Answered step by step

Verified Expert Solution

Question

1 Approved Answer

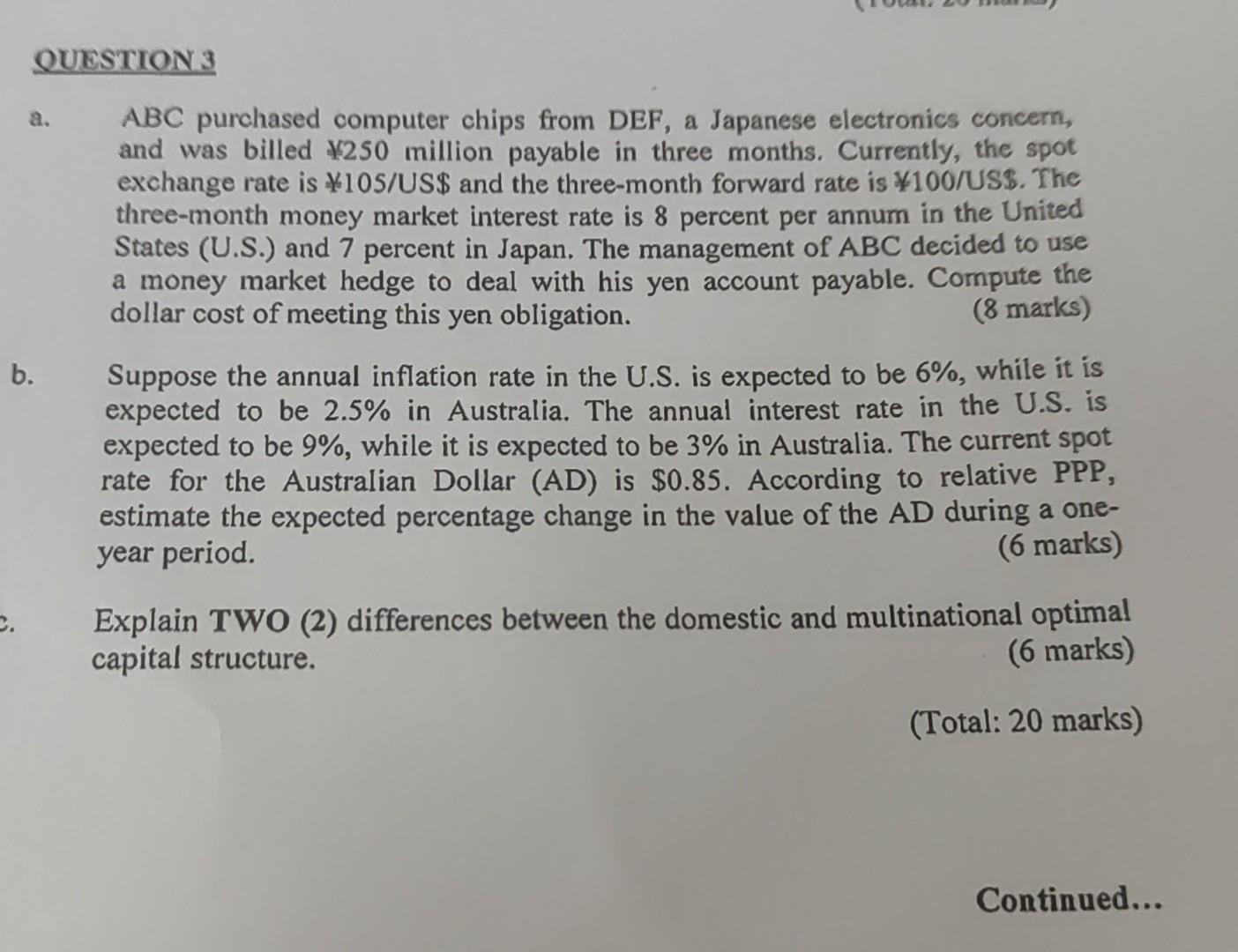

a. ABC purchased computer chips from DEF, a Japanese electronics concern, and was billed 250 million payable in three months. Currently, the spot exchange rate

