Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) A and B are partners in a firm sharing profits and losses equally. On 1st April, 20 20 the balance of their Capital

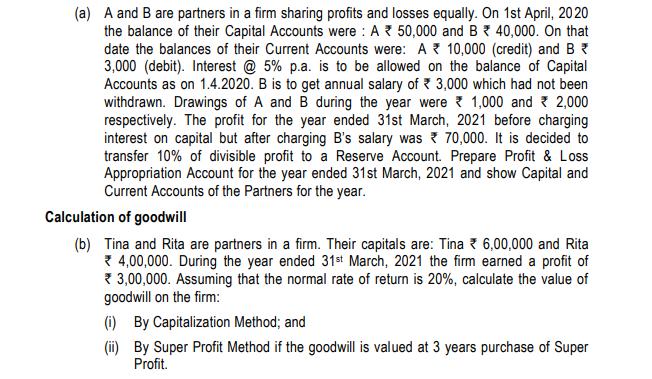

(a) A and B are partners in a firm sharing profits and losses equally. On 1st April, 20 20 the balance of their Capital Accounts were A 50,000 and B 40,000. On that date the balances of their Current Accounts were: A 10,000 (credit) and B 3,000 (debit). Interest @ 5% p.a. is to be allowed on the balance of Capital Accounts as on 1.4.2020. B is to get annual salary of 3,000 which had not been withdrawn. Drawings of A and B during the year were 1,000 and 2,000 respectively. The profit for the year ended 31st March, 2021 before charging interest on capital but after charging B's salary was 70,000. It is decided to transfer 10% of divisible profit to a Reserve Account. Prepare Profit & Loss Appropriation Account for the year ended 31st March, 2021 and show Capital and Current Accounts of the Partners for the year. Calculation of goodwill (b) Tina and Rita are partners in a firm. Their capitals are: Tina 6,00,000 and Rita 4,00,000. During the year ended 31st March, 2021 the firm earned a profit of 3,00,000. Assuming that the normal rate of return is 20%, calculate the value of goodwill on the firm: (i) By Capitalization Method; and (ii) By Super Profit Method if the goodwill is valued at 3 years purchase of Super Profit.

Step by Step Solution

★★★★★

3.35 Rating (136 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started