Question: A 9.00 percent annual coupon bond has a face value of $1,000, a market price of $1,089.37, and a yield-to-maturity of 8.00 percent. The

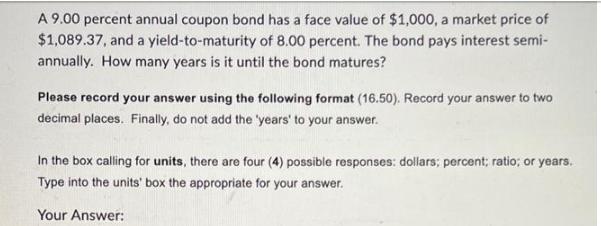

A 9.00 percent annual coupon bond has a face value of $1,000, a market price of $1,089.37, and a yield-to-maturity of 8.00 percent. The bond pays interest semi- annually. How many years is it until the bond matures? Please record your answer using the following format (16.50). Record your answer to two decimal places. Finally, do not add the 'years' to your answer. In the box calling for units, there are four (4) possible responses: dollars; percent; ratio; or years. Type into the units' box the appropriate for your answer. Your Answer:

Step by Step Solution

There are 3 Steps involved in it

To calculate the number of years until the bond matures we can use the formula for the present value ... View full answer

Get step-by-step solutions from verified subject matter experts