Question

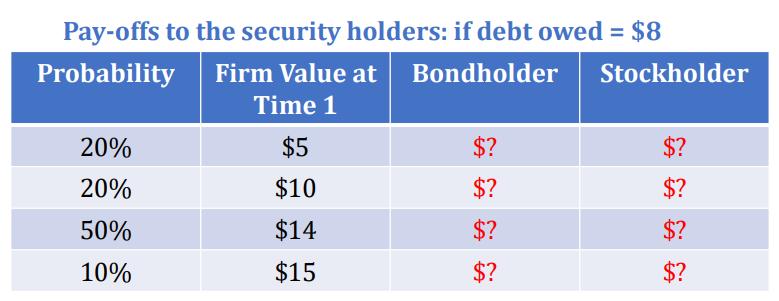

A. (20 points) The possible outcomes of a firms value at time 1 are as below. At time 1, the debtholders are entitled $8 payment

A. (20 points) The possible outcomes of a firms value at time 1 are as below. At time 1, the debtholders are entitled $8 payment from the firm. In other words, the firm owes its bondholders $8 at time 1. The stockholders will receive whatever is left over after the bondholders have been paid. In the event the firm does not generate enough value to pay the bondholders at time 1, the firm is insolvent and the bondholders will take whatever the firm has. Please fill out the payoffs to bondholders and stockholders under each outcome.

Given the payoffs in each possible outcome for all the stakeholders,

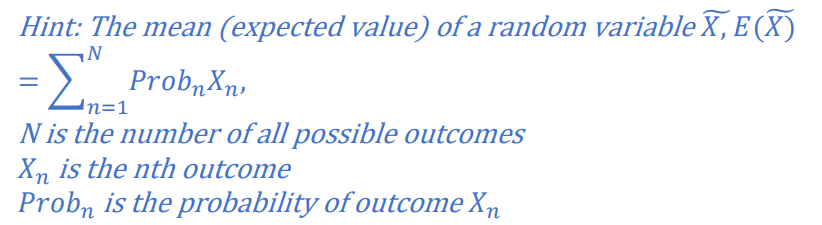

B. (10) What is the expected value of the firm at time 1?

C. (10) What is the expected value of the debt at time 1?

D. (10) What is the expected value of the equity at time 1?

From Questions B,C,D above, you know the expected values of the firm, its debt, and equity a time 1, you could calculate their values at time 0 by discounting them with their respective costs of capital.

Please come up with any economically sensible costs of capital for the firm, debt, and equity, that satisfy the following condition:

() > E() > E()

E. (10 points) E()?

F. (10 points) E() ?

G. (10 points) E() ?

H. (20 points) To see if your choices of the costs of capital make sense, please verify the equation with your results: () = E() (Equity Ratio) + E() (Debt Ratio)

Hint: there is no unique solution. Any reasonable combination of costs of capital may work.

Pay-offs to the security holders: if debt owed = $8 Probability Firm Value at Bondholder Stockholder Time 1 20% $5 $? $? 20% $? 50% $10 $14 $15 $? 10% $? N Hint: The mean (expected value) of a random variable X, E(X) = ProbnXn N is the number of all possible outcomes Xn is the nth outcome Probn is the probability of outcome Xn n=1 Pay-offs to the security holders: if debt owed = $8 Probability Firm Value at Bondholder Stockholder Time 1 20% $5 $? $? 20% $? 50% $10 $14 $15 $? 10% $? N Hint: The mean (expected value) of a random variable X, E(X) = ProbnXn N is the number of all possible outcomes Xn is the nth outcome Probn is the probability of outcome Xn n=1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started