Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A 2-year project is under consideration. Here's what's known about its cash flows: - $3,000,000 would need to be spent immediately to buy production equipment

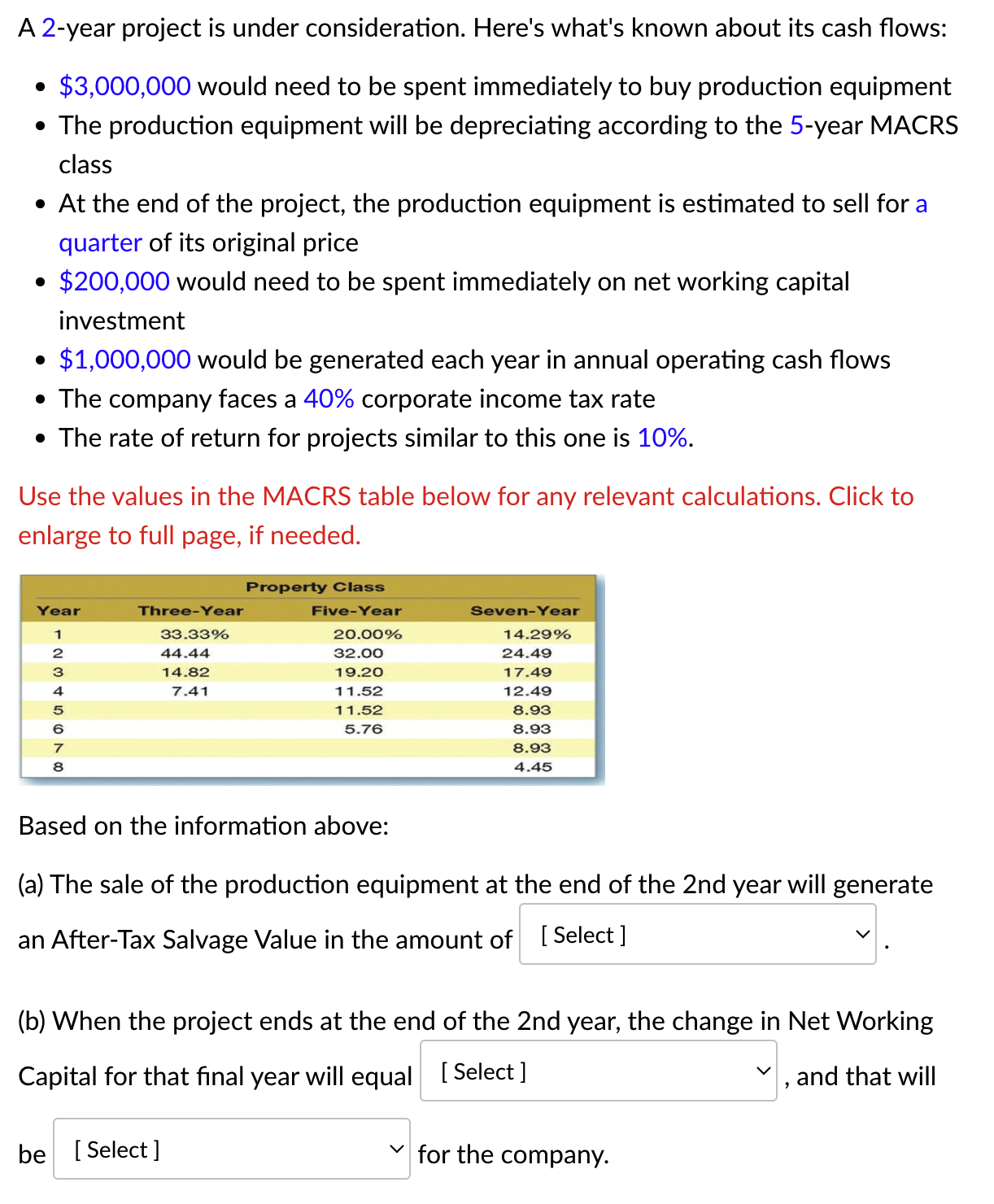

A 2-year project is under consideration. Here's what's known about its cash flows: - $3,000,000 would need to be spent immediately to buy production equipment - The production equipment will be depreciating according to the 5-year MACRS class - At the end of the project, the production equipment is estimated to sell for a quarter of its original price - $200,000 would need to be spent immediately on net working capital investment - $1,000,000 would be generated each year in annual operating cash flows - The company faces a 40% corporate income tax rate - The rate of return for projects similar to this one is 10%. Use the values in the MACRS table below for any relevant calculations. Click to enlarge to full page, if needed. Based on the information above: (a) The sale of the production equipment at the end of the 2 nd year will generate an After-Tax Salvage Value in the amount of (b) When the project ends at the end of the 2 nd year, the change in Net Working Capital for that final year will equal , and that will be for the company

A 2-year project is under consideration. Here's what's known about its cash flows: - $3,000,000 would need to be spent immediately to buy production equipment - The production equipment will be depreciating according to the 5-year MACRS class - At the end of the project, the production equipment is estimated to sell for a quarter of its original price - $200,000 would need to be spent immediately on net working capital investment - $1,000,000 would be generated each year in annual operating cash flows - The company faces a 40% corporate income tax rate - The rate of return for projects similar to this one is 10%. Use the values in the MACRS table below for any relevant calculations. Click to enlarge to full page, if needed. Based on the information above: (a) The sale of the production equipment at the end of the 2 nd year will generate an After-Tax Salvage Value in the amount of (b) When the project ends at the end of the 2 nd year, the change in Net Working Capital for that final year will equal , and that will be for the company Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started