Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Martindale Company, a 100% owned subsidiary of Weisman Corporation, sells inventory to Weisman at a 20% profit on selling price. The following data are

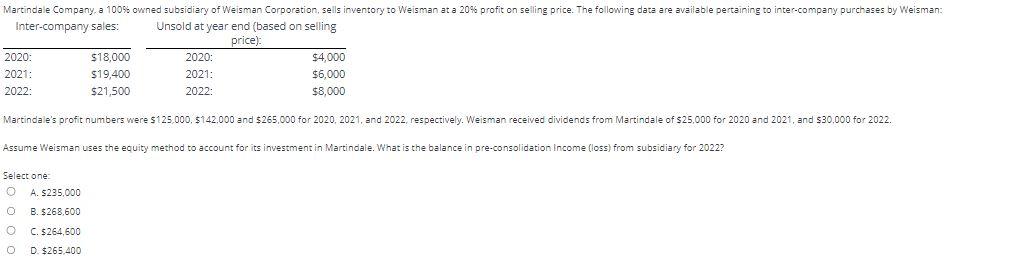

Martindale Company, a 100% owned subsidiary of Weisman Corporation, sells inventory to Weisman at a 20% profit on selling price. The following data are available pertaining to inter-company purchases by Weisman: Inter-company sales: Unsold at year end (based on selling 2020: $18,000 2021: $19,400 2022: $21,500 2020: 2021: 2022: price): $4,000 $6,000 $8,000 Martindale's profit numbers were $125,000, $142,000 and $265,000 for 2020, 2021, and 2022, respectively. Weisman received dividends from Martindale of $25,000 for 2020 and 2021, and $30.000 for 2022. Assume Weisman uses the equity method to account for its investment in Martindale. What is the balance in pre-consolidation Income (loss) from subsidiary for 2022? Select one: A. $235,000 B. $268,600 C. $264,600 D. $265,400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the balance in preconsolidation income l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started