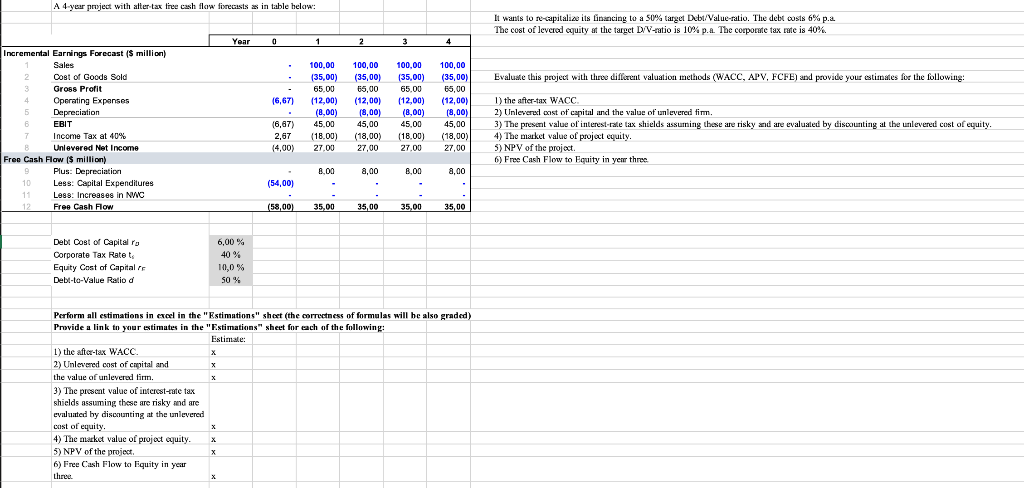

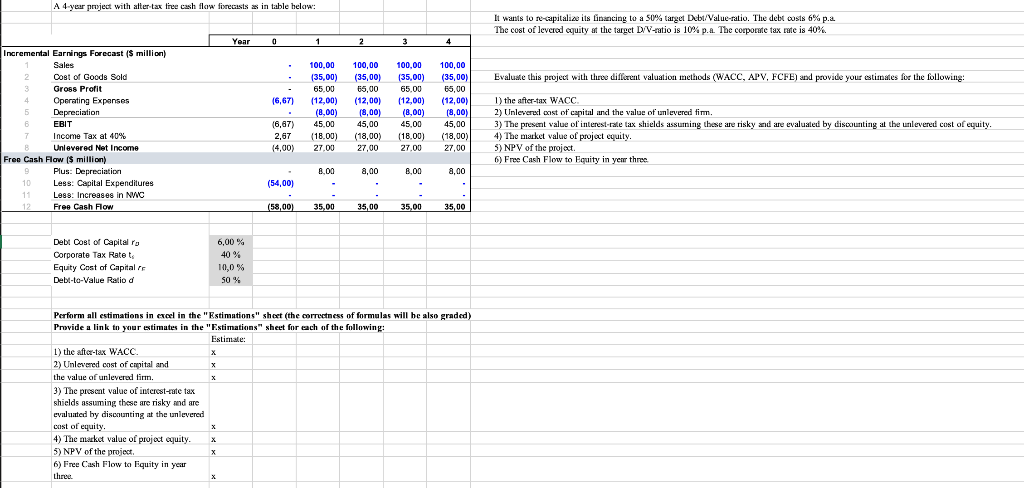

A 4-year project with after-tax tice cash flaw fixecasts as in table helow: It wants to re-capitaliae its linancing to a 50% target Debt/Value-ratio. The debt costs 6% p.a The cost of leverad spuity at the target D V-eratio is 10% p. a. The corporate tax rate is 40%. Evaluate this projed with throe different valuation methods (WACC, APV, FCFE) and provide your estimates for the following: 1) the after-tax WACC. 2) Unlevered onst of capital and the value of umlevered finm. 3) The present value of interest-rate tax shields assuming these are risky and are evaluated by wiscounting at the unlevered cost of euity. 4) The market value of project equity. 5) NPV of the projoct. 6) Free Cash Flow to Equity in yem three. Perform all estimations in exel in the "Estimations" shext (the correctness of formulas will be also graded) Provide a link tn your estimutes in the "Estimations" sheut for each of the following: 1) the after-tax WACC. 2) Unlevered cost of cmital and the value of unlevered tirm. 3) The preseat value of interest-rate tax shields assuming these are risky and are evaluated by discoumting at the umlevered cost of equity. 4) The market value of projot cpuity. x 5) NPV of the project. 6) Free Cash Flow to Equity in year three. A 4-year project with after-tax tice cash flaw fixecasts as in table helow: It wants to re-capitaliae its linancing to a 50% target Debt/Value-ratio. The debt costs 6% p.a The cost of leverad spuity at the target D V-eratio is 10% p. a. The corporate tax rate is 40%. Evaluate this projed with throe different valuation methods (WACC, APV, FCFE) and provide your estimates for the following: 1) the after-tax WACC. 2) Unlevered onst of capital and the value of umlevered finm. 3) The present value of interest-rate tax shields assuming these are risky and are evaluated by wiscounting at the unlevered cost of euity. 4) The market value of project equity. 5) NPV of the projoct. 6) Free Cash Flow to Equity in yem three. Perform all estimations in exel in the "Estimations" shext (the correctness of formulas will be also graded) Provide a link tn your estimutes in the "Estimations" sheut for each of the following: 1) the after-tax WACC. 2) Unlevered cost of cmital and the value of unlevered tirm. 3) The preseat value of interest-rate tax shields assuming these are risky and are evaluated by discoumting at the umlevered cost of equity. 4) The market value of projot cpuity. x 5) NPV of the project. 6) Free Cash Flow to Equity in year three