Answered step by step

Verified Expert Solution

Question

1 Approved Answer

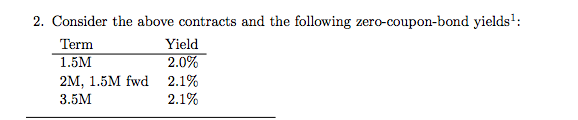

(a) (2 points) Using the 1.5M and 3.5M zeros (i.e. not the 2M 1.5M forward): What are the fair contract prices in this case? (b)

(a) (2 points) Using the 1.5M and 3.5M zeros (i.e. not the 2M 1.5M forward): What are the fair contract prices in this case?

(b) (2 points) How would you make money in this case?

(c) (3 points) Decompose your profit into futures curve P&L and yield curve P&L.

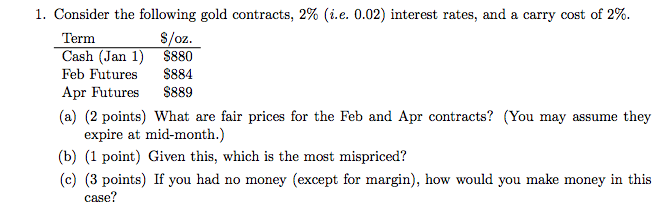

1. Consider the following gold contracts, 2% (i.e. 0.02) interest rates, and a carry cost of 2%. S/oz Term Cash (Jan 1) $880 Feb Futures $884. Apr Futures $889 (a) (2 points) What are fair prices for the Feb and Apr contracts (You may assume they expire at mid-month.) (b) (1 point) Given this, which is the most mispriced? (c) (3 points) If you had no money (except for margin how would you make money in this caseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started