Question

A 3-year project is expected to generate annual revenues of $125,000, variable costs of $50,000, and fixed costs of $55,000. Assume that variable costs

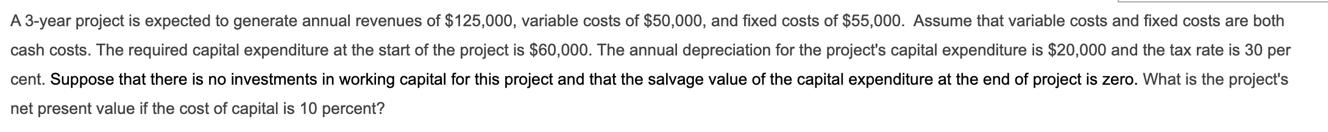

A 3-year project is expected to generate annual revenues of $125,000, variable costs of $50,000, and fixed costs of $55,000. Assume that variable costs and fixed costs are both cash costs. The required capital expenditure at the start of the project is $60,000. The annual depreciation for the project's capital expenditure is $20,000 and the tax rate is 30 per cent. Suppose that there is no investments in working capital for this project and that the salvage value of the capital expenditure at the end of project is zero. What is the project's net present value if the cost of capital is 10 percent?

Step by Step Solution

3.50 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net present value NPV of the project we need to discount the projects cash flows to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Practical Management Science

Authors: Wayne L. Winston, Christian Albright

5th Edition

1305631540, 1305631544, 1305250907, 978-1305250901

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App