Question

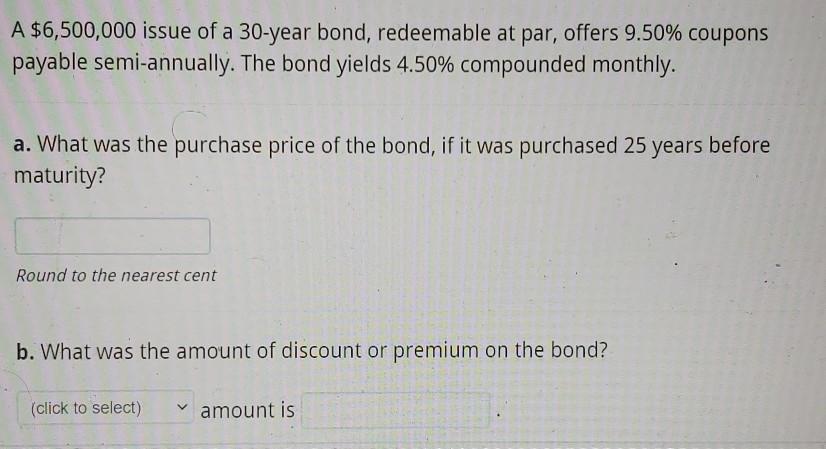

A $6,500,000 issue of a 30-year bond, redeemable at par, offers 9.50% coupons payable semi-annually. The bond yields 4.50% compounded monthly. a. What was

A $6,500,000 issue of a 30-year bond, redeemable at par, offers 9.50% coupons payable semi-annually. The bond yields 4.50% compounded monthly. a. What was the purchase price of the bond, if it was purchased 25 years before maturity? Round to the nearest cent b. What was the amount of discount or premium on the bond? (click to select) amount is

Step by Step Solution

3.44 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Par value 6500000 YEILD to MATURITY 45 monthly interest 45120375 Coupon monthly 009565000001251...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Contemporary Business Mathematics with Canadian Applications

Authors: S. A. Hummelbrunner, Kelly Halliday, Ali R. Hassanlou, K. Suzanne Coombs

11th edition

134141083, 978-0134141084

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App