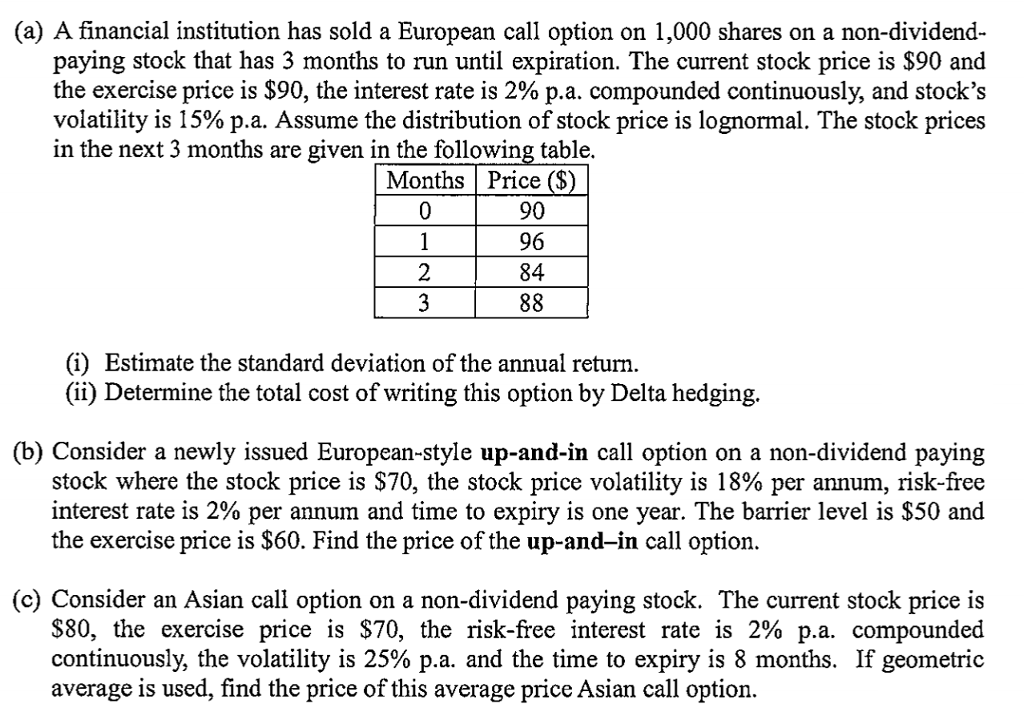

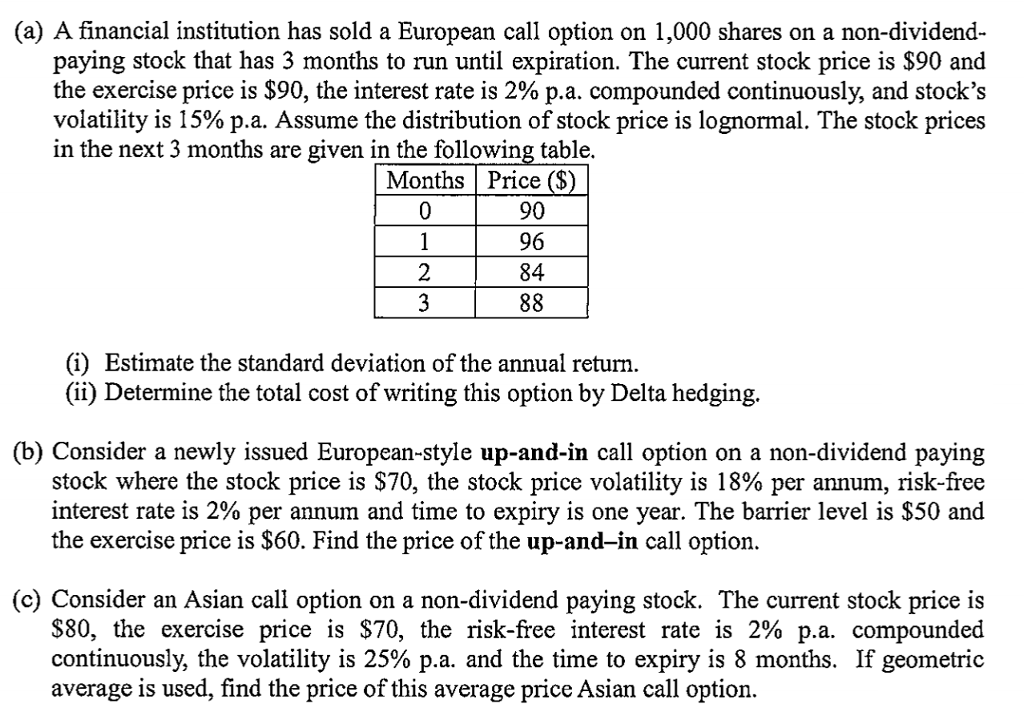

(a) A financial institution has sold a European call option on 1,000 shares on a non-dividend- paying stock that has 3 months to run until expiration. The current stock price is $90 and the exercise price is $90, the interest rate is 2% p.a. compounded continuously, and stock's volatility is 15% pa. Assume the distribution of stock price is lognormal. The stock prices in the next 3 months are given in the following table, MonthsPrice (S 90 96 84 2 (i) Estimate the standard deviation of the annual return (ii) Determine the total cost of writing this option by Delta hedging (b) Consider a newly issued European-style up-and-in call option on a non-dividend paying stock where the stock price is $70, the stock price volatility is 18% per annum, risk-free interest rate is 2% per annum and time to expiry is one year. The barrier level is $50 and the exercise price is $60. Find the price of the up-and-in call option. (c) Consider an Asian call option on a non-dividend paying stock. The current stock price is $80, the exercise price is $70, the risk-free interest rate is 2% pa. compounded continuously, the volatility is 25% .a. and the time to expiry is 8 months. If geometric average is used, find the price of this average price Asian call option. (a) A financial institution has sold a European call option on 1,000 shares on a non-dividend- paying stock that has 3 months to run until expiration. The current stock price is $90 and the exercise price is $90, the interest rate is 2% p.a. compounded continuously, and stock's volatility is 15% pa. Assume the distribution of stock price is lognormal. The stock prices in the next 3 months are given in the following table, MonthsPrice (S 90 96 84 2 (i) Estimate the standard deviation of the annual return (ii) Determine the total cost of writing this option by Delta hedging (b) Consider a newly issued European-style up-and-in call option on a non-dividend paying stock where the stock price is $70, the stock price volatility is 18% per annum, risk-free interest rate is 2% per annum and time to expiry is one year. The barrier level is $50 and the exercise price is $60. Find the price of the up-and-in call option. (c) Consider an Asian call option on a non-dividend paying stock. The current stock price is $80, the exercise price is $70, the risk-free interest rate is 2% pa. compounded continuously, the volatility is 25% .a. and the time to expiry is 8 months. If geometric average is used, find the price of this average price Asian call option