Answered step by step

Verified Expert Solution

Question

1 Approved Answer

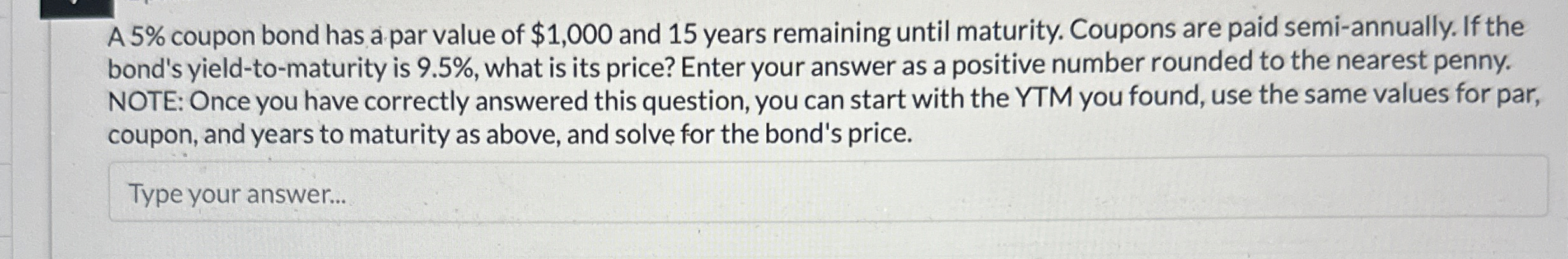

A 5 % coupon bond has a par value of $ 1 , 0 0 0 and 1 5 years remaining until maturity. Coupons are

A coupon bond has a par value of $ and years remaining until maturity. Coupons are paid semiannually. If the

bond's yieldtomaturity is what is its price? Enter your answer as a positive number rounded to the nearest penny.

NOTE: Once you have correctly answered this question, you can start with the YTM you found, use the same values for par,

coupon, and years to maturity as above, and solve for the bond's price.

Type your answer...

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started