Question

A 2-year interest rate swap contract with a constant notional amount of 200,000 is established on January 1, 2021. Under the contract, Corp. A

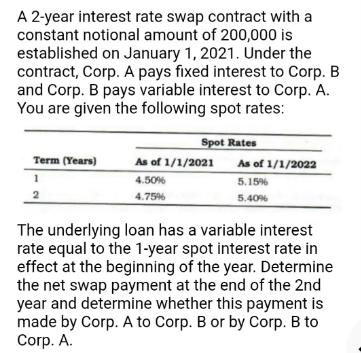

A 2-year interest rate swap contract with a constant notional amount of 200,000 is established on January 1, 2021. Under the contract, Corp. A pays fixed interest to Corp. B and Corp. B pays variable interest to Corp. A. You are given the following spot rates: Term (Years) 1 2 Spot Rates As of 1/1/2021 4.50% 4.75% As of 1/1/2022 5.15% 5.40% The underlying loan has a variable interest rate equal to the 1-year spot interest rate in effect at the beginning of the year. Determine the net swap payment at the end of the 2nd year and determine whether this payment is made by Corp. A to Corp. B or by Corp. B to Corp. A.

Step by Step Solution

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To determine the net swap payment at the end of the 2nd year and the direction of the payment Corp A ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Theory

Authors: William R. Scott

7th edition

132984660, 978-0132984669

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App