benchmark) is 8 percent. Based on four years of historical data, the bank has estimated the maximum change in the risk premium on the computer parts industry to be approximately 5.5 percent. The current market rate for loans in this industry is 10 percent.

Estimate the RAROC with information provided in the problem and State whether the loan should be accepted or rejected and why.

use this

Also answer the question

LNLN=DLN1+RRStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started