Answered step by step

Verified Expert Solution

Question

1 Approved Answer

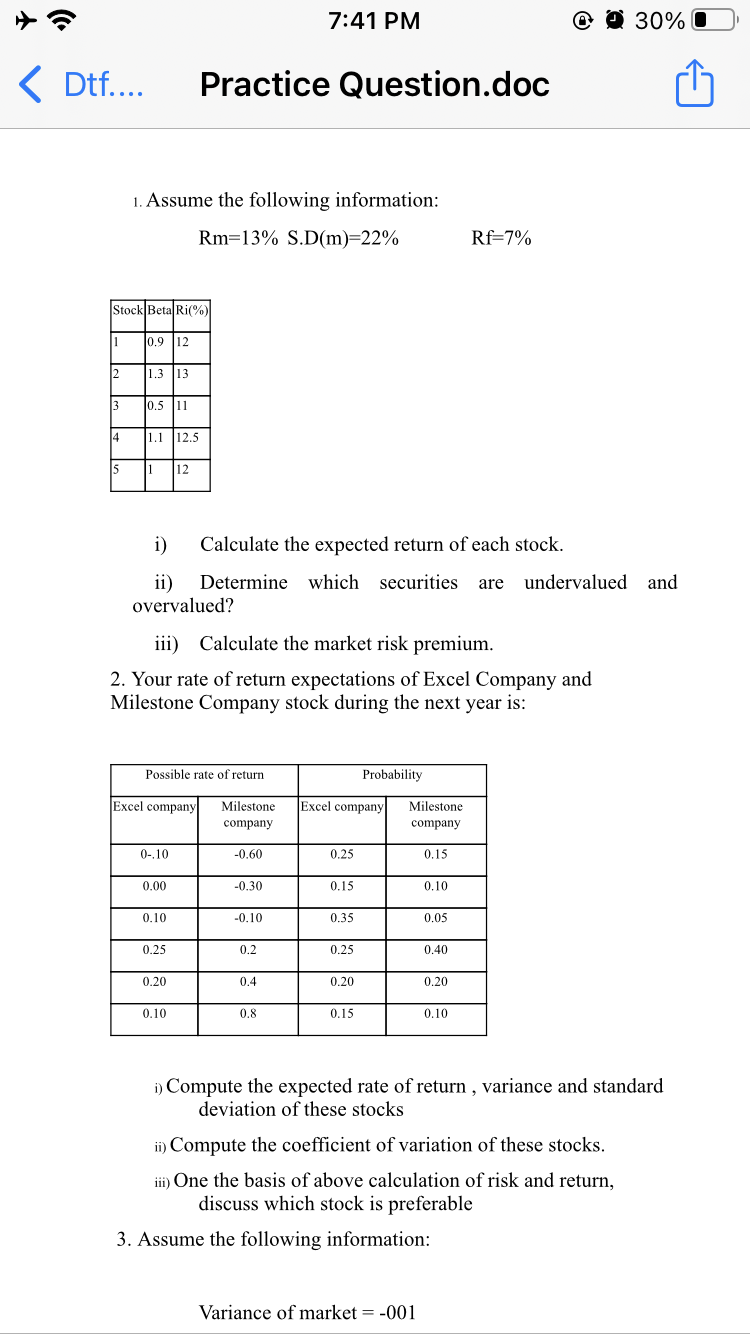

a. '5' 7:41 PM @ n 30% E]- < Dtf 7:41 PM Practice Question.doc 3. Assume the following information: Variance of market -001 Stock Variance

