Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) A company has long-term borrowings of K3,000,000 on which it pays interest at 6% per year. The equity capital consists of 500,000 of K10

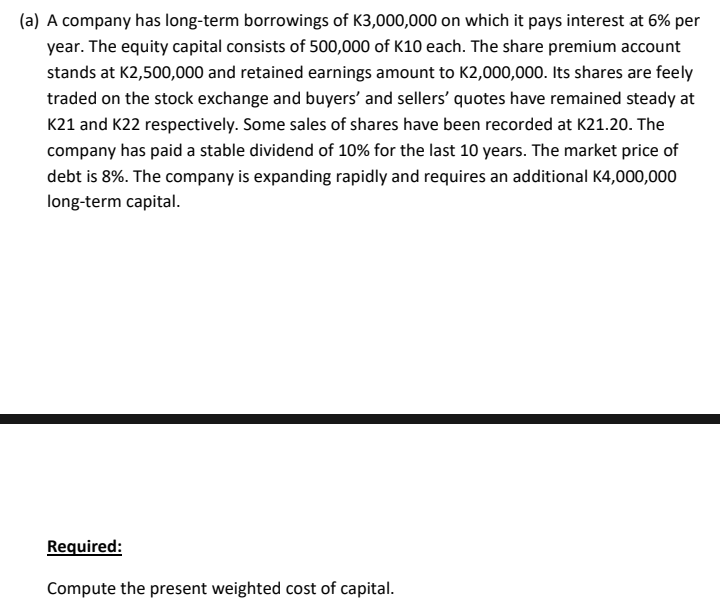

(a) A company has long-term borrowings of K3,000,000 on which it pays interest at 6% per year. The equity capital consists of 500,000 of K10 each. The share premium account stands at K2,500,000 and retained earnings amount to K2,000,000. Its shares are feely traded on the stock exchange and buyers' and sellers' quotes have remained steady at K21 and K22 respectively. Some sales of shares have been recorded at K21.20. The company has paid a stable dividend of 10% for the last 10 years. The market price of debt is 8%. The company is expanding rapidly and requires an additional K4,000,000 long-term capital. Required: Compute the present weighted cost of capital

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started