Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) A financial planner recommends that you have accumulated $1.5 million by the time that you retire in 30 years. If you can earn

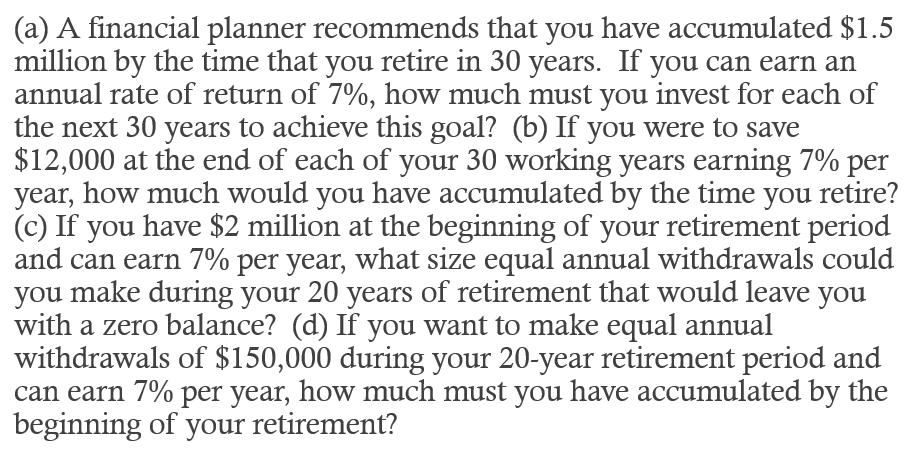

(a) A financial planner recommends that you have accumulated $1.5 million by the time that you retire in 30 years. If you can earn an annual rate of return of 7%, how much must you invest for each of the next 30 years to achieve this goal? (b) If you were to save $12,000 at the end of each of your 30 working years earning 7% per year, how much would you have accumulated by the time you retire? (c) If you have $2 million at the beginning of your retirement period and can earn 7% per year, what size equal annual withdrawals could you make during your 20 years of retirement that would leave you with a zero balance? (d) If you want to make equal annual withdrawals of $150,000 during your 20-year retirement period and can earn 7% per year, how much must you have accumulated by the beginning of your retirement?

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a To accumulate 15 million in 30 years with an annual rate of return of 7 we can use the formula for the future value of an annuity FV PMT x 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started