Answered step by step

Verified Expert Solution

Question

1 Approved Answer

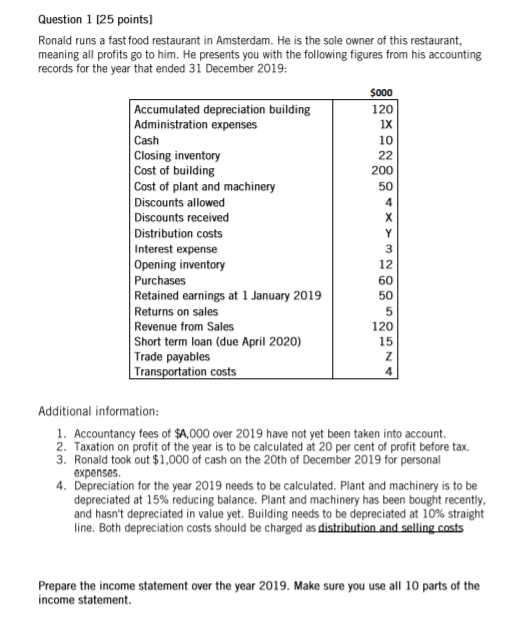

A: 9 B: 5 C: 6 X: 8 Y: 6 Z: 6 120 Question 1 125 points) Ronald runs a fast food restaurant in Amsterdam.

A: 9

B: 5

C: 6

X: 8

Y: 6

Z: 6

120 Question 1 125 points) Ronald runs a fast food restaurant in Amsterdam. He is the sole owner of this restaurant, meaning all profits go to him. He presents you with the following figures from his accounting records for the year that ended 31 December 2019: $000 Accumulated depreciation building Administration expenses 1x Cash 10 Closing inventory 22 Cost of building 200 Cost of plant and machinery 50 Discounts allowed Discounts received Distribution costs Interest expense Opening inventory 12 Purchases 60 Retained earnings at 1 January 2019 50 Returns on sales 5 Revenue from Sales Short term loan (due April 2020) 15 Trade payables Z Transportation costs Y 3 120 Additional information: 1. Accountancy fees of $A, 000 over 2019 have not yet been taken into account 2. Taxation on profit of the year is to be calculated at 20 per cent of profit before tax. 3. Ronald took out $1,000 of cash on the 20th of December 2019 for personal expenses. 4. Depreciation for the year 2019 needs to be calculated. Plant and machinery is to be depreciated at 15% reducing balance. Plant and machinery has been bought recently, and hasn't depreciated in value yet. Building needs to be depreciated at 10% straight line. Both depreciation costs should be charged as distribution and selling costs Prepare the income statement over the year 2019. Make sure you use all 10 parts of the income statementStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started