Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. A bond with a face value of $100 has a coupon rate of 12%, paid quarterly. The bond matures in 1 year. If

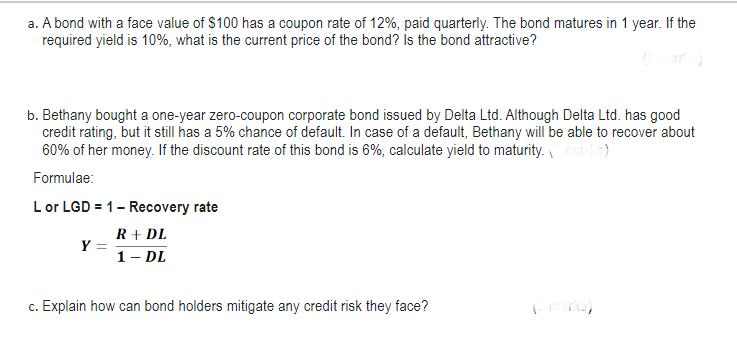

a. A bond with a face value of $100 has a coupon rate of 12%, paid quarterly. The bond matures in 1 year. If the required yield is 10%, what is the current price of the bond? Is the bond attractive? b. Bethany bought a one-year zero-coupon corporate bond issued by Delta Ltd. Although Delta Ltd. has good credit rating, but it still has a 5% chance of default. In case of a default, Bethany will be able to recover about 60% of her money. If the discount rate of this bond is 6%, calculate yield to maturity. mail) Formulae: L or LGD = 1 - Recovery rate R + DL 1 - DL Y = c. Explain how can bond holders mitigate any credit risk they face?

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the current price of the bond we need to find the present value of its future cash flows The bond pays quarterly coupons so there are f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started