Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A 3 years bond with an annual coupon rate of 6% has a face value of $100. The bond has a yearly interest payment, calculate

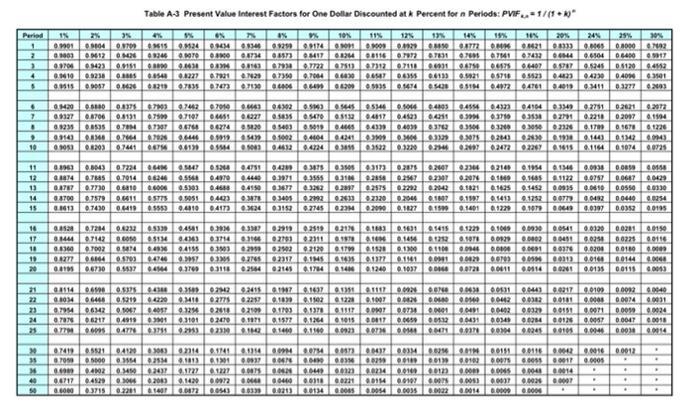

A 3 years bond with an annual coupon rate of 6% has a face value of $100. The bond has a yearly interest payment, calculate the market value of the bond. What will be the value of the bond if the yield to maturity is below (YTM = 4%) or above (YTM = 8%) coupon rate? (Use Table A-3 Present Value Interest Factors for One Dollar Discounted at k Percent for n Periods: PVIFk,n. Show your calculations step-by-step and interpret your findings).

Table A-3 Present Value Interest Factors for One Dollar Discounted at & Percent for n Periods: PVIF 1/(1+k)" Period 1% 3% 4% 3% 4% 03615 0.9524 0.9434 4% 09259 091745091 12% 0.4929 1 09901 9004 09709 09003 09412 05426 09246 0.0070 0900 0.4734 08573 08417 63264 08116 0.7972 3 0.9706 09423 09151 08143 67938 0.7722 67513 07312 07118 07629 07350 0.7064 0.6430 0.4547 06355 07130 04006 0.60 04209 05935 1474 4 0.9410 0.9236 0.3005 09057 0.3626 000 08438 0339 08540 0.8227 0.7921 03219 9.7835 07473 S 2 4 7 0.9420 0.0000 0.8375 0.8643 67903 0744207010 0.9327 0.8706 0.8131 67999 0.7107 04451 04227 . 89235 08535 07014 67307 0.6764 84274 0.5820 03143 08346 0.7044 06446 03919 05439 04139 05544 05043 09053 08203 07441 06756 10 11 12 13 14 15 16 17 18 19 20 24 25 SISED K 35 36 40 50 CLOED SCOLO PISED 756 MPED 0.3963 08043 0.7224 0.5447 05264 0.4299 03475 0.8874 0.7885 07014 06246 0.5568 0.4970 0.3971 0.3555 0.3767 0.7730 0.6810 04006 0.5303 04648 03677 0.3262 08700 9.7579 06411 05775 0.5051 04423 0.3878 03405 02992 0.4310 04173 0.3624 03152 0.4150 0.7430 06419 06596 0.5375 08034 06446 0.5219 SPEED 0.4528 0.7204 0.8232 6.5339 0.4581 0.3936 88444 07142 06050 65134 04363 0.3714 6.3166 0.8360 0.7002 0.5874 04936 0.4155 0.3503 2959 0.8277 06004 0.5703 04746 6.3957 03305 0.2765 04544 0.3709 03118 0.2564 06730 0.5537 67419 05521 04120 63063 02314 0.1741 7059 5000 0.3554 02554 0.1813 61301 0.4909 0.3450 0.4002 02437 43727 63227 06717 0.4529 03004 02083 0.1429 00972 86000 61407 6.3715 0.0872 0.0543 0.2201 0.4751 9% SOLED 04302 05963 5645 05346 0.5835 05470 05132 04817 0540305019 0.4445 6.4339 0100204404 04241 03909 04432 0.4224 03055 03522 10% 02919 0.2519 0270302311 11% 6006 21 04300 22 23 6.7954 06342 01047 43549 02942 02415 01947 1437 01311 61117 0.0924 64220 9.3416 02775 02257 0.1839 01102 01228 0.1007 0.0826 0.4057 03254 02418 62109 0.1703 0.1378 61117 0.0734 6.7976 06217 0.4919 6.3901 03101 02470 0.1971 01577 01264 0.4776 63751 92953 02339 $1642 01400 0.1140 6.7794 06095 03505 43173 03106 02856 02897 02575 02433 02120 02314 02090 6.1314 60994 00754 00573 0937 00676 0040 00354 0.0075 00424 00449 00040 00440 0.0318 0.0221 00339 0.0213 0.0134 00045 10% 33% 14% 19% 20% 24% 08450 08772 OMK 0.8421 08333 0.0005 07831 07695 67041 07432 04044 0.6504 06400 4.5017 04931 04759 06575 06407 6.5747 0.5245 05120 04552 04133 0.5921 05716 05523 0.4823 0.4230 0.4094 63501 05428 05154 0.4972 04761 04019 93411 03277 4.2003 03404 03329 03075 02043 02430 01938 0.3220 02944 0.2997 02472 02267 0.1415 2000 0.1044 04005 9.4554 04323 04104 03349 0.2751 02621 42072 0.4523 0.4251 6.3994 0.3750 0.3538 02791 0.2218 0.2017 0.1994 0.4039 63762 0.3504 63200 03050 02126 0.1709 01678 6.1226 0.1443 0.1342 0943 0.1164 0.1074 0725 0.2875 0.2007 02304 02145 02567 0.2307 0.2076 0.2292 02042 0.1821 02044 0.1007 0.1997 01413 0.1252 00779 0.0492 0.1401 01229 0.1079 00649 0.1827 02176 01683 0.1631 0.1415 6.1229 01049 0.0930 00541 0.0320 0.0201 00150 0.1970 61606 0.1454 01252 0.1076 00929 0.0002 00451 0.0258 60225 60116 02502 02120 01709 0.1528 0.1300 01100 0.0044 0.0000 0.0001 00376 0.0200 0.0180 0.0009 02317 0.1345 01635 0.1377 0.1161 0.0429 60703 0.0554 00313 0.0166 00144 60068 02145 0.1784 0.1240 0.1037 0.0728 00114 0.0135 00115 10000 20100 0.1954 0.1346 0.0936 01040 0.1485 1122 0.0757 0.068740429 0.1625 0.1452 0.0935 0.0410 0.0550 0.0330 00440 00254 0.0352 0.0195 00437 00334 08256 0014 00151 68259 00109 00139 0.0102 00323 60234 0.0149 00123 0000 00045 00154 0.0053 0.0037 60000 0.0035 0.0054 6.0022 0.0014 00740 00438 00531 00443 0.0217 00000 00540 00442 0.0342 0.0101 0.0001 40491 00402 0.0329 0.0071 0.0059 0.0024 0.0057 0.0047 00018 1015 0.0017 0.0059 00112 00431 00349 0.0284 00126 0.0923 00734 0.0544 00471 0.0374 00304 0.0245 00105 0.0046 0.0038 00014 50009 5:00 LOCO'D 15100 0007 . 25% 30% 0.0109 0.0008 0800067692 . . 00859 40156 00116 00042 0.0016 0.0012 60055 00017 0.0005 80014 0.0048 0.0024 0004 . 00092 60040 00074 0031 . . . . . . . .

Step by Step Solution

★★★★★

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started