Answered step by step

Verified Expert Solution

Question

1 Approved Answer

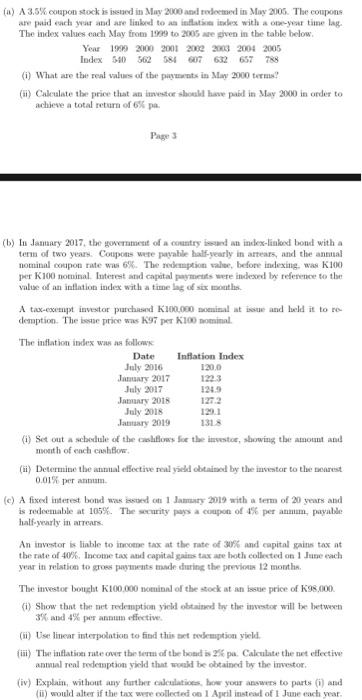

(a) A 3.5% coupon stock is issued in May 2000 and redeemed in May 2005. The coupons are paid each year and are linked to

(a) A 3.5% coupon stock is issued in May 2000 and redeemed in May 2005. The coupons are paid each year and are linked to an inflation index with a one-year time lag. The index values each May from 1999 to 2005 are given in the table below. Year Index 1999 2000 2001 2002 2003 2004 2005 540 562 584 607 632 657 788 (i) What are the real values of the payments in May 2000 terms? (ii) Calculate the price that an investor should have paid in May 2000 in order to achieve a total return of 6% pa. Page 3 (b) In January 2017, the government of a country issued an index-linked bond with a term of two years. Coupons were payable half-yearly in arrears, and the annual nominal coupon rate was 6%. The redemption value, before indexing, was K100 per K100 nominal. Interest and capital payments were indexed by reference to the value of an inflation index with a time lag of six months. A tax-exempt investor purchased K100,000 nominal at issue and held it to re- demption. The issue price was K97 per K100 nominal. The inflation index was as follows: Date July 2016 January 2017 July 2017 January 2018 July 2018 January 2019 Inflation Index 120.0 122.3 124.9 127.2 129.1 131.8. (i) Set out a schedule of the cashflows for the investor, showing the amount and month of each cashflow. (ii) Determine the annual effective real yield obtained by the investor to the nearest 0.01% per annum. (c) A fixed interest bond was issued on 1 January 2019 with a term of 20 years and is redeemable at 105%. The security pays a coupon of 4% per annum, payable half-yearly in arrears. An investor is liable to income tax at the rate of 30% and capital gains tax at the rate of 40%. Income tax and capital gains tax are both collected on 1 June each year in relation to gross payments made during the previous 12 months. The investor bought K100,000 nominal of the stock at an issue price of K98,000. (i) Show that the net redemption yield obtained by the investor will be between 3% and 4% per annum effective. (ii) Use linear interpolation to find this net redemption yield. (iii) The inflation rate over the term of the bond is 2% pa. Calculate the net effective annual real redemption yield that would be obtained by the investor. (iv) Explain, without any further calculations, how your answers to parts (i) and (ii) would alter if the tax were collected on 1 April instead of 1 June each year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started