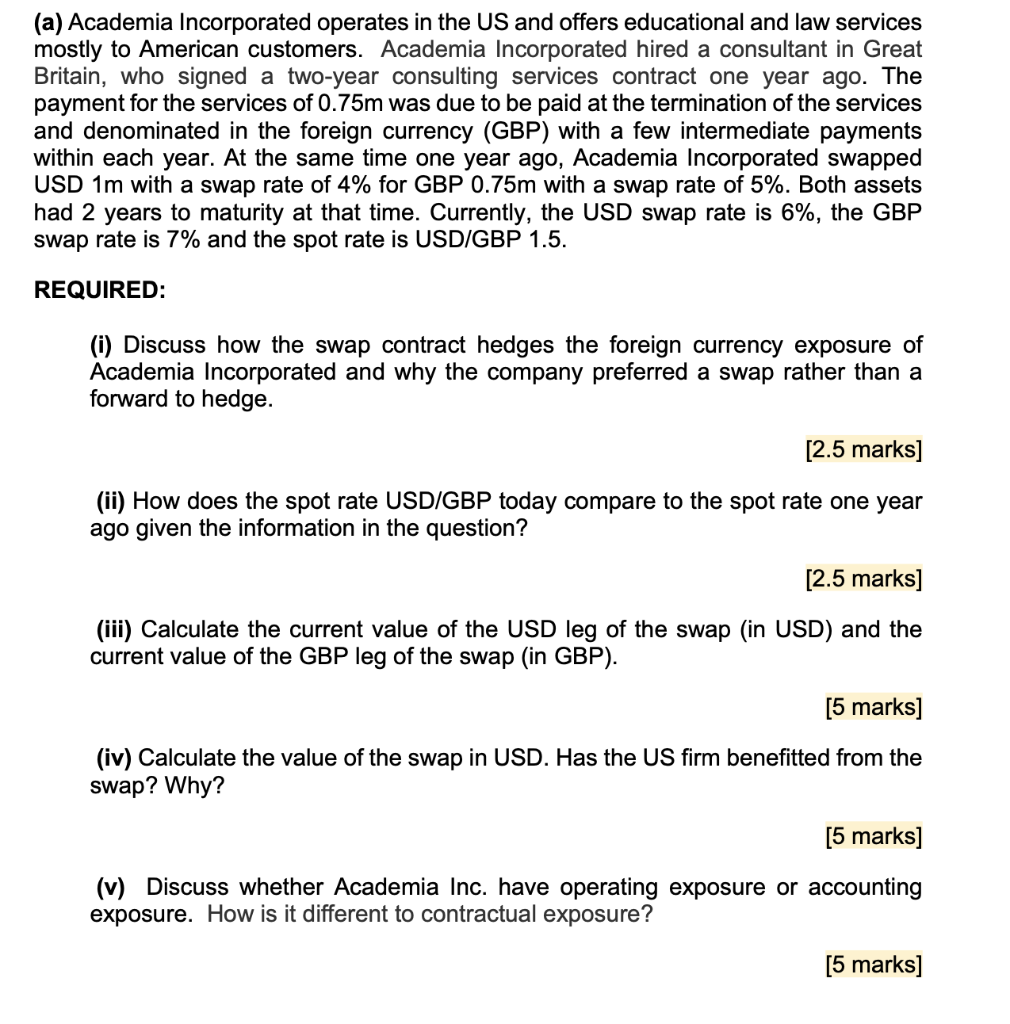

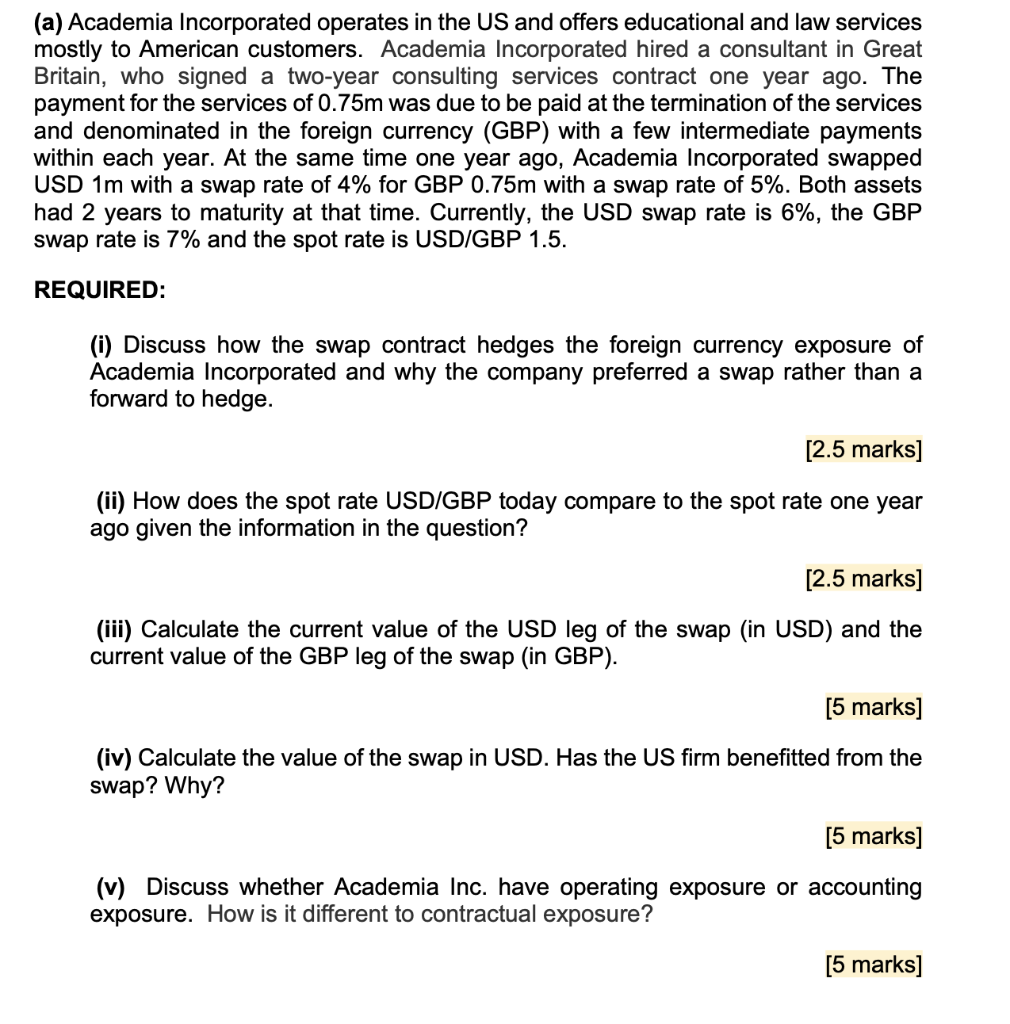

(a) Academia Incorporated operates in the US and offers educational and law services mostly to American customers. Academia Incorporated hired a consultant in Great Britain, who signed a two-year consulting services contract one year ago. The payment for the services of 0.75m was due to be paid at the termination of the services and denominated in the foreign currency (GBP) with a few intermediate payments within each year. At the same time one year ago, Academia Incorporated swapped USD 1m with a swap rate of 4% for GBP 0.75m with a swap rate of 5%. Both assets had 2 years to maturity at that time. Currently, the USD swap rate is 6%, the GBP swap rate is 7% and the spot rate is USD/GBP 1.5. REQUIRED: (i) Discuss how the swap contract hedges the foreign currency exposure of Academia Incorporated and why the company preferred a swap rather than a forward to hedge. [2.5 marks] (ii) How does the spot rate USD/GBP today compare to the spot rate one year ago given the information in the question? [2.5 marks] (iii) Calculate the current value of the USD leg of the swap (in USD) and the current value of the GBP leg of the swap (in GBP). [5 marks] (iv) Calculate the value of the swap in USD. Has the US firm benefitted from the swap? Why? [5 marks] (v) Discuss whether Academia Inc. have operating exposure or accounting exposure. How is it