Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. 55,400 B. 71,400 C. 90,400 D. 105,000 E. 106,400 As a manager of ABC Corp., you are considering launching a project... As a manager

A. 55,400

B. 71,400

C. 90,400

D. 105,000

E. 106,400

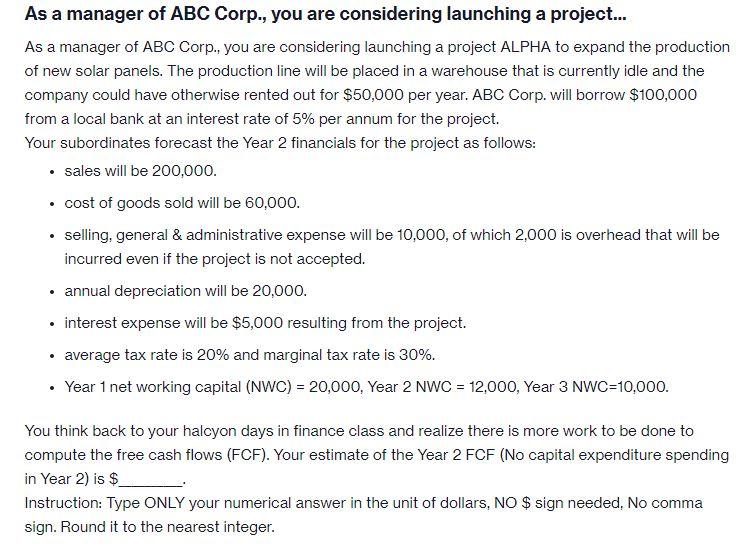

As a manager of ABC Corp., you are considering launching a project... As a manager of ABC Corp., you are considering launching a project ALPHA to expand the production of new solar panels. The production line will be placed in a warehouse that is currently idle and the company could have otherwise rented out for $50,000 per year. ABC Corp. will borrow $100,000 from a local bank at an interest rate of 5% per annum for the project. Your subordinates forecast the Year 2 financials for the project as follows: sales will be 200,000. cost of goods sold will be 60,000. selling, general & administrative expense will be 10,000, of which 2,000 is overhead that will be incurred even if the project is not accepted. annual depreciation will be 20,000. interest expense will be $5,000 resulting from the project. average tax rate is 20% and marginal tax rate is 30%. Year 1 net working capital (NWC) = 20,000, Year 2 NWC = 12,000, Year 3 NWC=10,000. You think back to your halcyon days in finance class and realize there is more work to be done to compute the free cash flows (FCF). Your estimate of the Year 2 FCF (No capital expenditure spending in Year 2) is $_ Instruction: Type ONLY your numerical answer in the unit of dollars, NO $ sign needed, No comma sign. Round it to the nearest integerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started