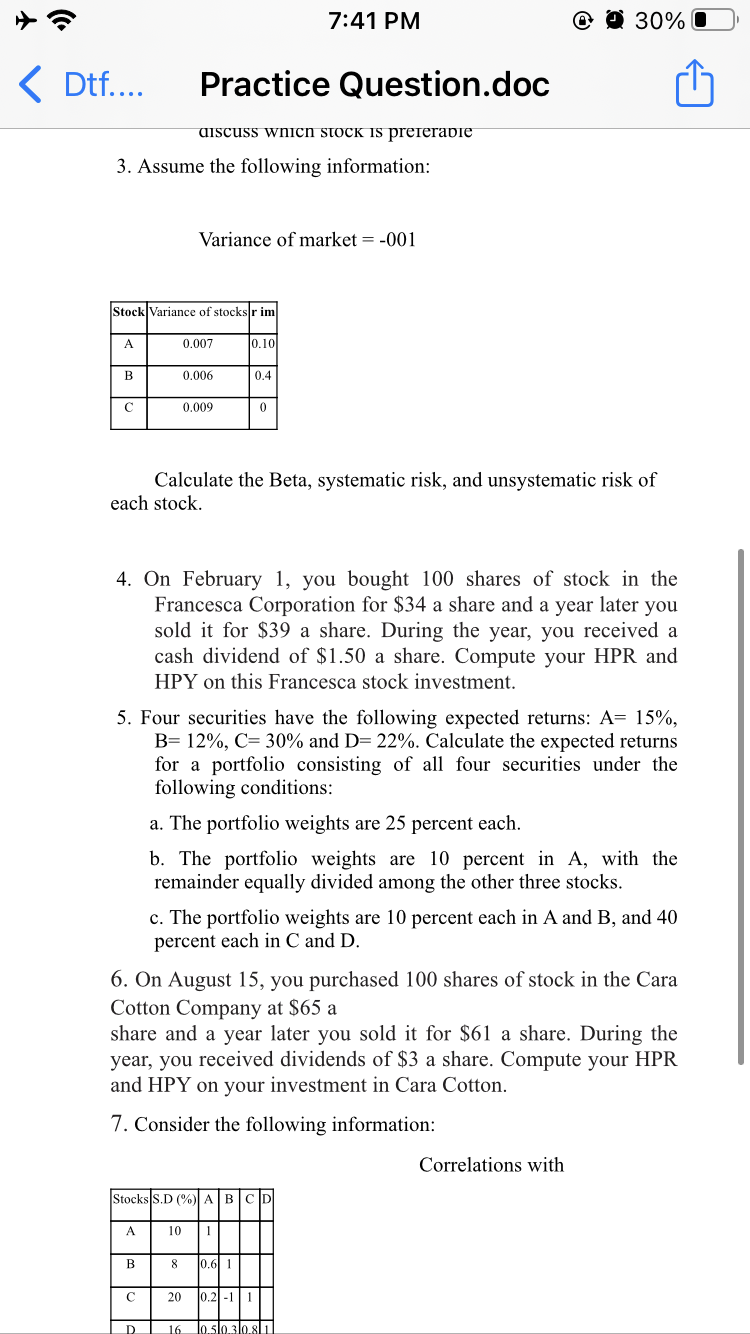

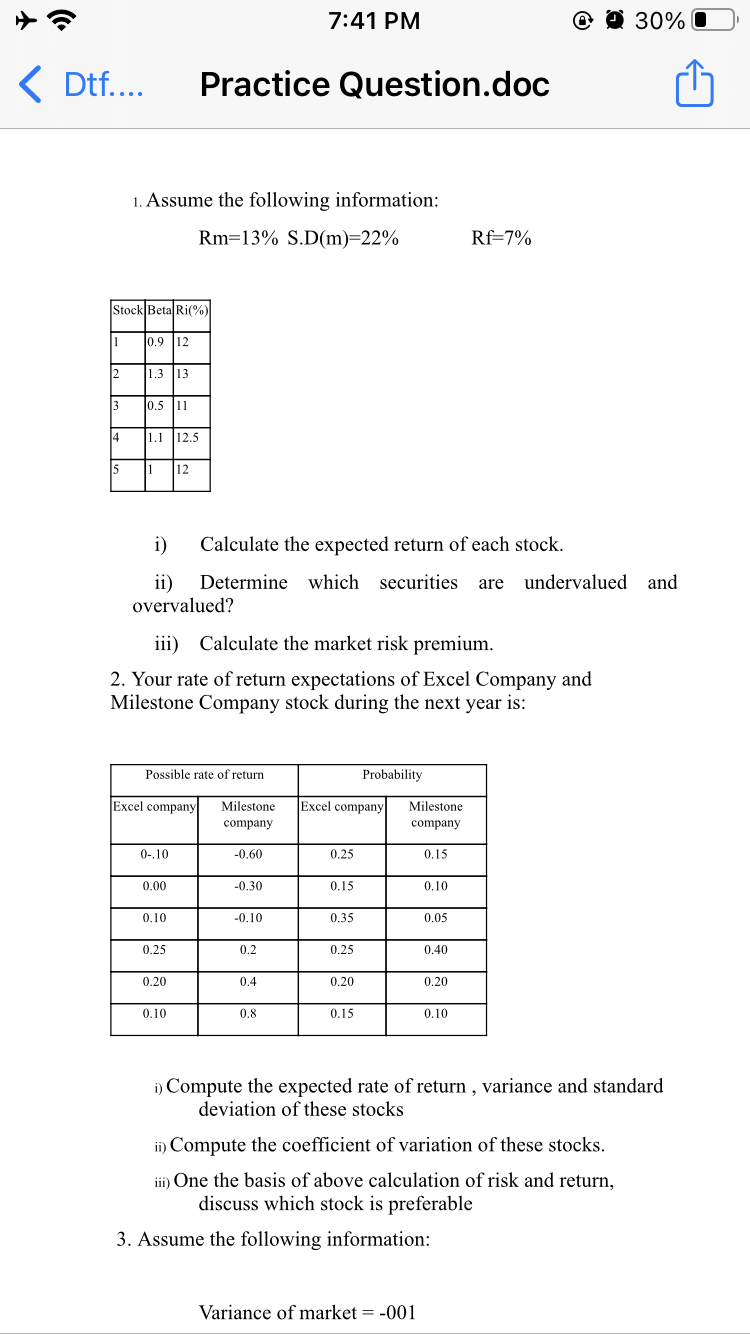

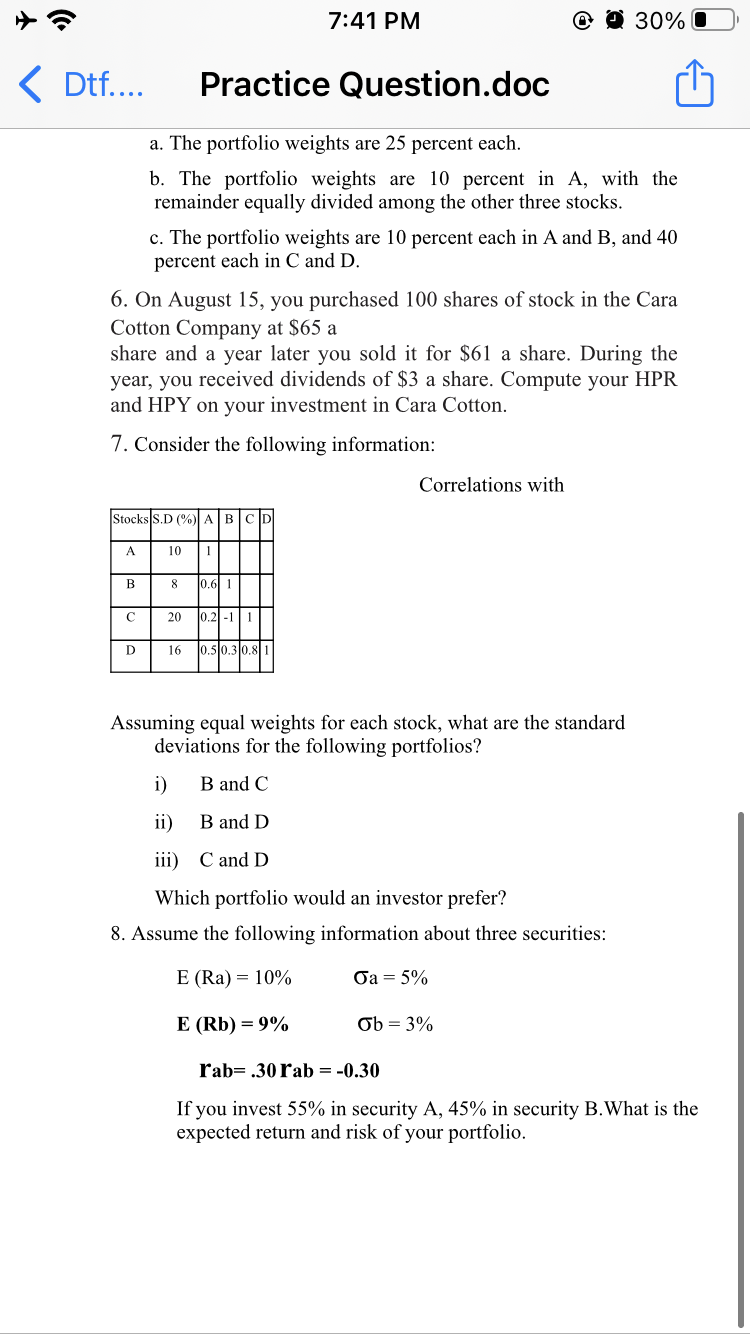

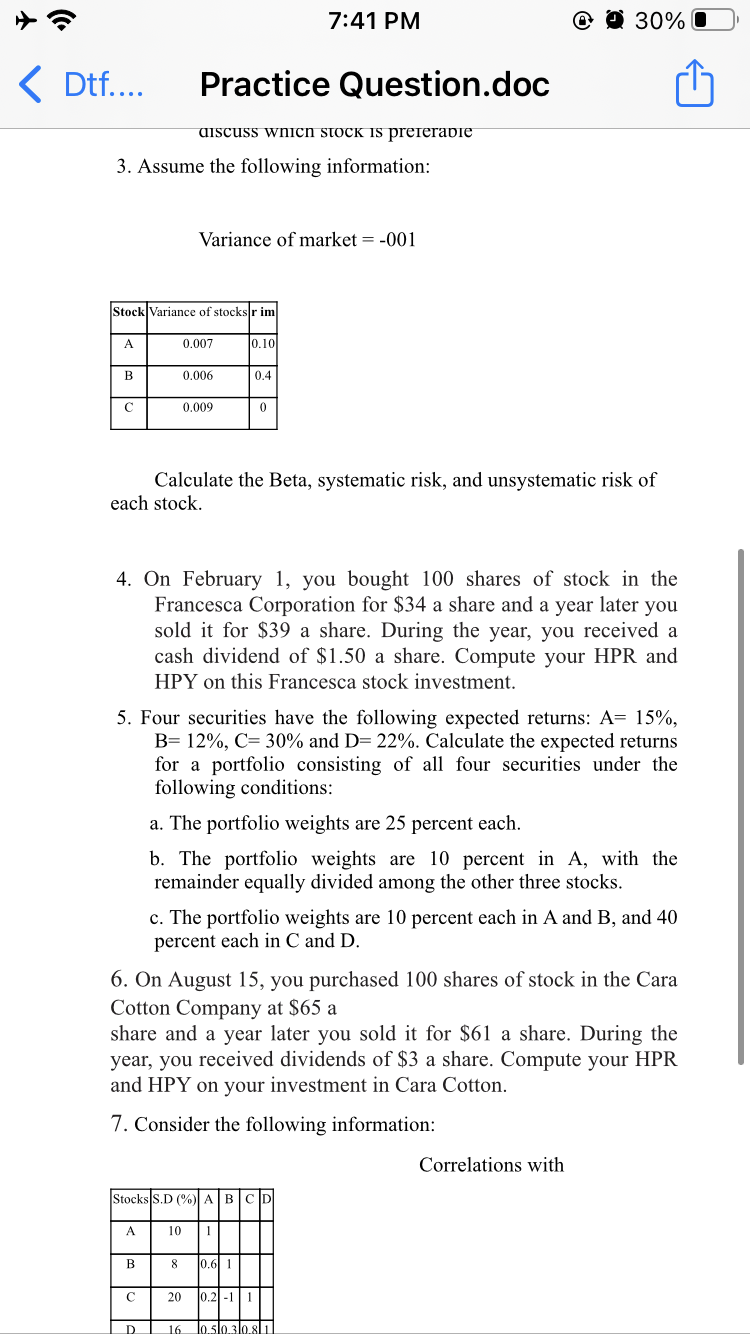

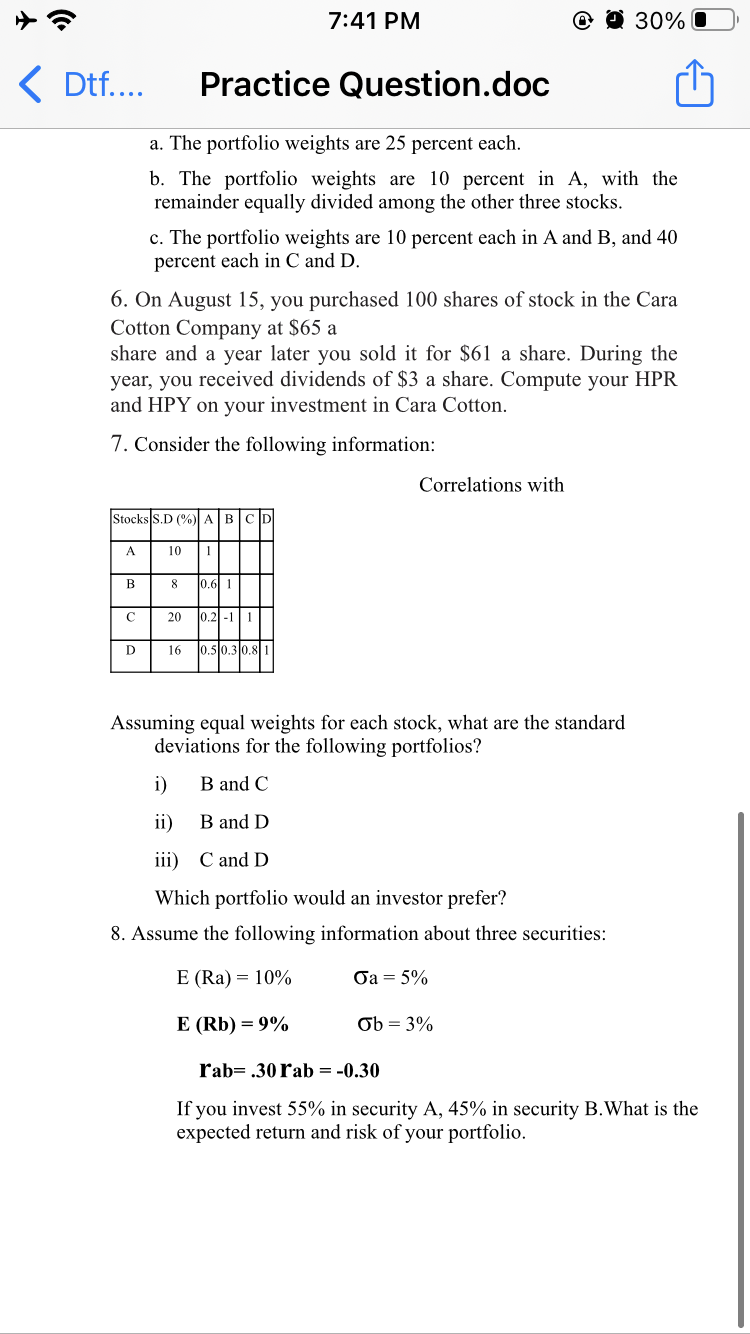

< Dtf 7:41 PM Practice Question.doc 3. Assume the following information: Variance of market -001 Stock Variance of stocks r im c 0.007 0.006 0.009 0.10 0.4 Calculate the Beta, systematic risk, and unsystematic risk Of each stock. 4. On February 1, you bought 100 shares of stock in the Francesca Corporation for $34 a share and a year later you sold it for $39 a share. During the year, you received a cash dividend of $1.50 a share. Compute your HPR and HPY on this Francesca stock investment. 5. Four securities have the following expected returns: A= 15%, B= 12%, C= 30% and 1)=22%. Calculate the expected returns for a portfolio consisting of all four securities under the following conditions: a. The portfolio weights are 25 percent each. b. The portfolio weights are 10 percent in A, with the remainder equally divided among the other three stocks. c. The portfolio weights are 10 percent each in A and B, and 40 percent each in C and D. 6. On August 15, you purchased 100 shares of stock in the Cara Cotton Company at S65 a share and a year later you sold it for $61 a share. During the year, you received dividends of $3 a share. Compute your HPR and HPY on your investment in Cara Cotton. 7. Consider the following information: Correlations with B CD Stocks A 10 20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started