Answered step by step

Verified Expert Solution

Question

1 Approved Answer

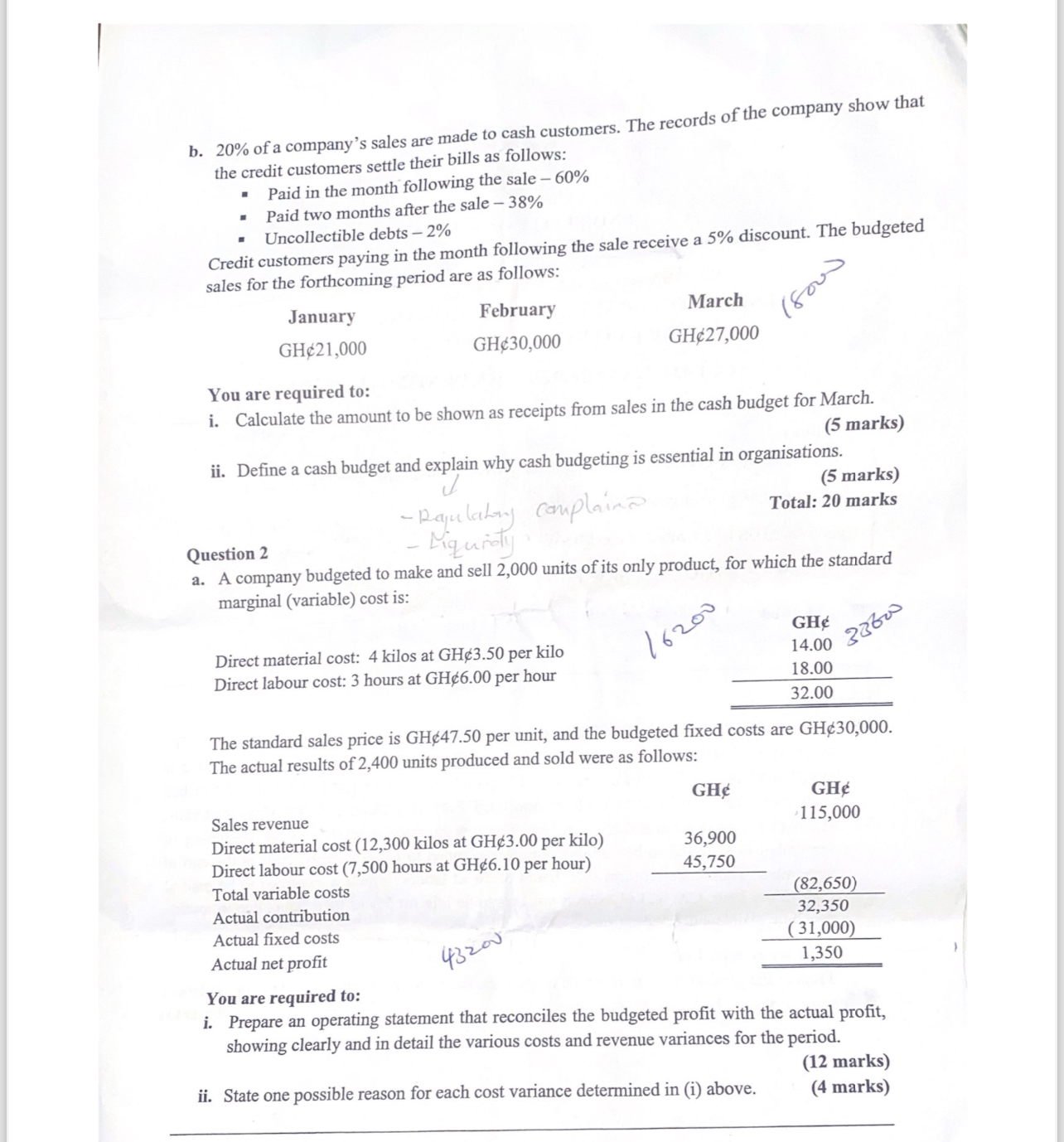

a . Acompany budgeted ot make and sel 2 , 0 0 0 units of its only product, for which the standard marginal ( variable

a Acompany budgeted ot make and sel units of its only product, for which the standard marginal variable cost is:GHDirect material cost: kilos at GH$ per kiloDirect labour cost: hours at GH per hourThe standard sales price si GH per unit, and the budgeted fixed costs are GH The actual results of units produced and sold were as follows:GHeGHSales revenue Direct material cost kilos at GH per kiloDirect labour cost hours ta GH per hourTotal variable costsActual contributionActual fixed costs Actual net profitYou are required to:i Prepare an operating statement that reconciles the budgeted profit with the actual profit, showing clearly and ni detail the various costs and revenue variances for the period. marksi State one possible reason for each cost variance determined ni i above. mar

b of a company's sales are made to cash customers. The records of the company show that the credit customers settle their bills as follows:

Paid in the month following the sale

Paid two months after the sale

Credit customers paying in the month following the sale receive a discount. The budgeted

Uncollectible debts

tableJanuaryFebruaryGH& GH&

sales for the forthcoming period are as follows:

You are required to:

i Calculate the amount to be shown as receipts from sales in the cash budget for March.

marks

ii Define a cash budget and explain why cash budgeting is essential in organisations.

marks

Total: marks

Question

a A company budgeted to make and sell units of its only product, for which the standard marginal variable cost is:

Direct material cost: kilos at GH per kilo

Direct labour cost: hours at GH per hour

The standard sales price is GH& per unit, and the budgeted fixed costs are GH& The actual results of units produced and sold were as follows:

Sales revenue

Direct material cost kilos at GH per kilo

Direct labour cost hours at GH per hour

Total variable costs

Actual contribution

Actual fixed costs

Actual net profit

You are required to:

i Prepare an operating statement that reconciles the budgeted profit with the actual profit, showing clearly and in detail the various costs and revenue variances for the period.

marks

ii State one possible reason for each cost variance determined in i above. marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started