Answered step by step

Verified Expert Solution

Question

1 Approved Answer

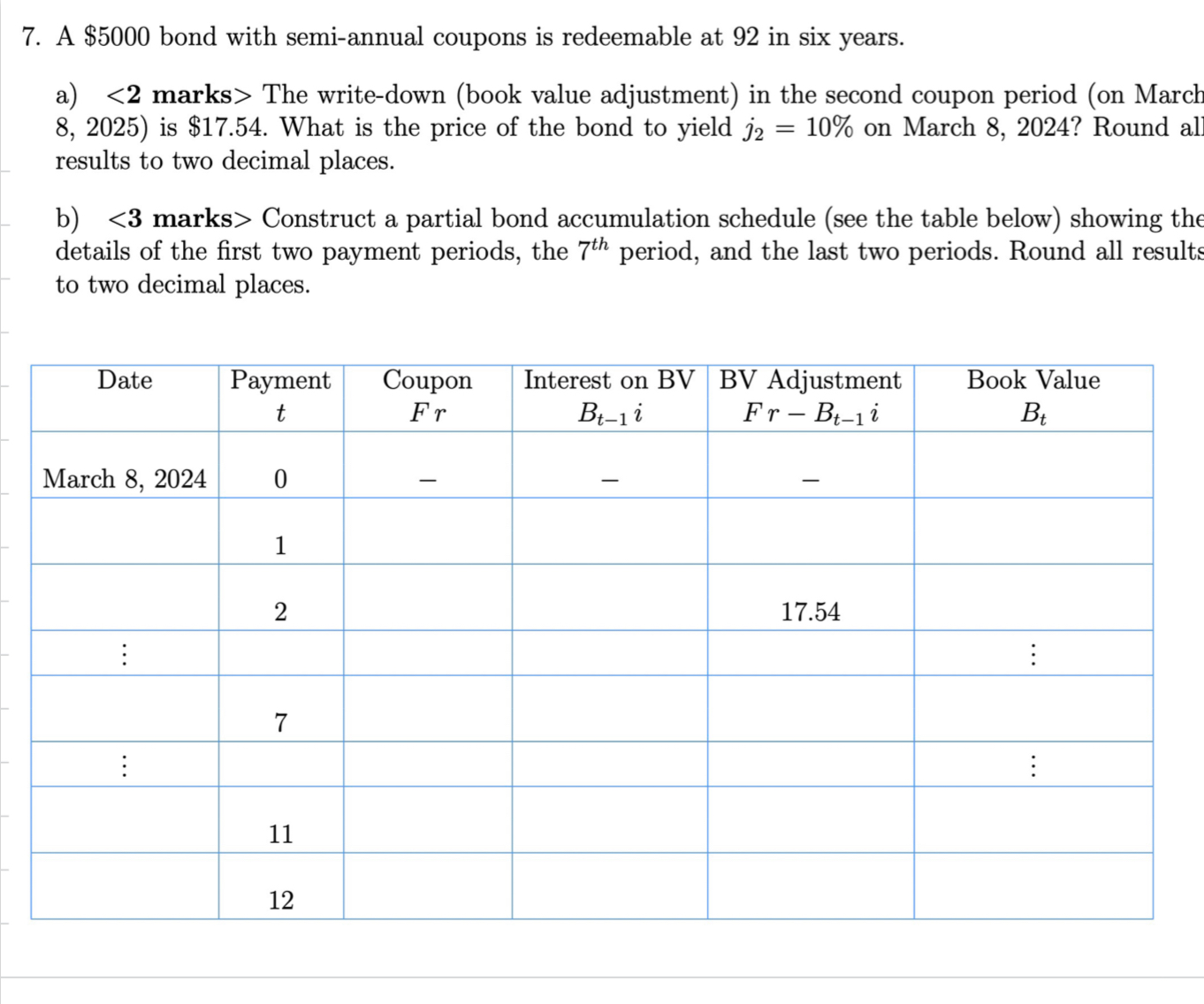

A $ 5 0 0 0 bond with semi - annual coupons is redeemable at 9 2 in six years. a ) 2 marks >

A $ bond with semiannual coupons is redeemable at in six years.

a marks The writedown book value adjustment in the second coupon period on March

is $ What is the price of the bond to yield on March Round al

results to two decimal places.

b marks Construct a partial bond accumulation schedule see the table below showing the

details of the first two payment periods, the period, and the last two periods. Round all results

to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started