Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. ABC Corp. has expected earnings before interest payments for the next year equal to $300 million if it does not lose a product

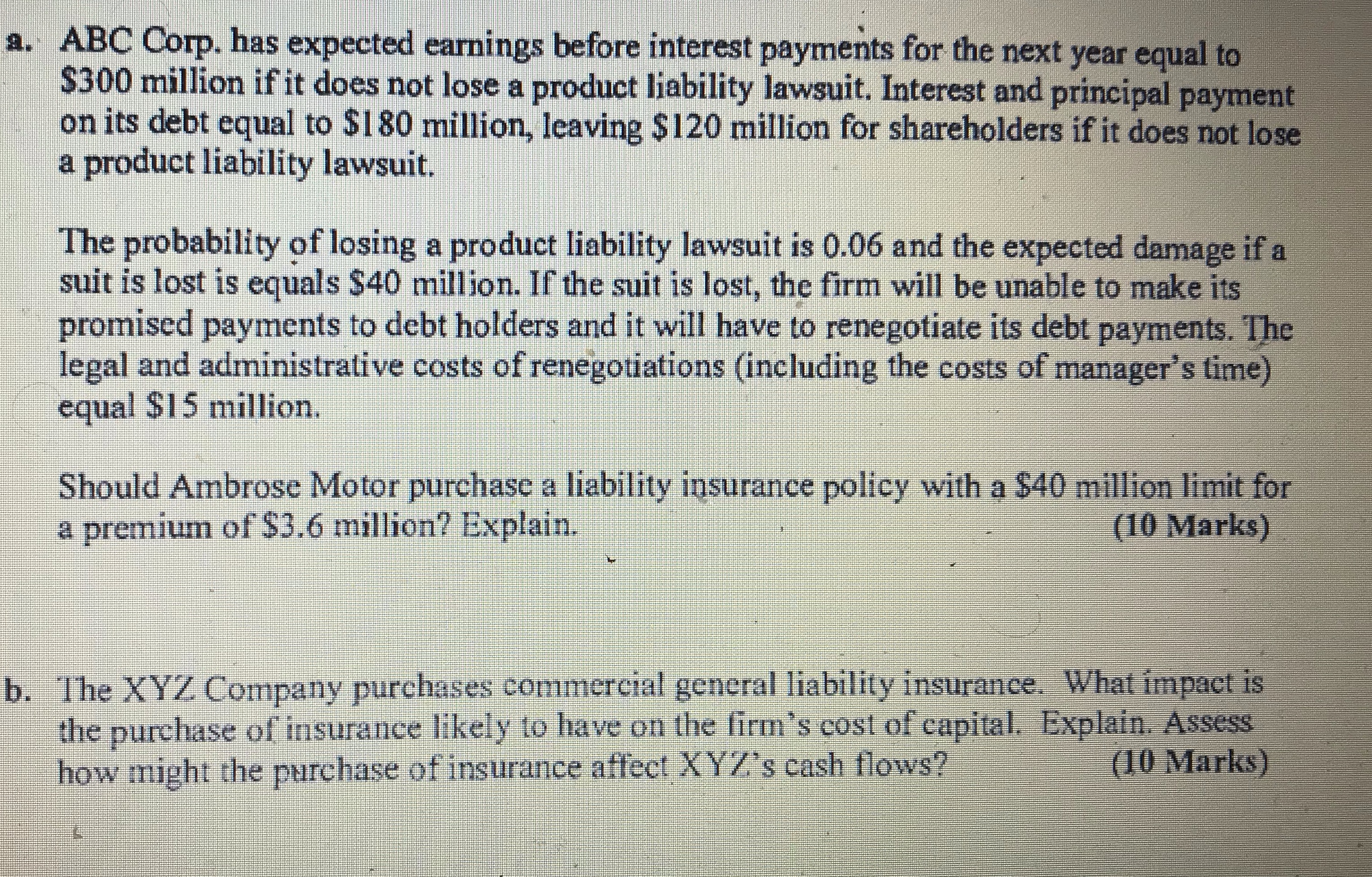

a. ABC Corp. has expected earnings before interest payments for the next year equal to $300 million if it does not lose a product liability lawsuit. Interest and principal payment on its debt equal to $180 million, leaving $120 million for shareholders if it does not lose a product liability lawsuit. The probability of losing a product liability lawsuit is 0.06 and the expected damage if a suit is lost is equals $40 million. If the suit is lost, the firm will be unable to make its promised payments to debt holders and it will have to renegotiate its debt payments. The legal and administrative costs of renegotiations (including the costs of manager's time) equal $15 million. Should Ambrose Motor purchase a liability insurance policy with a $40 million limit for a premium of $3.6 million? Explain. (10 Marks) b. The XYZ Company purchases commercial general liability insurance. What impact is the purchase of insurance likely to have on the firm's cost of capital. Explain. Assess how might the purchase of insurance affect XYZ's cash flows? (10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ABC Corp and Liability Insurance a Should ABC Corp purchase liability insurance Yes ABC Corp should purchase the liability insurance policy Heres why ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started