Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) A company based in United Kingdom expects that it has to pay 1 million dollars in nine months for imports from United States.

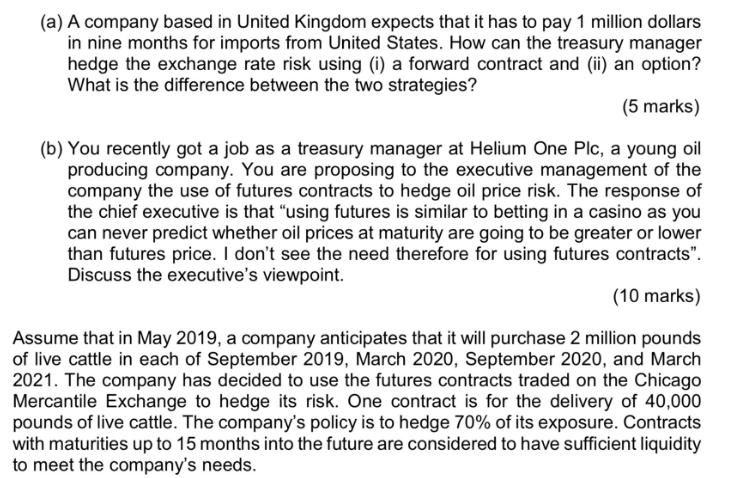

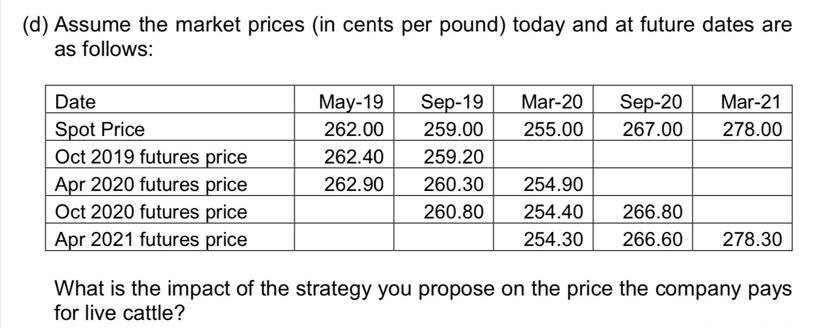

(a) A company based in United Kingdom expects that it has to pay 1 million dollars in nine months for imports from United States. How can the treasury manager hedge the exchange rate risk using (i) a forward contract and (ii) an option? What is the difference between the two strategies? (5 marks) (b) You recently got a job as a treasury manager at Helium One Plc, a young oil producing company. You are proposing to the executive management of the company the use of futures contracts to hedge oil price risk. The response of the chief executive is that "using futures is similar to betting in a casino as you can never predict whether oil prices at maturity are going to be greater or lower than futures price. I don't see the need therefore for using futures contracts". Discuss the executive's viewpoint. (10 marks) Assume that in May 2019, a company anticipates that it will purchase 2 million pounds of live cattle in each of September 2019, March 2020, September 2020, and March 2021. The company has decided to use the futures contracts traded on the Chicago Mercantile Exchange to hedge its risk. One contract is for the delivery of 40,000 pounds of live cattle. The company's policy is to hedge 70% of its exposure. Contracts with maturities up to 15 months into the future are considered to have sufficient liquidity to meet the company's needs. (c) Propose a hedging strategy for the company. (5 marks) (d) Assume the market prices (in cents per pound) today and at future dates are as follows: Date Spot Price Oct 2019 futures price Apr 2020 futures price Oct 2020 futures price Apr 2021 futures price May-19 Sep-19 Mar-20 Sep-20 Mar-21 262.00 259.00 255.00 267.00 278.00 262.40 259.20 262.90 260.30 254.90 260.80 254.40 266.80 254.30 266.60 278.30 What is the impact of the strategy you propose on the price the company pays for live cattle?

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a i Hedging with a forward contract The treasury manager can hedge the exchange rate risk by entering into a forward contract In this case the company can enter into a forward contract to sell British ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started