different to contractual exposure? [5 marks] (a) Academia Incorporated operates in the US and offers educational and law services mostly to American customers. Academia Incorporated hired a consultant in Great Britain, who signed a two-year consulting services contract one year ago. The payment for the services of 0.75m was due to be paid at the termination of the services and denominated in the foreign currency (GBP) with a few intermediate payments within each year. At the same time one year ago, Academia Incorporated swapped USD 1m with a swap rate of 4% for GBP 0.75m with a swap rate of 5%. Both assets had 2 years to maturity at that time. Currently, the USD swap rate is 6%, the GBP swap rate is 7% and the spot rate is USD/GBP 1.5. REQUIRED: (i) Discuss how the swap contract hedges the foreign currency exposure of Academia Incorporated and why the company preferred a swap rather than a forward to hedge. [2.5 marks] (ii) How does the spot rate USD/GBP today compare to the spot rate one year ago given the information in the question? [2.5 marks] (iii) Calculate the current value of the USD leg of the swap (in USD) and the current value of the GBP leg of the swap (in GBP). [5 marks] (iv) Calculate the value of the swap in USD. Has the US firm benefitted from the swap? Why? [5 marks] (v) Discuss whether Academia Inc. have operating exposure or accounting exposure. How is it different to contractual exposure? [5 marks]