Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Accrued interest revenue of $30 on a note receivable. b. Determined that the Allowance for Bad Debts account balance should be decreased by

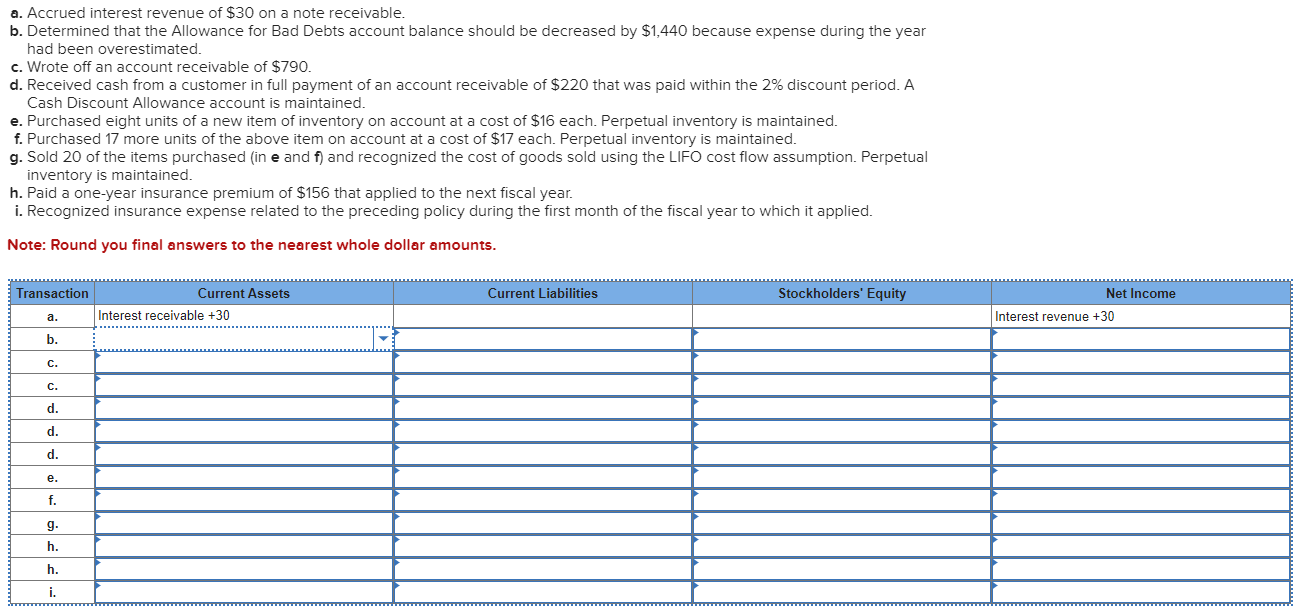

a. Accrued interest revenue of $30 on a note receivable. b. Determined that the Allowance for Bad Debts account balance should be decreased by $1,440 because expense during the year had been overestimated. c. Wrote off an account receivable of $790. d. Received cash from a customer in full payment of an account receivable of $220 that was paid within the 2% discount period. A Cash Discount Allowance account is maintained. e. Purchased eight units of a new item of inventory on account at a cost of $16 each. Perpetual inventory is maintained. f. Purchased 17 more units of the above item on account at a cost of $17 each. Perpetual inventory is maintained. g. Sold 20 of the items purchased (in e and f) and recognized the cost of goods sold using the LIFO cost flow assumption. Perpetual inventory is maintained. h. Paid a one-year insurance premium of $156 that applied to the next fiscal year. i. Recognized insurance expense related to the preceding policy during the first month of the fiscal year to which it applied. Note: Round you final answers to the nearest whole dollar amounts. Transaction Current Assets a. Interest receivable +30 b. C. C. d. d. d. e. g. h. h. i. Current Liabilities Net Income Stockholders' Equity Interest revenue +30

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started