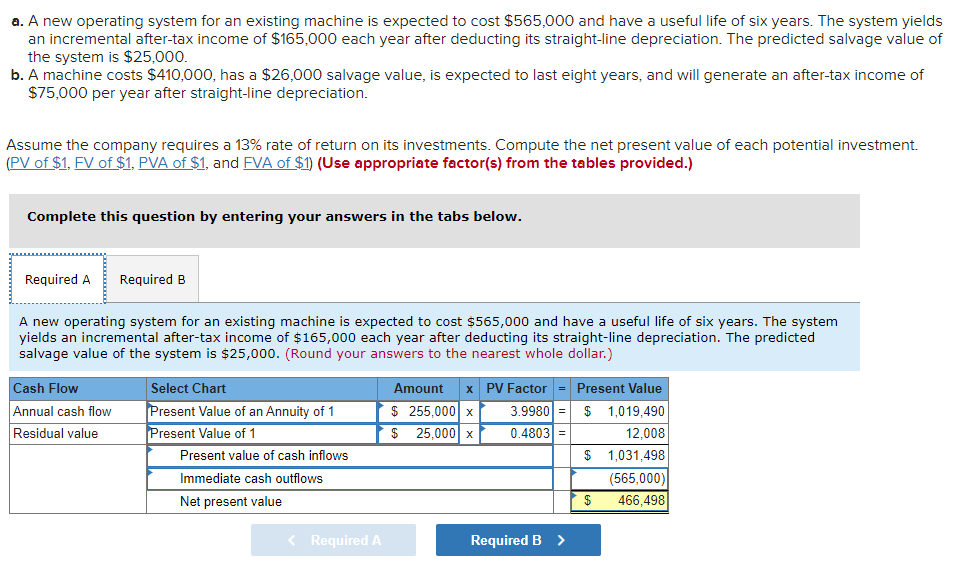

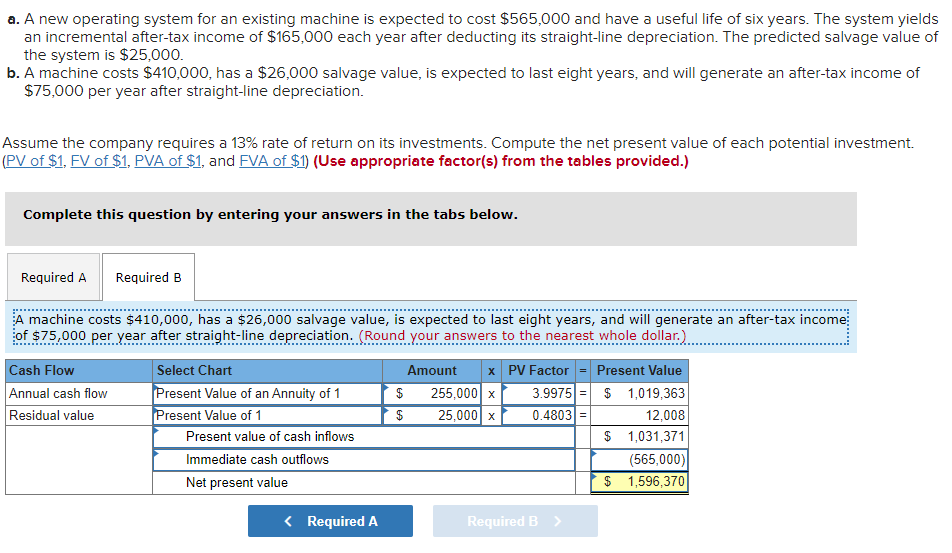

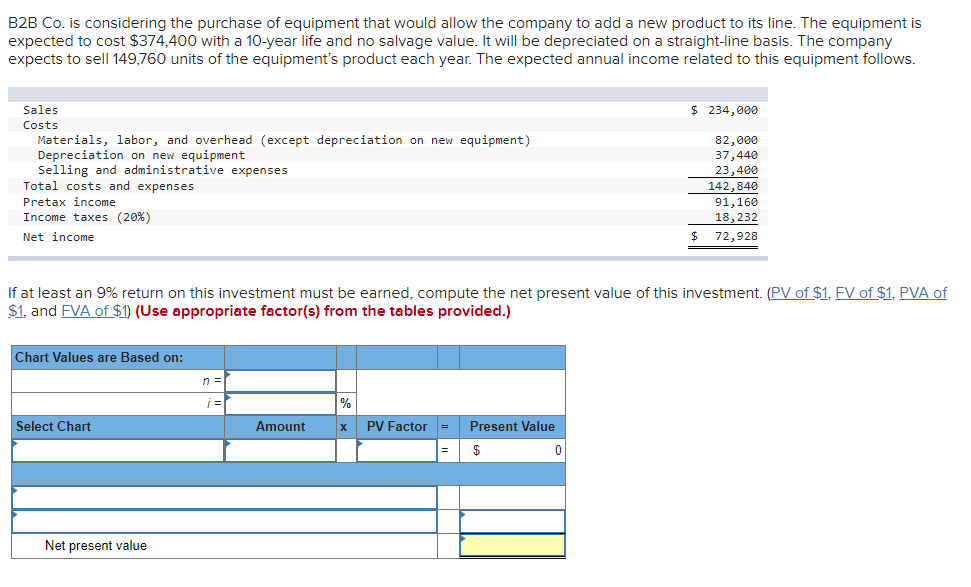

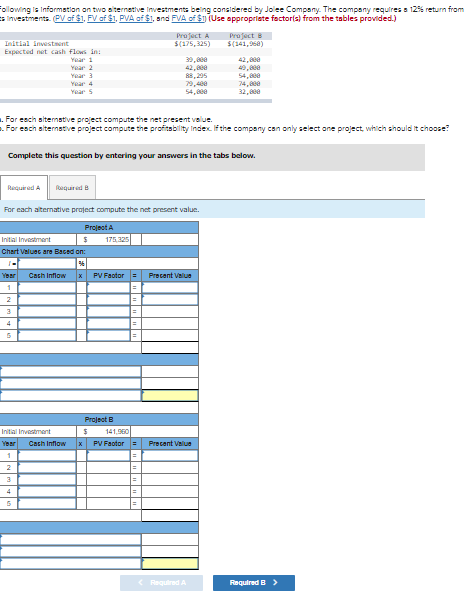

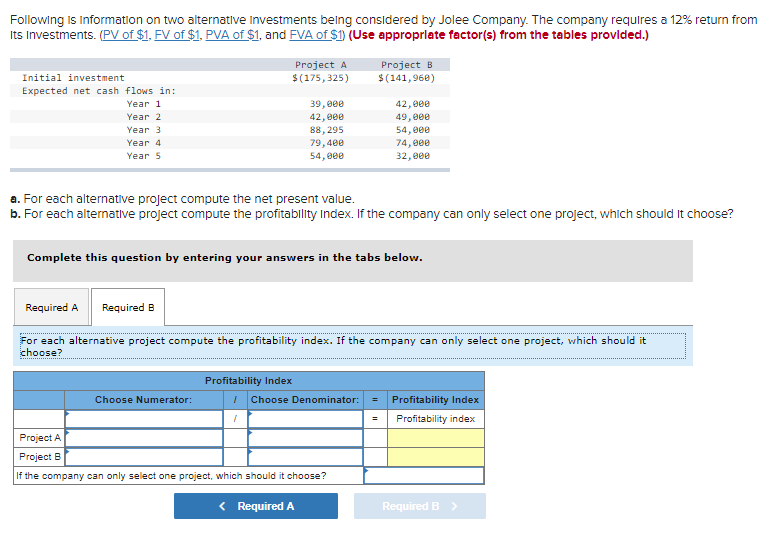

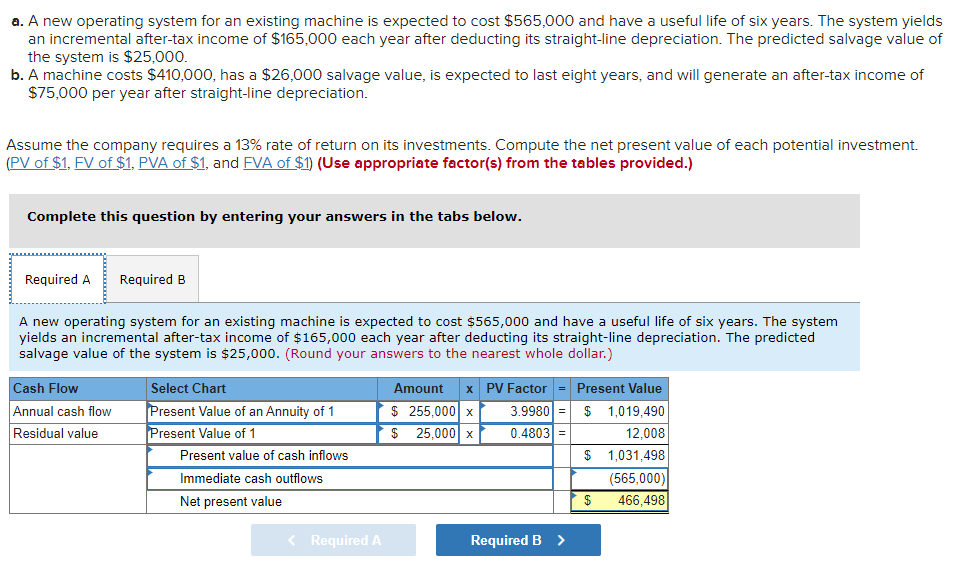

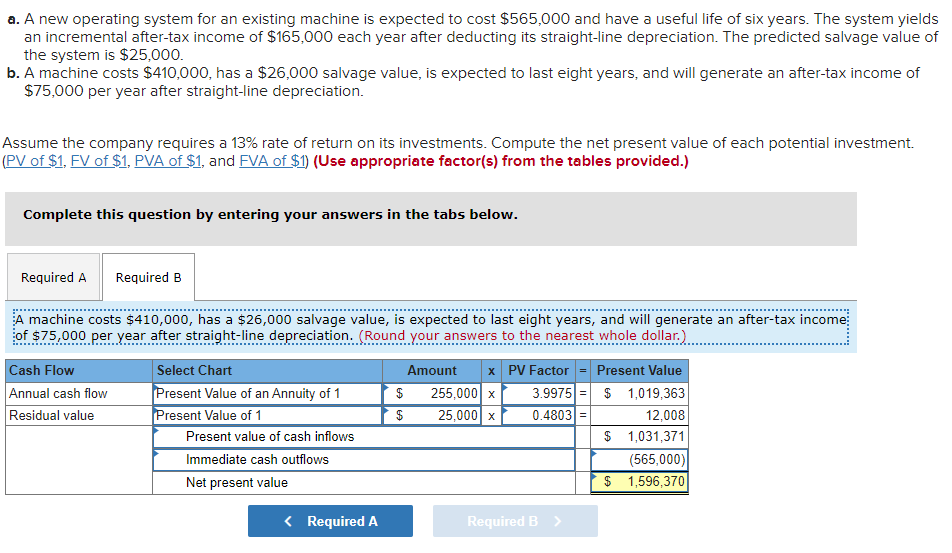

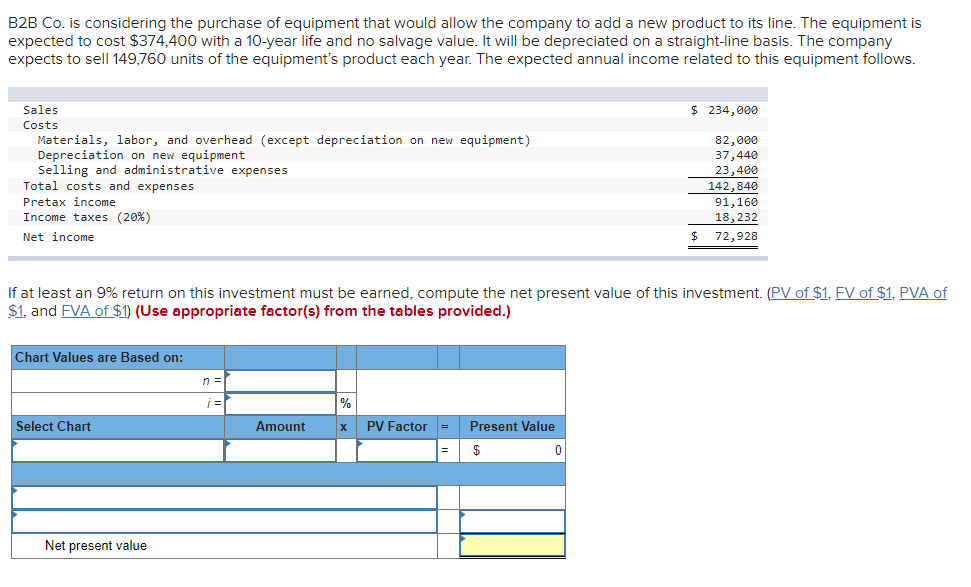

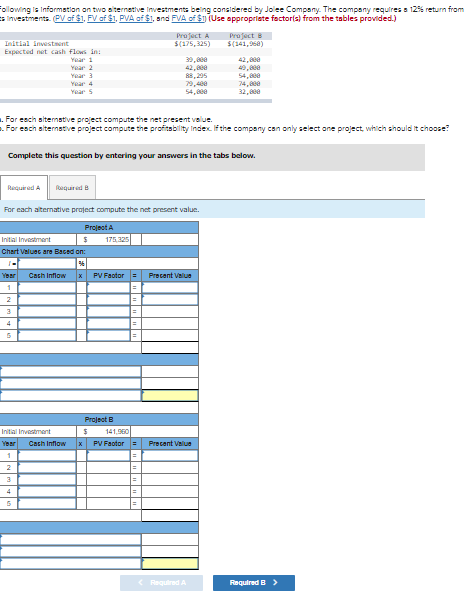

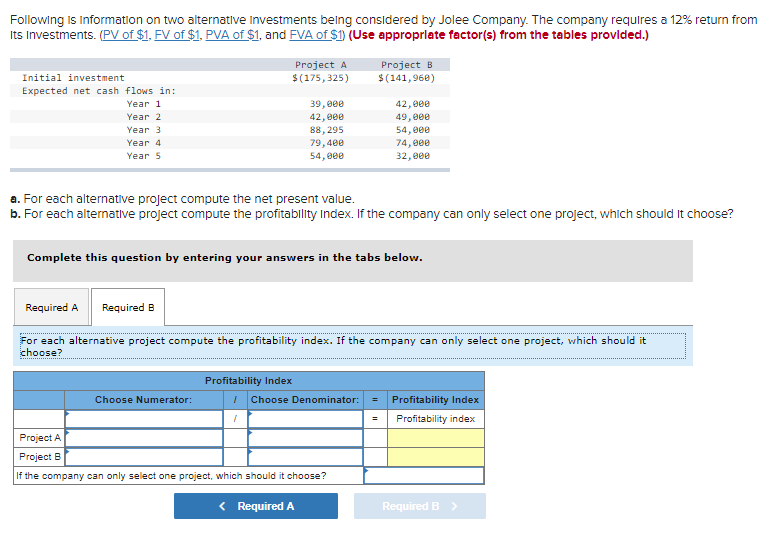

a. A new operating system for an existing machine is expected to cost $565,000 and have a useful life of six years. The system yields an incremental after-tax income of $165,000 each year after deducting its straight-line depreciation. The predicted salvage value of the system is $25,000. b. A machine costs $410,000, has a $26,000 salvage value, is expected to last eight years, and will generate an after-tax income of $75,000 per year after straight-line depreciation. Assume the company requires a 13% rate of return on its investments. Compute the net present value of each potential investment. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Complete this question by entering your answers in the tabs below. Required A Required B A new operating system for an existing machine is expected to cost $565,000 and have a useful life of six years. The system yields an incremental after-tax income of $165,000 each year after deducting its straight-line depreciation. The predicted salvage value of the system is $25,000. (Round your answers to the nearest whole dollar.) Cash Flow Annual cash flow Residual value Select Chart Present Value of an Annuity of 1 Present Value of 1 Present value of cash inflows Immediate cash outflows Net present value Amount x PV Factor = Present Value $ 255,000 3.9980] = $ 1,019,490 $ 25,000 x 0.4803 12,008 $ 1,031,498 (565,000) $ 466,498 a. A new operating system for an existing machine is expected to cost $565,000 and have a useful life of six years. The system yields an incremental after-tax income of $165,000 each year after deducting its straight-line depreciation. The predicted salvage value of the system is $25,000. b. A machine costs $410,000, has a $26,000 salvage value, is expected to last eight years, and will generate an after-tax income of $75,000 per year after straight-line depreciation. Assume the company requires a 13% rate of return on its investments. Compute the net present value of each potential investment. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Complete this question by entering your answers in the tabs below. Required A Required B A machine costs $410,000, has a $26,000 salvage value, is expected to last eight years, and will generate an after-tax income of $75,000 per year after straight-line depreciation. (Round your answers to the nearest whole dollar.). Cash Flow Annual cash flow Residual value $ Amount x PV Factor 255,000 x 3.9975/= 25,000 x 0.4803= $ Select Chart Present Value of an Annuity of 1 Present Value of 1 Present value of cash inflows Immediate cash outflows Net present value Present Value $ 1,019,363 12,008 $ 1,031,371 (565,000) $ 1,596,370 Following is Information on two alternative Investments being considered by Jolee Company. The company requires a 12% return from Its Investments. (PV of $1, FV of $1. PVA of $1, and FVA of $1) (Use approprlate factor(s) from the tables provided.) Project A $(175, 325) Project B $(141,960) Initial investment Expected net cash flows in: Year 1 Year 2 Year 3 Year 4 Year 5 39,000 42,eee 88, 295 79,400 54, eee 42, eee 49,000 54,00 74, eee 32,000 a. For each alternative project compute the net present value. b. For each alternative project compute the profitability Index. If the company can only select one project, which should it choose? Complete this question by entering your answers in the tabs below. Required A Required B For each alternative project compute the profitability index. If the company can only select one project, which should it choose? Profitability Index Choose Numerator: Choose Denominator: Profitability Index Profitability index Project A Project B If the company can only select one project, which should it choose?