a) (5 points) A standard corporate bond ($1,000 face value, semi-annual compounding) was issued exactly 12 years ago and had a 40-year maturity at

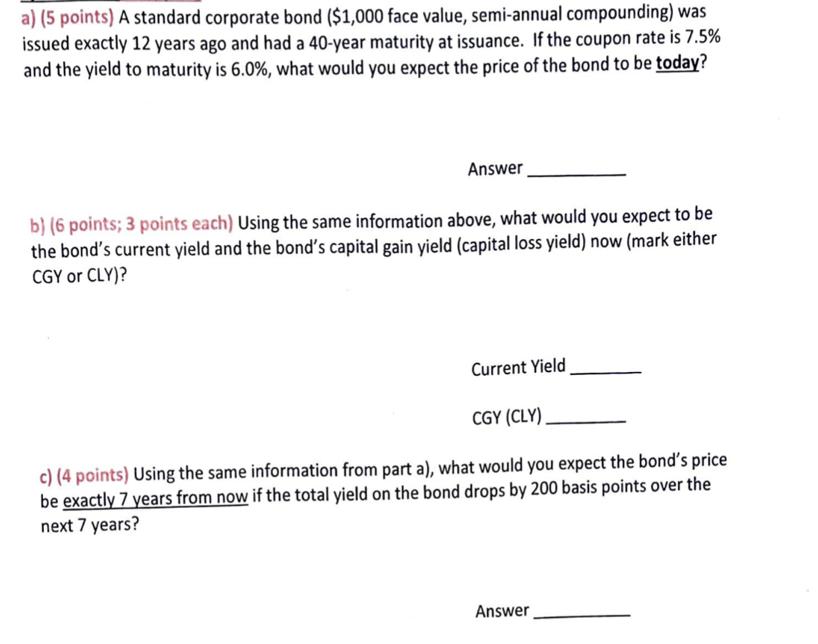

a) (5 points) A standard corporate bond ($1,000 face value, semi-annual compounding) was issued exactly 12 years ago and had a 40-year maturity at issuance. If the coupon rate is 7.5% and the yield to maturity is 6.0%, what would you expect the price of the bond to be today? Answer b) (6 points; 3 points each) Using the same information above, what would you expect to be the bond's current yield and the bond's capital gain yield (capital loss yield) now (mark either CGY or CLY)? Current Yield CGY (CLY). c) (4 points) Using the same information from part a), what would you expect the bond's price be exactly 7 years from now if the total yield on the bond drops by 200 basis points over the next 7 years? Answer

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the price of the bond today we need to calculate the present value of its future cash flows The bond pays a semiannual coupon so it wil...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started