Question

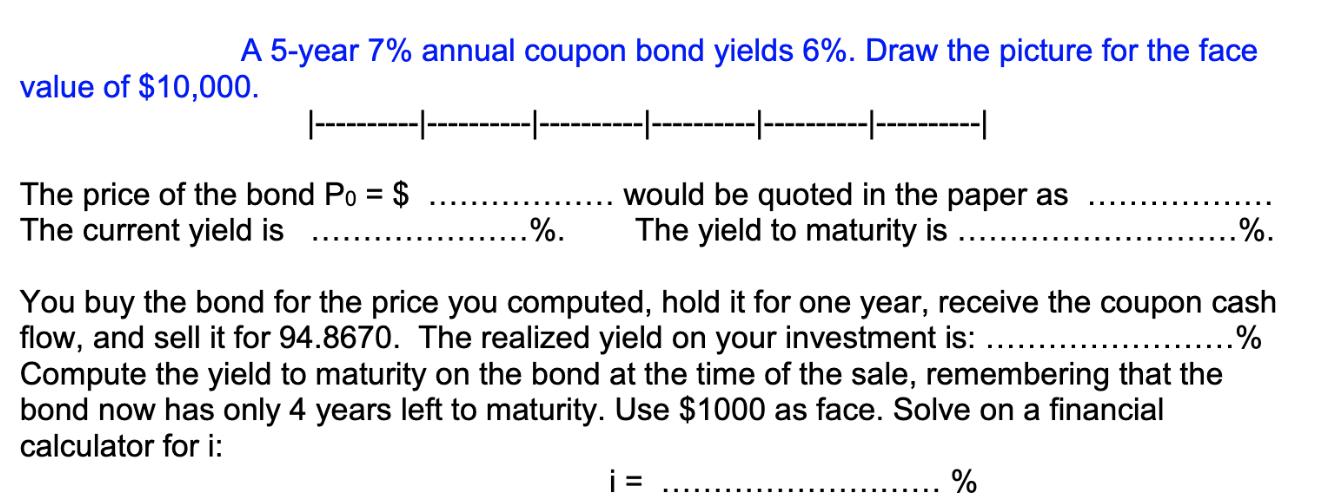

A 5-year 7% annual coupon bond yields 6%. Draw the picture for the face value of $10,000. | -|- -1 The price of the

A 5-year 7% annual coupon bond yields 6%. Draw the picture for the face value of $10,000. | -|- -1 The price of the bond Po = $ would be quoted the paper as The yield to maturity is The current yield is .%. .%. You buy the bond for the price you computed, hold it for one year, receive the coupon cash flow, and sell it for 94.8670. The realized yield on your investment is: .% Compute the yield to maturity on the bond at the time of the sale, remembering that the bond now has only 4 years left to maturity. Use $1000 as face. Solve on a financial calculator for i: %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To begin we can calculate the price of the bond using the following formula Po C x 1 1 rn r F 1 rn W...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Foundations of Financial Management

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta

10th Canadian edition

1259261018, 1259261015, 978-1259024979

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App