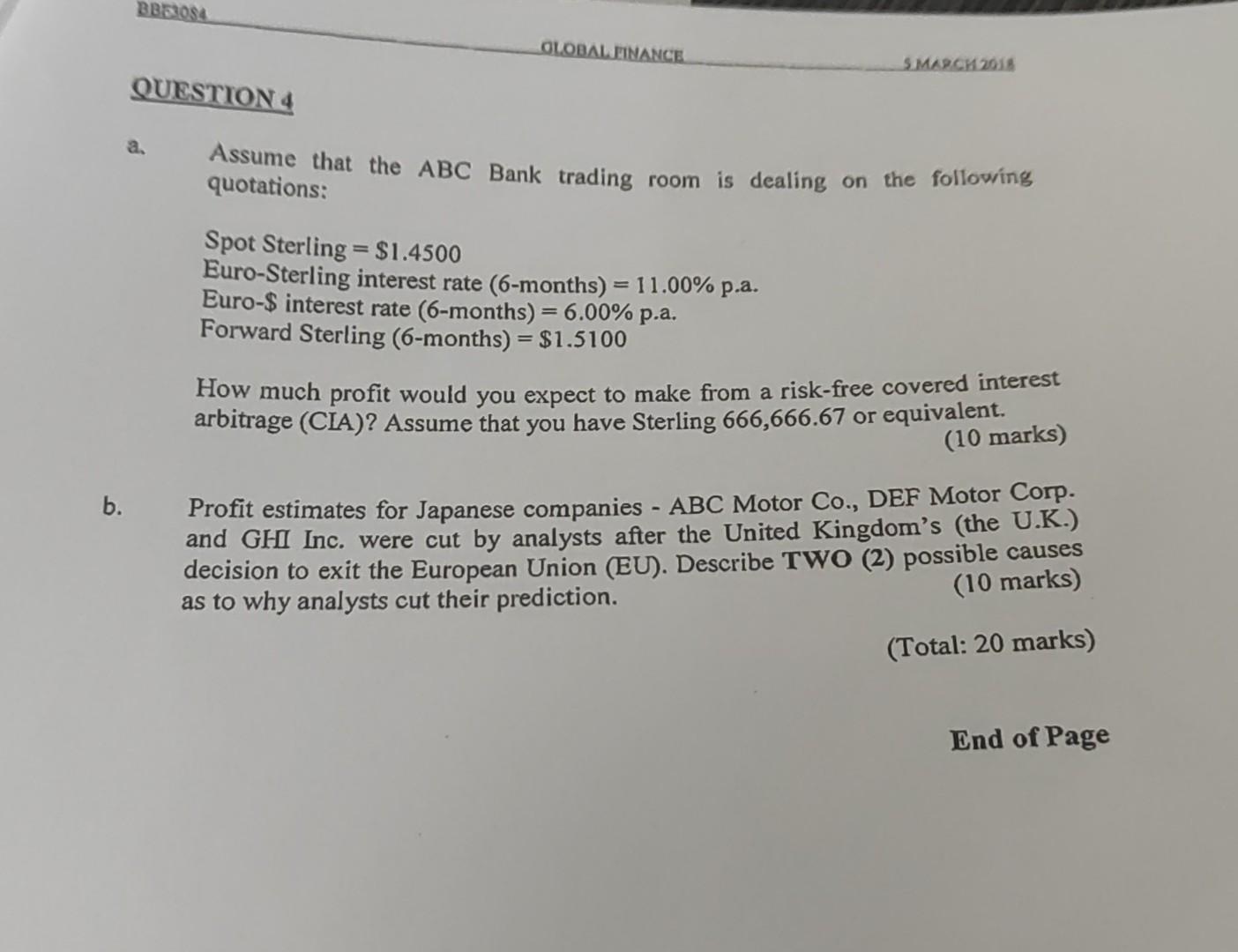

a. ABC purchased computer chips from DEF, a Japanese electronics concern, and was billed 250 million payable in three months. Currently, the spot exchange rate is 10 /US $ and the three-month forward rate is 100/ US $. The three-month money market interest rate is 8 percent per annum in the United States (U.S.) and 7 percent in Japan. The management of ABC decided to use a money market hedge to deal with his yen account payable. Compute the dollar cost of meeting this yen obligation. ( 8 marks) Suppose the annual inflation rate in the U.S. is expected to be 6%, while it is expected to be 2.5% in Australia. The annual interest rate in the U.S. is expected to be 9%, while it is expected to be 3% in Australia. The current spot rate for the Australian Dollar (AD) is \$0.85. According to relative PPP, estimate the expected percentage change in the value of the AD during a oneyear period. (6 marks) Explain TWO (2) differences between the domestic and multinational optimal capital structure. (6 marks) (Total: 20 marks) Continued... QUESTION 4 a. Assume that the ABC Bank trading room is dealing on the following quotations: Spot Sterling =$1.4500 Euro-Sterling interest rate (6-months )=11.00% p.a. Euro- $ interest rate (6 months )=6.00% p.a. Forward Sterling (6-months) =$1.5100 How much profit would you expect to make from a risk-free covered interest arbitrage (CIA)? Assume that you have Sterling 666,666.67 or equivalent. (10 marks) b. Profit estimates for Japanese companies - ABC Motor Co., DEF Motor Corp. and GHII Inc. were cut by analysts after the United Kingdom's (the U.K.) decision to exit the European Union (EU). Describe TWO (2) possible causes as to why analysts cut their prediction. (10 marks) (Total: 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started