(a) A project undertaking by BP Sdn. Bhd. has base-case earnings before interest and taxes of RM29,500, fixed costs of RM35,600, a selling price

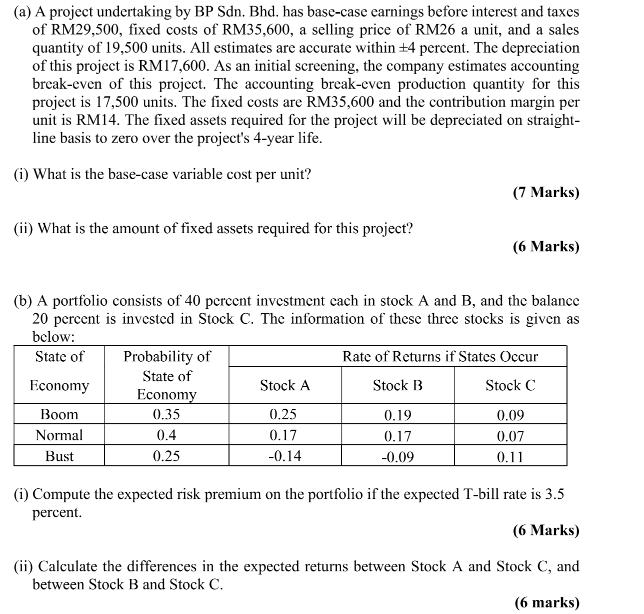

(a) A project undertaking by BP Sdn. Bhd. has base-case earnings before interest and taxes of RM29,500, fixed costs of RM35,600, a selling price of RM26 a unit, and a sales quantity of 19,500 units. All estimates are accurate within +4 percent. The depreciation of this project is RM17,600. As an initial screening, the company estimates accounting break-even of this project. The accounting break-even production quantity for this project is 17,500 units. The fixed costs are RM35,600 and the contribution margin per unit is RM14. The fixed assets required for the project will be depreciated on straight- line basis to zero over the project's 4-year life. (i) What is the base-case variable cost per unit? (7 Marks) (ii) What is the amount of fixed assets required for this project? (6 Marks) (b) A portfolio consists of 40 percent investment each in stock A and B, and the balance 20 percent is invested in Stock C. The information of these three stocks is given as below: State of Probability of State of Rate of Returns if States Occur Economy Stock A Stock B Stock C Economy Boom 0.35 0.25 0.19 0.09 Normal 0.4 0.17 0.17 0.07 Bust 0.25 -0.14 -0.09 0.11 (i) Compute the expected risk premium on the portfolio if the expected T-bill rate is 3.5 percent. (6 Marks) (ii) Calculate the differences in the expected returns between Stock A and Stock C, and between Stock B and Stock C. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a i To calculate the basecase variable cost per unit we can use the contribution margin per unit Contribution Margin per unit Selling Price per unit V...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started