Answered step by step

Verified Expert Solution

Question

1 Approved Answer

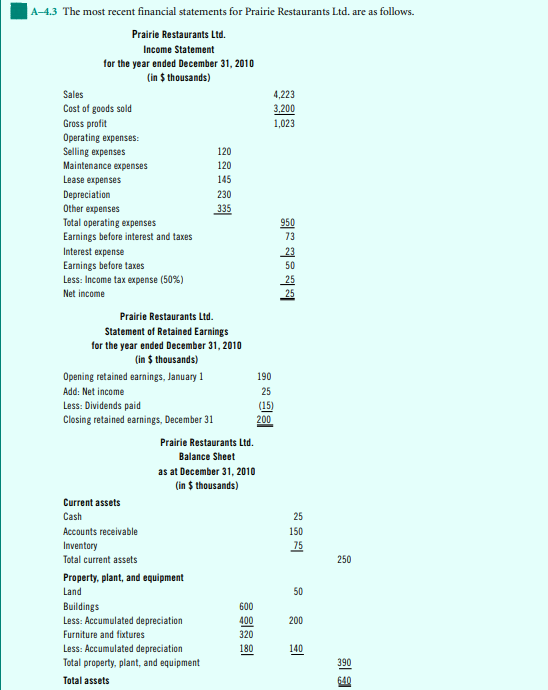

A - 4 . 3 The most recent financial statements for Prairie Restaurants Ltd . are as follows. Current liabilities Accounts payable 1 4 0

A The most recent financial statements for Prairie Restaurants Ltd are as follows. Current liabilities

Accounts payable

Income taxes payable

Total current liabilities

Longterm debt

Bonds,

Total liabilities

Shareholders' equity

Notes

There are thousand shares outstanding, with the most recent price being $ per share.

Prairie Restaurants employs people.

Prairie Restaurants runs its own credit card program, which provides incentives for customers

to pay within days. of sales are on credit.

The amount of inventory, all of which is purchased on credit, has remained the same during

the year.

Industry data on the restaurant industry are as follows:

a ROE

b ROCE

c Operating profit margin

d Gross profit margin

e Average inventory turnover period

f Average collection period for receivables

Average payment period for payables

h Sales revenue to capital employed

i Sales revenue per employee

j Current ratio

k Acid test ratio

I Leverage ratio

m Times interest earned ratio

n Dividend payout ratio

Dividend cover ratio

p Dividend yield

q EPS

r ratio

days

days

days

times

$ million

times

times

$

Required:

a Prepare calculations for the same ratios as shown above for Prairie Restaurants.

b Based on comparisons to the industry ratios, how would you rate Prairie

Restaurants?

Prairie Restaurants Ltd

Statement of Retained Earnings

for the year ended December

in $ thousands

Opening retained earnings, January

Add: Net income

Less: Dividends paid

Closing retained earnings, December

Prairie Restaurants Ltd

Balance Sheet

as at December

in $ thousands

Current assets

Cash

Accounts receivable

Inventory

Total current assets

Property, plant, and equipment

Land

Buildings

Less: Accumulated depreciation

Furniture and fixtures

Less: Accumulated depreciation

Total property, plant, and equipment

Total assets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started