Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) A investor, who is taxed at 35% on income, has just purchased 500 shares in a small education company ex-dividend. Dividends are paid annually

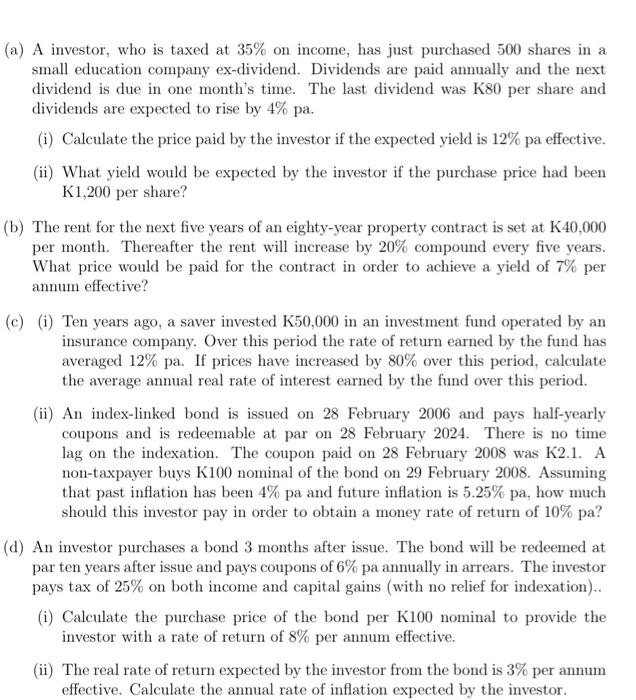

(a) A investor, who is taxed at 35% on income, has just purchased 500 shares in a small education company ex-dividend. Dividends are paid annually and the next dividend is due in one month's time. The last dividend was K80 per share and dividends are expected to rise by 4% pa. (i) Calculate the price paid by the investor if the expected yield is 12% pa effective. (ii) What yield would be expected by the investor if the purchase price had been K1,200 per share? (b) The rent for the next five years of an eighty-year property contract is set at K40,000 per month. Thereafter the rent will increase by 20% compound every five years. What price would be paid for the contract in order to achieve a yield of 7% per annum effective? (c) (i) Ten years ago, a saver invested K50,000 in an investment fund operated by an insurance company. Over this period the rate of return earned by the fund has averaged 12% pa. If prices have increased by 80% over this period, calculate the average annual real rate of interest earned by the fund over this period. (ii) An index-linked bond is issued on 28 February 2006 and pays half-yearly coupons and is redeemable at par on 28 February 2024. There is no time lag on the indexation. The coupon paid on 28 February 2008 was K2.1. A non-taxpayer buys K100 nominal of the bond on 29 February 2008. Assuming that past inflation has been 4% pa and future inflation is 5.25% pa, how much should this investor pay in order to obtain a money rate of return of 10% pa? (d) An investor purchases a bond 3 months after issue. The bond will be redeemed at par ten years after issue and pays coupons of 6% pa annually in arrears. The investor pays tax of 25% on both income and capital gains (with no relief for indexation).. (i) Calculate the purchase price of the bond per K100 nominal to provide the investor with a rate of return of 8% per annum effective. (ii) The real rate of return expected by the investor from the bond is 3% per annum effective. Calculate the annual rate of inflation expected by the investor.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started