Answered step by step

Verified Expert Solution

Question

1 Approved Answer

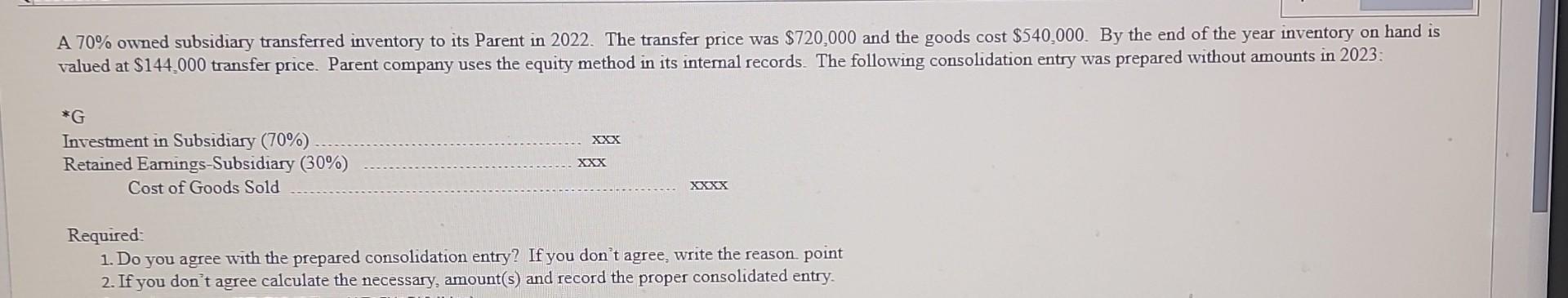

A 70% owned subsidiary transferred inventory to its Parent in 2022. The transfer price was $720,000 and the goods cost $540,000. By the end of

A 70% owned subsidiary transferred inventory to its Parent in 2022. The transfer price was $720,000 and the goods cost $540,000. By the end of the year inventory on hand is valued at $144,000 transfer price. Parent company uses the equity method in its internal records. The following consolidation entry was prepared without amounts in 2023 : * G Investment in Subsidiary (70\%) Retained Earnings-Subsidiary (30\%) xxx Cost of Goods Sold xxx Required: 1. Do you agree with the prepared consolidation entry? If you don't agree, write the reason. point 2. If you don't agree calculate the necessary, amount(s) and record the proper consolidated entry. A 70% owned subsidiary transferred inventory to its Parent in 2022. The transfer price was $720,000 and the goods cost $540,000. By the end of the year inventory on hand is valued at $144,000 transfer price. Parent company uses the equity method in its internal records. The following consolidation entry was prepared without amounts in 2023 : * G Investment in Subsidiary (70\%) Retained Earnings-Subsidiary (30\%) xxx Cost of Goods Sold xxx Required: 1. Do you agree with the prepared consolidation entry? If you don't agree, write the reason. point 2. If you don't agree calculate the necessary, amount(s) and record the proper consolidated entry

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started