Question

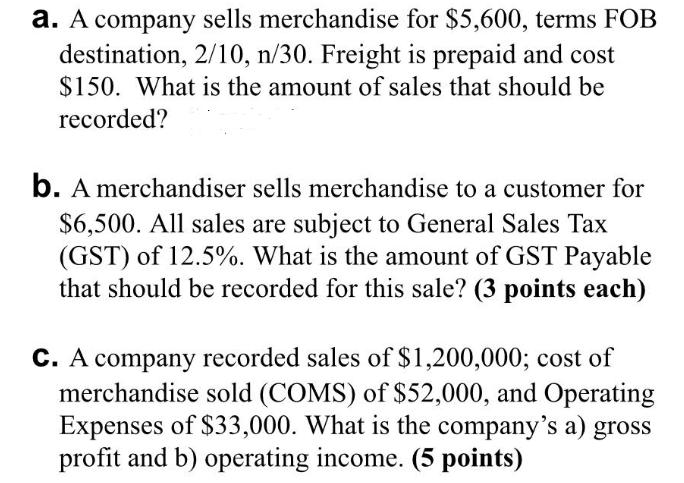

a. A company sells merchandise for $5,600, terms FOB destination, 2/10, n/30. Freight is prepaid and cost $150. What is the amount of sales

a. A company sells merchandise for $5,600, terms FOB destination, 2/10, n/30. Freight is prepaid and cost $150. What is the amount of sales that should be recorded? b. A merchandiser sells merchandise to a customer for $6,500. All sales are subject to General Sales Tax (GST) of 12.5%. What is the amount of GST Payable that should be recorded for this sale? (3 points each) C. A company recorded sales of $1,200,000; cost of merchandise sold (COMS) of $52,000, and Operating Expenses of $33,000. What is the company's a) gross profit and b) operating income. (5 points)

Step by Step Solution

3.53 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

A Amount of sales that should be recorded ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Robert Libby, Patricia Libby, Daniel Short, George Kanaan, M

5th Canadian edition

9781259105692, 978-1259103285

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App